Understanding how central bank interest rates impact our economy is like learning to ride the waves. When the rates go up or down, they start a ripple effect that touches your wallet, your job, and your future plans. Think of central banks as the big wave makers in the pool of global finance. They decide if the waves will be small ripples or big swells. In this article, I will strip away the jargon to show you how these waves matter. I’ll talk about the tricky balance central banks aim for and the slow but sure effects that follow their decisions. We’ll look at how they fight inflation and what this means for growth. Plus, we’ll explore how these choices shape what you do with your money—why you might save more, spend differently, or change your investment game. And we’re not just talking local; the international market feels the splash too. Ready to dive in? Let’s go!

Understanding Central Bank Policy Effects on the Economy

The Balancing Act: Interest Rate Adjustments and Their Immediate Impact

When a central bank tweaks its rates, it’s like a captain steering a giant ship. The move is small, but the waves it makes can rock boats miles away. Picture the economy as a vast ocean. Here, central bank policy effects work as the rudder. A minor shift in interest rates can push money flows in new directions swiftly.

Monetary Policy and Its Long-Term Economic Implications

Central banks wield a powerful tool in monetary policy. This tool helps shape our economic journey over time. Let’s dive into interest rate adjustments first. They’re vital for keeping inflation in check. Central banks aim to keep prices stable, so your dollar tomorrow buys almost as much as today. When prices rise too fast, central banks may up their rates. This makes borrowing cost more. In turn, folks and businesses might think twice before getting a loan. This can slow down spending and cool off inflation. Now, these rate hikes can tap the brakes on economic growth sometimes. So, central banks must act with care, finding a sweet spot that won’t stall the economy.

Then there’s the long game. Monetary policy goes beyond just managing inflation. It’s a big player in the whole economic show. It shapes things like how much it costs to buy a house or start a business. And it can either pump up or slow down how much money people want to spend or save. Rate changes are powerful. Yet, we don’t see their full effect right away. It takes time for the waves they make to reach the shore, changing jobs, sales, and even how much cash is worth around the world.

Decisions by the Federal Reserve in the U.S., or the European Central Bank, send ripples far and wide. They don’t just nudge the cost of borrowing. They can sway how much money bounces around globally. When rates rise, saving might seem more appealing because you’ll earn more interest. But, higher rates can also make it more expensive to get a home loan or expand your business. That can put a damper on how much people spend and invest. It’s this push and pull that central banks balance every day.

Quantitative easing is another piece of the puzzle. It’s when central banks buy up bonds to pour more money into the economy. It’s like turning on a money faucet, aiming to make spending and lending easier. This can help in tough times, but it has to be done just right to avoid sparking too much inflation later on. It’s a delicate dance between keeping things moving and not letting the dance floor get too crowded.

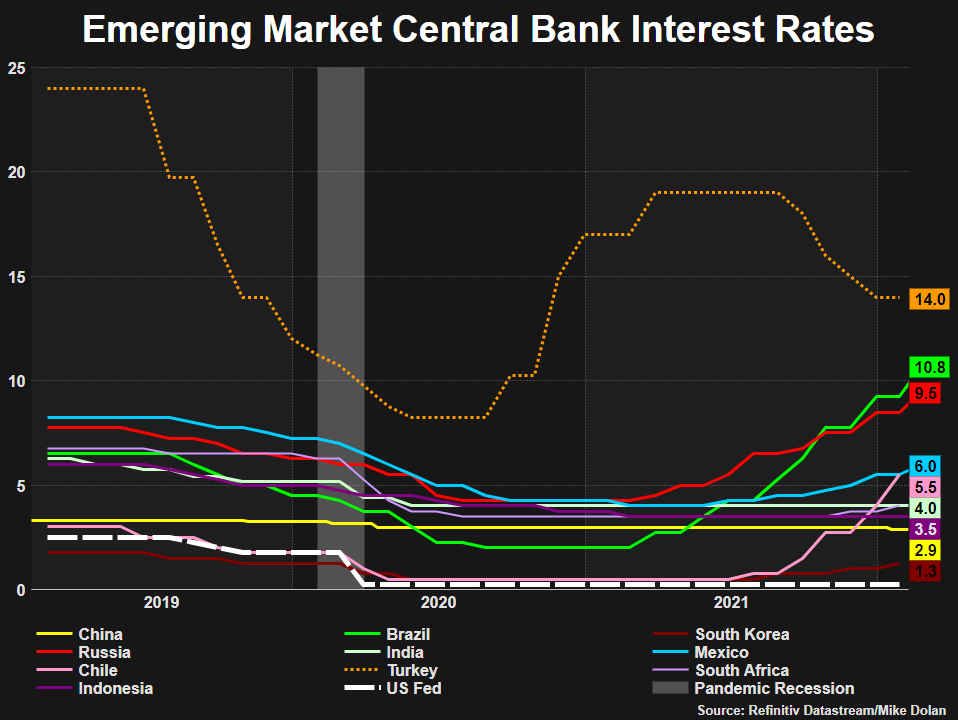

There’s also the global angle. Central banks are like players on a world stage. Their solo acts can influence the whole show. Let’s take the U.S. dollar. It’s a key player in global markets. When the Fed changes its rates, it can alter how much the dollar is worth compared to other money. If the dollar gets stronger, it’s great for American buyers but tougher for exporters.

In short, central banks’ moves are a big deal. They reach into every corner of the economy. And they’re working to keep that balance just right – not too hot, not too cold, but just perfect for steady growth. It’s not easy, but it’s vital for our economic health. So, we watch and wait, ready to adjust as these policy wizards work their magic.

The Influence of Central Banks on Inflation and Growth

Inflation Targeting: Strategies and Challenges for Central Authorities

Central banks aim to keep prices stable. They work hard to hit just-right inflation rates. Too much inflation, and cash buys less. Not enough, and folks may not spend. Banks use tools like interest rate changes. They make it cost more or less to borrow money. This can speed up or slow down how much cash moves around.

When they get it right, everyone can plan better for housing, food, and business costs. They often target a sweet spot of around 2% inflation. This can help jobs grow without prices running wild. But hitting that target? It’s not always easy. Many things can stir up inflation. Things like how much we all spend and even politics play big parts.

Central banks have to be sharp. They watch numbers like hawks. They need to predict and act fast. Sometimes they guess wrong, and it’s back to the drawing board.

Rate Hikes and Economic Growth: The Double-Edged Sword

Now, let’s talk rate hikes. Say the bank lifts rates to cool down hot inflation. This makes it pricier to borrow. Families might think twice before buying a new house. Businesses might hold off on growing. These choices all slow down the money-go-round. Yes, it can tame wild prices. But it also can put the brakes on jobs and growth.

And yet, there’s another side. Higher rates mean savers get more for their stash. It’s a give and take. Loans cost more but saving pays off more too. Banks have to find that middle ground. It’s like walking a tightrope. They need a clear head and steady hand. One wrong move and things could tip over.

People always have lots of questions about this stuff. Like how does a bank decide to raise rates? They look at lots of clues. They check out how much stuff we’re all buying. They peek at what it costs to make things. They even look at what’s going on in other countries.

Banks also think about tomorrow, not just today. They plan for what our cash will be worth in the future. It’s a big puzzle with many pieces. And they’re trying to solve it in a way that helps as many people as possible. They care about our wallets, our businesses, and our jobs.

In a nutshell, central banks have the tough job of steering our money-ship. They want to keep prices stable and help jobs grow. They raise and lower rates to keep things on track. But it’s not a perfect science. It’s more like a big, ongoing experiment where banks learn and adjust over time. We all feel the ripples of their choices. So, it pays to keep an eye on what they’re up to.

How Interest Rates Shape the Financial Behavior of Consumers and Investors

Analyzing the Relationship between Savings, Mortgage Rates, and Consumer Spending

When central banks tweak interest rates, your wallet feels it. Say the central bank ups rates. Saving cash now earns you more. It’s like a reward for not spending. You think, “Cool, my saved money grows faster.” So, you might save more and spend less.

But here’s the twist. Higher rates also mean higher costs to borrow money. Got a mortgage or a loan? Your payments can climb. This can be tough for folks with tight budgets. It squeezes how much they can shell out on other stuff.

Now let’s chat about shopping and spending. Lower interest rates often lead to more of that. When rates drop, loans and mortgages cost less. People find it easier to borrow. So, they might buy that new car or house they’ve been eyeing.

And what about investors? They think about rates a lot. Lower rates can mean that putting money in savings isn’t as sweet. They might buy stocks or houses instead. This can push up prices in the market.

The Impact of Central Bank Decisions on Investment and Currency Valuation

Let’s dive into how the big money decisions by central banks nudge investment and currency worth. When a central bank lowers rates, it’s cheaper for companies to borrow money to grow or start new projects. This can hike up stock prices. People and companies are more gung-ho to invest.

But this can affect the dough in your pocket too. See, when your country’s bank cuts rates, the value of your money compared to others might fall. This is because investors hunt for the best returns. If another country’s bank offers higher rates, investors might move their money there.

This can help exporters, though. Cheaper money means products cost less for buyers from other lands. Still, it means imports could cost more for you.

Central banks wield a lot of clout. They have to really think things through before moving rates. They aim to nail a balance. Too high, and it might choke spending too much. Too low, and it may cause prices to leap. It’s about hitting that sweet spot where the economy hums along nicely.

In short, central bank rates steer much of what happens in your wallet and the broader economy. They influence whether you’ll save more, invest differently, or rethink that big purchase. Next time you hear about central bank policy, you’ll know it’s pretty crucial stuff – shaping not just economies but lives and dreams.

Global Interactions of Monetary Policies and Market Stability

The Effects of Federal Reserve Actions and ECB Monetary Decisions on Global Markets

When the Federal Reserve moves rates, the world feels it. It’s like throwing a big rock into a pond. The splash hits everyone, near and far. Rates go up, and some businesses and people find it harder to borrow money. This can slow down how much they spend. Now, not everyone agrees on how much or how fast rates should change. But both the Federal Reserve and the ECB (the European Central Bank) must decide on these tough calls, trying to keep prices stable and help the economy grow.

Think of monetary policy like a game of dominoes. One move leads to a bunch of other moves. The ECB might do something to fix a problem at home. But it might cause a different kind of trouble somewhere else, because money flows around the world like rivers between banks and countries. This is why those who make decisions must keep an eye on what’s happening across the globe, not just at home.

Assessing the Stability of Financial Markets in the Wake of Varying Central Bank Rates

Stable markets are what we all hope for. We want our money to be safe and our investments to grow. Central bank rates play a big part in this. They’re like the main levers in the engine of the world’s money machine. Sometimes, rates need to go up to keep prices from climbing too fast. Other times, they need to go down so people and businesses can get loans to grow.

When banks change their rates, it’s a big deal. People who have savings might earn more interest. But those with loans might pay more. This can make them cut back on buying things, which in turn can slow down the economy. And if one big bank changes its rates, other banks might do the same to keep things even. It’s a careful dance to keep markets happy and not too shaky.

Think of it like a seesaw. On one side, you’ve got the cost of borrowing money. On the other, you’ve got how much people spend and save. The central bank’s job is to keep the seesaw level, not too high or too low. It’s tricky because sometimes what’s good for one country is not so good for another.

Interest rates affect more than just money. They can change how many jobs there are, how much stuff costs, and whether it’s a good time to buy a house. So, we trust central banks to get it right, to figure out the best rates that help everyone.

But they’ve got to look at the whole map, not just one spot. Because like a game of Jenga, if you pull the wrong piece, the whole tower might tumble down. They must make sure that changing rates here doesn’t hurt someone else over there. That way, we all get to play and maybe win.

We’ve covered the key ways central banks affect our economy. They adjust interest rates, which is a bit like tuning a guitar to find the right pitch. These tweaks can help manage inflation and growth. It’s not easy keeping things balanced. Too high, and loans can cost too much. Too low, and our money’s worth less.

Strategies to keep prices stable are tricky. Sometimes they work well. Other times, not so much. When banks hike rates, it’s good and bad. It can slice into growth, but also cool down high prices.

Your savings and spending change when interest rates move. High mortgage rates can make you think twice about buying a house. Low rates might lead you to spend more. Investors keep an eye on these changes too. They decide where to put their money based on what banks do.

Around the world, each central bank decision sends ripples across the markets. They’re all linked. What happens here can shake things up in another country.

In short, banks’ choices matter. They’re big players in our economic game. They can make or break market stability. Thinking about all this, I hope you see how each piece fits together. It’s complex, but it really touches our everyday lives.

Q&A :

How do central bank interest rates affect the economy?

Central bank interest rates, often called the benchmark or policy rates, are critical tools for managing a nation’s economic activity. Changes in these rates can influence inflation, employment levels, and overall economic growth. Lowering interest rates tends to encourage borrowing and spending by businesses and consumers, which can boost economic activity. Conversely, raising interest rates may decrease borrowing and spending, which can slow down the economy to prevent overheating and control inflation.

What happens when a central bank changes its interest rate?

When a central bank adjusts its interest rate, it directly influences the cost of borrowing. An interest rate hike increases the cost of loans and mortgages, making them more expensive for consumers and businesses, which can reduce spending and investment. On the other hand, a rate cut makes borrowing cheaper, potentially stimulating economic growth by encouraging spending and investment. These rate changes also affect the exchange rate of the currency and can influence foreign investment flows.

Why do central banks increase interest rates?

Central banks increase interest rates primarily to control inflation. When the economy grows too quickly, it can lead to an inflation rate that exceeds the central bank’s target. By increasing interest rates, borrowing becomes more expensive, spending levels may decrease, and the pace of economic growth can slow down. This helps to stabilize prices and bring inflation back to a desired level.

Can central bank interest rate changes impact the stock market?

Yes, central bank interest rate changes can have a significant impact on the stock market. Generally, when interest rates are cut, it can lead to higher stock prices as lower borrowing costs may result in increased corporate profits and more liquidity in the market. Conversely, when interest rates rise, borrowing costs go up and consumer spending can decrease, potentially reducing corporate earnings and leading to lower stock prices.

How do central bank interest rates affect personal finances?

Changes in central bank interest rates can have a direct impact on personal finances. If rates increase, the cost of borrowing for mortgages, auto loans, and other types of credit goes up, potentially leading to higher monthly payments. This can reduce disposable income and impact savings rates. Conversely, when interest rates are cut, it can result in lower borrowing costs, but also reduce the interest earned on savings. Consumers should consider how central bank rate changes might influence their financial strategy, including debt repayment and savings plans.