Central bank interest rates and stock market dynamics are like dance partners in a tango — complex, intimate, and always captivating. Your money feels each step, each turn, as rates dip and dive. It’s vital to understand how a central bank’s interest decisions echo through Wall Street. Dive into this financial ballet where we decode how these rates steer the stock market’s surges and stumbles. You’ll uncover how each move can fatten or flatten your wallet. Ready to demystify the impact? Let’s unravel the power of these financial forces together.

Understanding Central Bank Interest Rate Policies

Deciphering Federal Reserve and ECB Rate Decisions

Ever wonder how big banks decide on interest rates? Think of the economy like a car. Central banks like the Federal Reserve and the European Central Bank (ECB) can hit the gas or tap the brakes. When they want to speed up the economy, they lower rates to make borrowing cheaper. But if they worry about too much speed leading to a crash (inflation), they raise rates to slow things down. Every move these banks make can send waves through the stock market.

Why? Well, cheaper loans mean companies can grow more easily. It can also mean people spend more. So when rates drop, stocks often go up. But when rates climb, loans get pricier and spending slows. This can make stock prices fall. It’s a dance central banks must do carefully to keep things just right.

Grasping the Federal Funds Rate and Quantitative Easing

Let’s break down some terms here. The federal funds rate is what banks charge each other for overnight loans. This rate matters because it affects all other rates for loans, including what people and businesses pay. A high rate can mean less money in your pocket, as loans are more expensive.

Quantitative easing is another trick up the central bank’s sleeve. When times are tough, they buy up bonds with made-up money. This pumps cash into the banking system, hoping banks will lend more. It’s like pouring oil onto a squeaky wheel to get it turning smoothly again.

Both these moves are about nudging people and businesses to either save or spend money. And that nudging can stir up the stock market like a breeze stirs leaves. When the Fed signals it might change rates, stocks might jump or drop before any cash even changes hands! In fact, just the hint of a rate change can make investors rush to change their strategies.

So, next time you hear about the Federal Reserve or the ECB changing rates, picture them driving the economic car, speeding up or slowing down. And remember, this affects your money—from your loans to your investments. Watch these banks closely. They hold the key to the stock market’s zigzags and can guide your next smart move in investing.

Interest Rate Movements’ Direct Influence on Stock Markets

Stock Valuation Fluctuations Amid Central Bank Rate Changes

Let’s dig into how a central bank’s decision might play with your stocks. When central banks change rates, stock prices often dance to a new tune. Think of interest rates as the heart rate of the economy. If the heart beats too fast (high rates), things can overheat. Too slow (low rates) might mean we’re not moving enough.

Central banks like the Federal Reserve or the ECB tweak interest rates to keep the economy in a sweet spot. But why do stocks care? It’s about cost and competition for cash. When rates rise, borrowing costs more. Companies may slow down spending on growing their business. This can mean less profit down the line. Less profit can scare off investors, pushing stock prices down.

Now, if rates drop, the story flips. Borrowing gets cheaper, companies can expand, hire, and invent more. This sparks investor joy, and they’ll likely pay more for stocks. But watch the central bank’s balance sheet; it’s a big deal too! With rates down, central banks may buy stuff, like bonds, to pump money into the economy. This is called quantitative easing. It’s like putting the economy on a money-steroid. Usually, this helps stocks shoot up in value.

But hold on, there’s a twist. Just hearing about a possible rate change can send stocks swaying. Investors try to guess what will happen next and often act fast. This can cause stock prices to jiggle well before any real rate movements.

Equity and Bond Market Volatility in Response to Interest Rate Hikes

Now, let’s talk about the rumbles and tumbles in the stock and bond markets when rates hike up. When central banks push up rates, they’re signaling “Hey, we’re keeping an eye on inflation.” But higher rates can make investors twitchy. They might ditch stocks for the steady beat of bonds. This shuffle can make stock prices drop.

Bonds compete with stocks for investor love. When rates go up, new bonds might pay better interest than old ones. Now, those old bonds sitting in investors’ hands? They look a little less charming. Their prices can fall. But if you hold onto them until they mature, you’ll still get the full amount back. That’s why some bond fans don’t sweat the rate hikes.

Sometimes though, stocks take the rate hike news well. If investors believe the economy is strong, stocks may shrug it off and keep marching up. But here’s the thing: different stocks react in their own ways. Like, utility and real estate stocks might frown at rate hikes. They rely on borrowing loads of cash, and higher rates make that pricey.

Investors need to stay sharp. They pay attention to what central banks suggest might happen next, plotting their moves carefully. This can mean shifting cash from one stock to another or between stocks and bonds. It’s all about staying ahead of the game and not letting higher rates trip you up.

Strategic Investment Approaches in Various Interest Rate Cycles

Adjusting Equity Portfolios During Expansionary and Contractionary Phases

When the economy grows, central banks may up interest rates. This can cool growth. At these times, stocks in banking tend to do well. They earn more on loans. In contrast, firms that need loans, like small businesses, might earn less. During growth times, it’s wise for investors to choose stocks carefully. Look for those likely to keep earning well even with higher costs.

During slow times, central banks may cut rates to boost spending. Lower rates make loans cheaper. This can help lots of firms and lift their stock prices. Investors may want to look at these when expanding their stock holdings.

Identifying Stock Sectors with Heightened Sensitivity to Monetary Policy

Some sectors feel rate changes more than others. Real estate often reacts to rate shifts. Lower rates can mean more home-buying. This could lift stocks in construction and related fields. Tech firms, which often rely on borrowing for growth, can be sensitive too. They may fall when rates go up. Utility companies are more stable. They often keep paying dividends. So, they may be safer in uncertain times.

Knowing how rate changes hit different sectors helps smart investing. Staying on top of rate trends is key. It lets investors switch their focus as needed to where the opportunity is. To succeed here, one must understand both the stock market and central bank cues.

Forecasting and Managing Market Expectations

Impact of Central Bank Forward Guidance on Market Projections

When central banks speak, markets listen. Think of forward guidance as a sneak peek. It hints at future rate moves. This helps businesses and investors make plans. If the Federal Reserve says rates might climb, people think, “Let’s borrow now.” As for stocks, this talk can push prices up or down. If the Fed hints at hikes, stock investors often think twice. They worry higher costs can hurt profits.

Now, not all chat from the Fed is doom and gloom. A dovish tone can cheer the market. This means they might keep rates low. Low rates can be good for stocks. It’s cheaper to borrow and grow. Equity prices may rise, and everyone’s in a good mood. On the flip side, a hawkish Fed suggests hikes are coming. They worry about too much spending and climbing prices. The market gets jittery. Share prices may dip as costs to borrow climb.

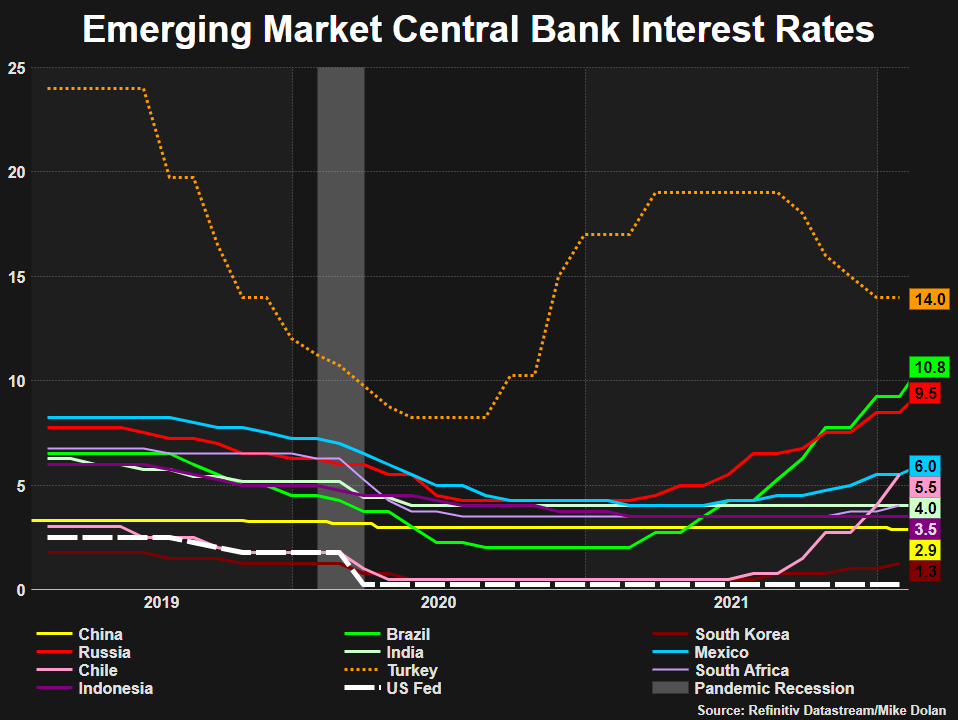

The ECB works in similar ways. If they say “rates may go up due to inflation,” people listen. Inflation is when money buys less over time. This chatter from the ECB can affect stocks all over, even in emerging markets. Higher rates in Europe can mean less money flowing to these places. Stocks there can take a hit.

Guidance isn’t a crystal ball, though. It’s a mix of goals and what’s happening now. Central banks watch things like jobs, prices, and how much we all spend. They try to steer the economy gently. It’s not easy, and they can change their minds.

Risk Management in an Environment of Interest Rate Fluctuations

Dealing with changing rates is like keeping balance in choppy water. It’s all about risk management. Investors keep a close eye on rate talks. They adjust their stock choices to stay safe and make money. Everyone wants to dodge the rough patches when interest rates climb. That’s when some stocks, like tech, may not do so well. These companies often get hit hard because they rely on borrowing lots.

During high-interest periods, some turn to stocks that hand out dividends. These can offer steady cash. They’re like a life raft when seas are rough. Bonds are a big part of the talk, too. When rates go up, bond prices often go down. Savvy folks manage this by picking bonds carefully. They balance risks and rewards.

The Fed’s federal funds rate plays a big part as well. It’s the cost banks charge each other for quick loans. When this rate shifts, all kinds of rates can move. Mortgage rates, bank loans, and more. Higher rates can slow down spending and investing. So, rate hikes mean keeping an even tighter grip on your hat.

When rates jump or dip, don’t just watch the signs. Dive into what the big banks are saying. Knowing the why behind their plans can help you stay afloat. Whether you’re saving, borrowing, or investing, these rate changes touch your wallet. It’s smart to keep an eye out and plan ahead. That way, you can paddle smoothly through the choppy waters of interest rate changes.

In this post, I’ve walked you through how central banks like the Fed shape the economy through interest rates. You’ve seen how these decisions jolt stock markets and sway the value of your shares. We explored how to adjust your investments, no matter if rates go up or down. The clever investor watches these signals to stay ahead.

I shared how to pick stocks that can weather rate changes and how smart planning can protect your cash when rates wiggle. Always remember, when central banks hint at their next moves, you’ve got a chance to plan yours. Stay informed, be nimble, and your investment health can stay strong, rain or shine. It’s all about playing the game with a steady hand and a sharp eye. Keep learning and your finances will thank you!

Q&A :

How do Central Bank interest rates impact the stock market?

Central bank interest rates are a critical factor influencing stock market performance. When a central bank raises rates, borrowing costs increase, which can lead to reduced consumer spending and corporate investment. This scenario often results in a slower economic growth pace and can lead to decreased corporate earnings, potentially leading to a decline in stock prices. Conversely, when a central bank lowers interest rates, it can stimulate economic activity by making borrowing cheaper, thus potentially boosting the stock market.

What happens to stocks when the Central Bank hikes interest rates?

Typically, when the Central Bank increases interest rates, stocks may initially react negatively. Higher rates mean higher borrowing costs for individuals and businesses, which can reduce spending and investment. This can lead to a decrease in corporate profits and dividends, which can dampen investor sentiment and stock valuations. However, the impact can vary based on the rate change magnitude, economic conditions, and market expectations.

Why do Central Bank interest rate cuts sometimes not lead to a bullish stock market?

Although rate cuts are traditionally seen as positive for the stock market, there are instances where they do not lead to a bullish market. Rate cuts generally stimulate economic growth by lowering financing costs, but if these cuts are seen as a response to severe economic downturns or crises, investor confidence may remain low despite the cuts. In such cases, concerns over economic health can overshadow the potential benefits of lower rates, keeping the stock market subdued.

Can Central Bank interest rate policies predict stock market trends?

While Central Bank interest rate policies are a significant indicator of economic conditions, they are not infallible predictors of stock market trends. Interest rates are just one of many factors that can influence market movements. Other factors, such as geopolitical events, corporate earnings, and technological innovations, can also play crucial roles. However, investors often closely watch interest rate changes for signs of how monetary policy might affect the economy and, consequently, the stock market.

How should investors adjust their portfolios in response to Central Bank interest rate changes?

Investors might consider adjusting their portfolios in response to Central Bank interest rate changes to manage risk and capitalize on potential opportunities. In a rising interest rate environment, investors might look towards sectors that traditionally benefit from higher rates, such as financials or sectors less sensitive to economic cycles. Conversely, in a falling rate environment, growth stocks and sectors that perform well during economic expansions, like technology or consumer discretionary, might become more attractive. However, investment decisions should always be based on individual financial goals, risk tolerance, and market conditions. Consulting with a financial advisor is also recommended.