Central bank interest rates news hits you where it matters most: your wallet. It’s not just about numbers and policies; it’s a chain reaction that reaches your everyday life. Here’s how: Say the folks who manage our money tap the brakes or hit the gas. They change interest rates, right? Well, that move sends waves across oceans of mortgages, loans, and savings. Your dreams of a new home or fears of rising bills? They’re riding on this tide too. Stick with me, let’s dive in and see exactly how these ripples from central bank decisions touch down on your finances.

Deciphering Central Bank Rate Decisions and Your Finances

Understanding the Latest Federal Reserve Rate Changes

Have you heard about the recent Federal Reserve rate changes? If you have a loan or savings, these changes likely affect you. When the Fed adjusts rates, it sends ripples through the economy. Your car loan or mortgage rate may go up or down. Saving money could seem more appealing—or less. Let’s break down what this means in simple terms.

Why does the Fed change rates? They aim to control inflation and support job growth. When inflation gets too high, the Fed may hike rates to cool things off. If the economy needs a boost, they might lower rates. It’s like a thermostat for economic heat. So, when you hear that rates have gone up, expect things like loans to cost more. If rates go down, loans might be cheaper, but saving won’t pay as much.

The ECB and Bank of England: Navigating Recent Interest Adjustments

Now, let’s talk about the ECB and the Bank of England. Both play big roles in Europe’s money world, much like the Fed does in the States. Recent ECB interest adjustments have been in the news. They target the same goals as the Fed: steady prices and jobs for all. If you live or shop in Europe, these rate changes hit home.

Just like with the Fed, if the ECB or Bank of England lifts rates, your loan costs may rise. If they cut rates, your loans could be cheaper. But your savings? They won’t grow as fast. They do this to keep the economy on track. If folks spend more, the economy grows, but if they spend too little, it can slow. It’s a careful dance, and these banks lead the way.

Knowing these changes is useful, especially if you borrow money or save. When rates drop, it’s often a good time to review your loans. Could you save by refinancing? If rates rise, locking in a fixed rate might be wise. If they hike rates, saving gets more tempting, as you can earn more interest.

Central bank rate decisions touch almost every part of your money life. From how much you pay on your credit card to your savings account growth, it matters. Being aware of these changes helps you make smart money moves. Stay informed, ask questions, and you’ll ride these waves like a pro. It’s your wallet, after all, and understanding these bits can make a big difference.

The Immediate Effects of Interest Rate Fluctuations on Inflation and Economic Growth

Analyzing Inflation Impact and Central Banks’ Inflation Targeting Strategies

Central banks work hard to keep prices stable. Stable prices mean you can buy the same amount of goods with your money over time. When you hear about central bank rate decisions, it’s usually about keeping inflation in check. Think of inflation as a sneaky thief. It makes everything more expensive. The central banks, like the ‘money police’, try to catch it before it empties your wallet.

When inflation impact on rates is big, central banks act. They boost interest rates to slow down spending. This helps calm down rising prices. It’s like when a video game is too fast, and you hit the pause to slow it down. Everyone talks about the federal reserve rate changes because they set a trend for others.

Exploring the Relationship Between Economic Growth and Central Bank Rate Policies

Now, let’s chat about economic growth and rates. When the central bank sets low interest rates, it’s like giving you a bigger water gun to play with in the summer. It means money is cheap to borrow. Businesses borrow more and grow like crazy. Jobs pop up like popcorn. But if money is too cheap, prices sprint like runners, and we’re back to fighting inflation.

Central banks also care about how fast the economy is growing. If it grows slow, they can cut rates to kick-start it. Imagine your bike slowing down uphill. Cutting rates is like shifting to a lighter gear so you can pedal faster.

The push and pull of rates can also ruffle the currency market reactions. Money can flow in or out of countries based on these decisions which can rock the boat for prices and jobs at home.

The big picture is that central banks use their rate tools to keep both prices and growth steady. It’s a bouncing game. And for you, this means your cash buys what it should and your job stays put. But when rates change, keep an eye out. Use your knowledge to plan your savings and budget to stay ahead.

How Central Bank Decisions Resonate Through Markets and Personal Finance

Currency Market Reactions to Monetary Policy Updates

When central banks move rates, it shakes currency markets. Picture it: one minute you’re shopping online from an overseas store, and the next minute, bang! Prices jump or fall. This isn’t some magic trick; it’s the real-time power of central bank rate decisions zapping through the economy.

Central banks, like the Federal Reserve or the ECB, change rates to keep the economy steady. When they hike rates, it usually means they’re trying to cool things down. Think of it like stepping on the gas or the brake of a car. Too much speed and we might crash (hello inflation!), but if we slow down too much, we might stall (that’s a recession!).

Those rate decisions ripple out far and wide. They alter how much your money is worth overseas. This affects everything from the cost of your vacation abroad to the price of goods we import. Even big companies feel the swells. They trade in global markets, so when the dollar’s value dances around after a rate change, their overseas income can take a hit or get a boost.

Investment and Borrowing: From Mortgage Rates to Consumer Loans

Now let’s turn to your wallet. Think about buying a home or getting a new car. The interest rate you pay on your mortgage or car loan doesn’t come out of thin air. They’re closely tied to these central bank rate decisions. When rates climb, your loan gets more costly. Ouch! But when rates drop, you can breathe easier with smaller interest payments.

Savings accounts and CDs are also in the mix. They may not be the thrilling heroes of your personal finance story, but they do their part. When rates are up, these trusty sidekicks offer higher returns on your savings. When rates dip, their superpowers aren’t as strong, and you earn less.

Investors, brace yourselves. Stock market rides can get bumpier after a rate announcement. Higher rates can mean companies pay more to borrow money, cutting into their profits. This can cause stocks to dip. But, if the central bank lowers the rates, it could give stocks a jolly good push upward as borrowing becomes cheaper.

Rate changes also meddle with bonds. They have an opposite relationship with interest rates—when rates rise, bond prices often drop, and vice versa. If you have a pension or a mutual fund, this affects you too.

In the grand tapestry of the economy, central bank rate decisions are like the threads that pull and tug at the financial fabric. They can gently shift how we save, spend, invest, and even go about our daily lives. Following their moves helps us dance to the beat of the economic rhythm and make smarter money moves. Keep a keen eye on these decisions, and you’ll start seeing the patterns that can guide your personal financial journey.

Being money-wise means tackling these tricky dance moves. So, lace up, tune into the beat of the central bank’s drum, and you’ll be set to groove through this financial melody.

Anticipating Future Economic Directions Through Indicators and Central Bank Insights

Interpreting Global Economic Indicators and Their Link to Interest Rates

When central banks change rates, they tell us if our economy is sick or well. As your go-to expert, let’s unravel this puzzle. Think of global economic indicators as a doctor’s tools. They check the economy’s health. The GDP shows how much we make and spend. Unemployment figures reveal how many of us have jobs. As these numbers shift, central banks react, adjusting interest rates in response, which in turn affects everything from your savings to how much buying a house costs.

Deciphering Central Bank Governor Speeches and the FOMC for Future Trends

Now, dive into the words of central bank leaders. Their speeches are gold mines for clues on what’s coming. We hang on every word they say, and here’s why: these talks often give us a heads-up on their next moves. The Federal Open Market Committee, or FOMC, keeps meeting notes that are packed with hints. If they say they’re “hawkish,” get ready for possible rate hikes. “Dovish”? They might cut rates. These statements and minutes directly influence your wallet, from the interest you earn to the loans you may need, so staying in the loop is key to keeping ahead.

In this post, we’ve looked at how rate changes by top banks like the Federal Reserve, ECB, and Bank of England touch your wallet. Higher rates can slow inflation but may also slow down growth. These decisions rock markets, changing costs for loans and shaping the cash in your pocket.

We saw that when central banks tweak rates, it’s not just big news for traders. It means your mortgage might cost more, or saving might get you more. And by watching signs and what bank bosses say, we might guess what’s next for our money.

To wrap it up, understanding these bank moves is key. It helps us make smart choices with our cash. So let’s keep an eye on those central bank hints and plan our finances like pros. We’ve got this!

Q&A :

How do central bank interest rate decisions affect the economy?

Central bank interest rate decisions are pivotal in influencing the economy, as they help control inflation and stabilize currency value. When a central bank raises interest rates, borrowing costs go up, which can slow consumer spending and investment, leading to cooler economic growth. Conversely, lowering rates can stimulate economic activity by making loans cheaper, encouraging spending and investment. Understanding these changes helps investors and business leaders make informed financial decisions.

What are the current global trends in central bank interest rates?

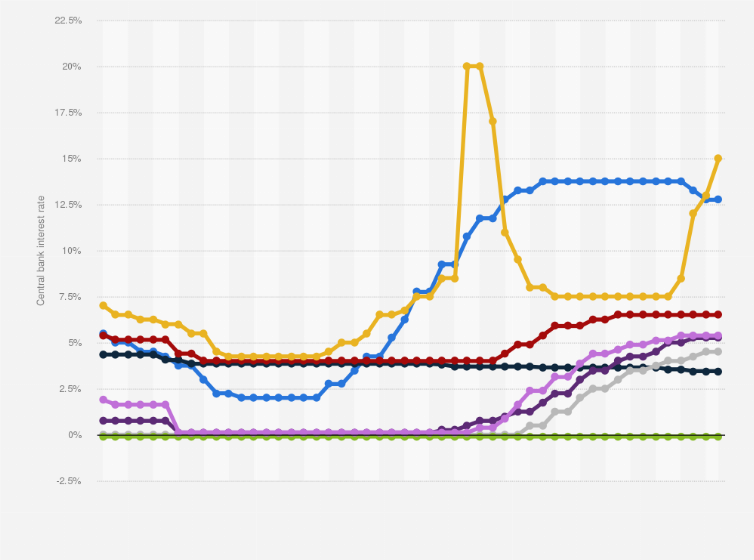

Recently, there has been a trend of central banks adjusting interest rates in response to various economic challenges, such as controlling inflation or stimulating economic growth during sluggish periods. News about current central bank interest rates often discusses whether rates are being raised, lowered, or held steady by major financial institutions across the globe. These trends can significantly impact global markets, exchange rates, and international trade.

Why do central bank interest rate announcements cause market volatility?

Central bank interest rate announcements often lead to market volatility due to the significant impact these rates have on currency values, stock prices, and bond yields. Investors and traders anticipate these announcements, and markets can react positively or negatively based on whether the decision aligns with expectations. Unexpected rate changes or future rate hints can cause sudden and sharp movements in financial markets as participants adjust their portfolios in real time.

How can I stay updated on central bank interest rate news?

For those looking to stay informed about central bank interest rate news, there are multiple channels to consider. Financial news websites, central bank press releases, market analytics platforms, and economic calendars are all valuable resources. Setting up news alerts specific to interest rates or following financial market analysts on social media can also help you stay ahead of the curve with timely updates and expert insights.

What does the term “hawkish” or “dovish” mean in central bank interest rates context?

In the context of central bank interest rate discussions, “hawkish” refers to a stance that supports higher interest rates to combat inflation, even at the risk of slowing economic growth. On the other hand, “dovish” indicates a tendency towards lower interest rates to encourage borrowing and spending, which can stimulate economic growth, potentially at the expense of rising inflation. These terms are essential for understanding the underlying sentiment of central bank policymakers and their future monetary strategies.