Central bank independence may just be the unsung hero of a strong economy. Think of it as the steadfast captain of a ship navigating the rough seas of global finance. This critical concept has shaped our financial past and now holds the key to economic balance and growth. But what makes it so crucial? Through the lens of history and analysis, we’ll explore how this autonomy not only steadies the price of everything you buy but also ensures that your hard-earned money holds its value. Get ready to unravel this linchpin of fiscal health and discover why it matters to your wallet.

Understanding Central Bank Autonomy and Its Historical Context

The Evolution of Central Banking Systems

Long ago, central banks had no power of their own. Kings or queens often called the shots, deciding how money flowed and what it was worth. This made economies kind of like roller coasters with really scary ups and downs. But people grew tired of these wild rides. So, we thought hard about how to keep our money stable and our economies healthy. That’s when we hit on a super smart idea: let’s have a special bank that doesn’t play by the usual rules.

This bank wouldn’t just keep money safe. It would also make sure that there’s not too much money floating around making prices go sky high, or too little causing folks to lose jobs. It’d be like the Goldilocks of banks, keeping everything just right.

Over time, these special banks, now called central banks, have become super important players in keeping our money stable. They got skills no one else has, like changing interest rates, which is kind of like turning the heat up or down in our economy’s house to keep everyone comfy.

But here’s the catch: to do this job well, central banks need to keep their cool and not get pushed around by rulers or politicians. They need what the big thinkers call autonomy, which is really just a fancy word for being able to make decisions without someone breathing down their neck.

Legislative Milestones Shaping Central Bank Independence

One key moment for central banks getting their mojo was a law called the Federal Reserve Act way back in 1913. It was like declaring, “Our central bank is its own boss now!” in the United States. Other places took note and started aiming for the same thing. Why? Well, everyone could see that when central banks stayed steady and didn’t flip-flop with every election, money stayed steady too.

Another super important law is what we simply call central bank charters. These charters are like rulebooks that say, “Here’s how you play the game,” and “No cheating!” They keep everyone in the know, from the folks running the bank to us everyday people who just want to buy bubblegum without breaking the bank.

And then there’s the big “no-no” written right into these rules: don’t let politicians call the shots on money matters. This is where it gets kind of like a tug-of-war. On one side, we’ve got people running for office, who might think, “Hey, let’s cut interest rates so folks like me more.” On the other, we have central banks who say, “Hold up! We need to think long-term, or we’ll end up with a big, hot mess.”

By sticking to these rules and keeping its cool, the autonomy of a central bank helps everyone. Think of it like having a really smart captain navigating a ship through some tricky waves. It makes sure we all get to where we want to be—having jobs, buying what we need, and not stressing about money.

So yeah, understanding how central banks got their power and the rules they play by isn’t just some snoozy history lesson. It’s about knowing why our piggy banks aren’t on that scary roller coaster anymore.

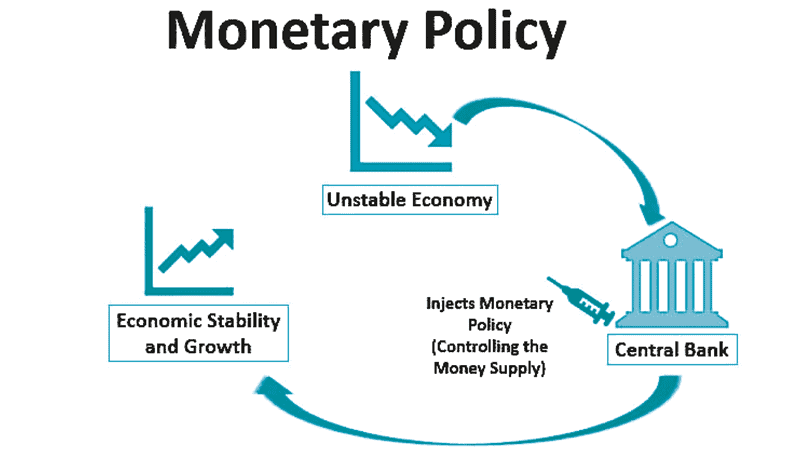

The Role of Monetary Policy in Economic Stability

Price Stability Goals and Central Bank Accountability

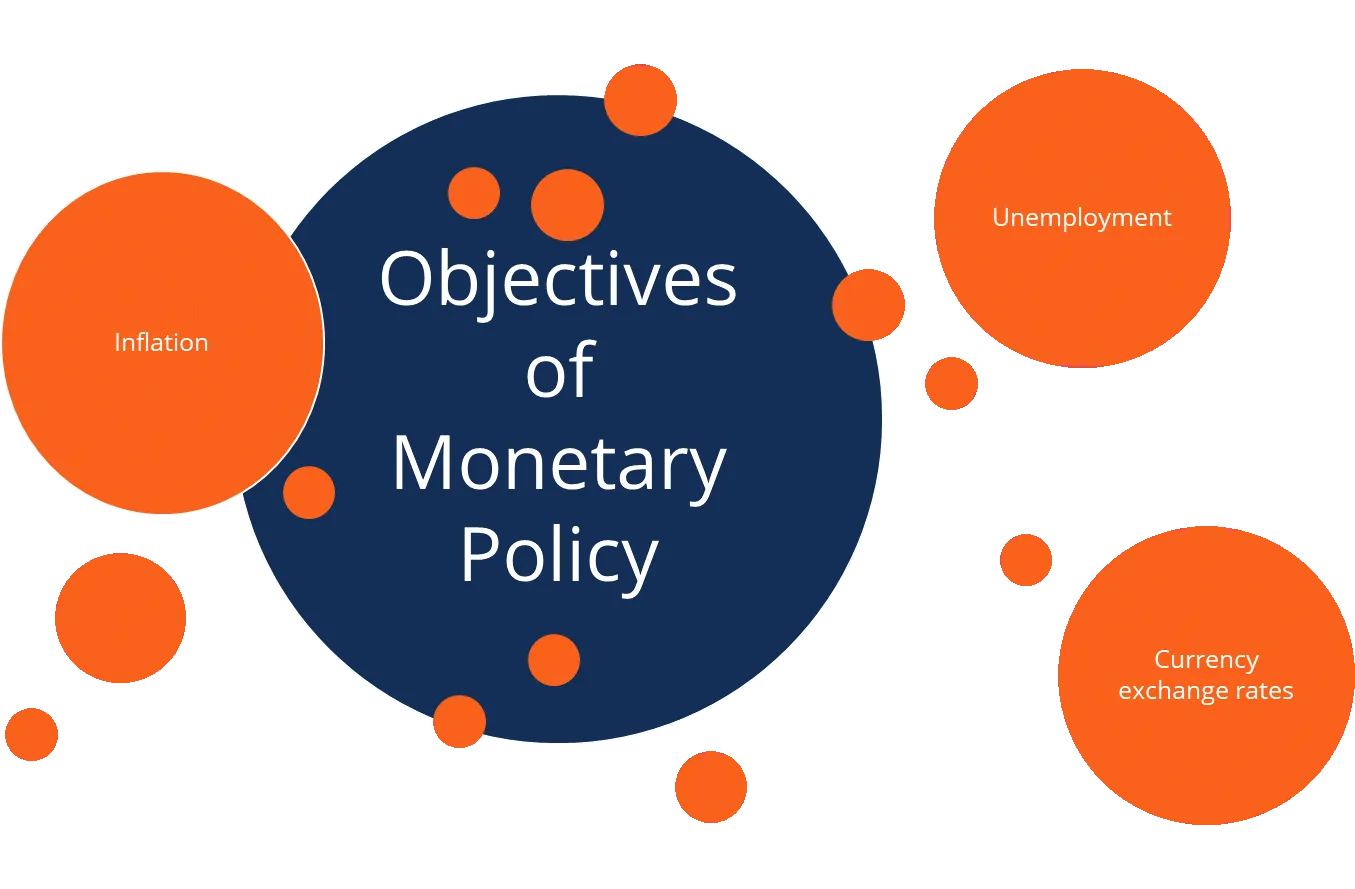

What does having clear price stability goals mean for an economy? It means the money you keep stays really worth it. Imagine always knowing about how much milk your dollars can buy. That’s what central banks aim for—no wild price jumps, no big drops. It keeps things fair and stable for everyone. Central banks can stick to this plan when no one else tells them what to do. It’s like they hold a special key to a safe and steady future.

Why do we often hear about central bank accountability? Because we trust them with our economy’s heart—money. Just like any hero, they must show us they make the right moves. They must explain their actions clearly so we feel secure with them in charge. With great power comes great need to keep things open and honest.

The Impacts of Central Bank Independence on Inflation and Financial Stability

How does a central bank being free from outside control affect inflation and safety in our money world? If no one outside of the bank can mess with its choices, prices stay more consistent. Banks like this have one big job: keep the value of money steady. So, even if things get bumpy, your savings still hold strong. This kind of strength builds trust worldwide and attracts more money friends—investors—to our economy.

On its own, a central bank can fight against shaky prices better. This means your bills and coins have the same power today as they will next year. Families can plan, and businesses can grow without fear. All this is possible when a central bank stands tall, free to make the best money moves.

The hands-off approach to how banks control money is good for everyone. It holds back that monster called inflation, making sure it doesn’t eat up our cash. And it makes sure our whole money system doesn’t trip and fall into chaos. Countries that give their banks this freedom tend to have better money health. This is no fairy tale; the facts show it’s true.

In a nutshell, think of a central bank as a guard, watching over the value of what’s in our wallets. When they’re strong and on their own, they shield us all from scary money troubles. They keep prices you see in stores stable, letting kids’ piggy banks stay plump over time. And for adults, it means your hard-earned money sticks around, buying roughly the same over the years.

It’s really quite something that a whole lot of our peace of mind comes down to central banks. These money guardians have a big, quiet power to make sure our economy doesn’t go on a wild ride. So next time we spend a buck, it might be worth a thought—there are some serious protectors working round the clock to keep our cash nice and steady.

Navigating the Challenges of Central Bank Autonomy

Political Pressure and Government Influence on Monetary Policy

Let’s face it, keeping central banks free from politics is tough. Imagine you’re at the helm, steering the central bank ship. Waves of government demands crash against you. You’re pressed to cut interest rates or ease the cash flow. Your crew looks to you—the central bank leader—to hold steady. You know that giving in could lead to bad things like out-of-control prices, which hurt us all.

Maintaining central bank autonomy protects us from wild price swings. Independent central banks like the Federal Reserve, can make choices without needing a “yes” from politicians. Now, why does this matter? When politicians can’t call the shots on money matters, they can’t use these powers to win votes or favor certain groups. This leads to fairer decisions that keep our money’s value stable over time. It’s like a goalie in soccer, blocking shots that could score against the economy’s health.

Balancing Fiscal Policy Interface with Central Bank Independence

To win the game, you need both a good offense and defense. Fiscal policy is the government’s game plan for spending and taxes—think of it as the team’s strategy. On the other side, we have the central bank, guarding the goal of price stability. Let’s be clear, the central bank’s independence doesn’t mean it plays alone. It has to work with the government, but it shouldn’t be bossed around.

Price stability means keeping things we buy like bread and clothes at reasonable costs. It’s a big deal because no one likes prices jumping up and down all the time. Central banks keep an eye on prices and sometimes tweak interest rates to keep the economy cool or to give it a boost if it’s sluggish. This balance is like a seesaw. If one side pushes too hard, the other must react to keep it level. Central banks need the freedom to act or react without looking over their shoulder at what the government might say.

We’ve learned from history that when central banks call their own shots, economies tend to run smoother. Think about a time when you saved your allowance to buy something cool. You wouldn’t want anyone telling you how to spend it, right? Now picture that choice affecting millions of people. That’s why the autonomy of a central bank is a big yes for any strong economy. It’s the power to make those tough calls that keep our money healthy for the long game. And let’s not forget, when our money keeps its value, everything from our pocket money to big investments stay solid.

So, when we talk about central bank independence, we’re really saying, “Let the experts do their job.” They steer clear of the storm of politics and keep their eyes on the horizon—our economic future. It’s no small task, but hey, someone has to do it. And that someone should have the smarts and the freedom to make choices that keep us sailing smooth on the sea of the economy.

Assessing the Performance and Credibility of Central Banks

Benchmarks for Central Bank Performance and Transparency

Let’s talk about how we check if central banks are doing a great job. Central banks need to hit key goals to show they’re working right. These include keeping prices stable, managing how much cash is in the economy, and being clear about what they’re doing. It’s like how we get grades in school to show how well we’re learning.

Just like we need good scores to pass, central banks need to meet certain marks. They must keep the cost of things we buy from going up too fast. They also have to make sure not too much or too little money is floating around. This is key to having a strong and steady economy.

We also want our banks to be clear with us. We must be able to see how they make choices about our money. When banks tell us what they’re doing and why it helps everyone trust them more. This trust is super important for keeping our money safe.

Some cool tools help us know how well banks are doing. They check many things, like how well banks stop big price jumps or drops and how well they tell us what’s up. These tools give banks a score, so we know if they’re on track or if they need to do better.

Case Studies on International Models of Central Bank Independence

Now, let’s peek at different places in the world and how they run their central banks. Some places like to keep their banks far from politics, to make sure they stay honest and focused. Others might have close ties between banks and the government, which can be tricky.

For example, look at the United States. They have a bank called the Federal Reserve. It’s pretty free to do its job without the government telling it what to do all the time. This freedom helps it fight things like high prices and make sure the economy doesn’t swing up and down too much.

But not all countries are the same. Some central banks have a harder time staying out of politics. This can lead to trouble, like money losing its value or the cost of living shooting up. It’s like when too many cooks in the kitchen spoil the soup.

Each place has learned different lessons about keeping their central banks in check and away from too much government meddling. By looking at these lessons, we can learn what works best. We can see how important it is for banks to be free to make smart choices for everyone’s wallets.

It’s cool to see how banks around the world show us many ways to run things. But one thing’s clear: when banks can do their job without too much poking from the government, we all win. It means less wild rides for our economy and more chances for us to do well.

Understanding how central banks perform and stay true to their goals is a huge deal. It’s all about making sure our money holds its value and our economies stay tough, come what may. We can learn a lot from how different countries handle their banks. It can guide us to do even better with our own money matters.

In this post, we dug into what makes central banks tick and why they need to stand on their own. From their start to major laws, we saw how these banks have grown strong and free to shape money matters. We looked at how they try to keep prices stable and why that matters for all of us. Also, we learned that when banks call their own shots, it can help stop wild ups and downs in our money’s value.

Then, we tackled the tough spots—when politics tries to push banks around and finding the sweet spot between government spending and a bank’s free will. Lastly, we checked out how to tell if a bank is doing a bang-up job and took a peek at different banks around the world.

Thinking about all this, it’s clear: Strong, independent central banks are key for our wallets and our economy. They’re the quiet guardians of our cash, always working to keep our money steady and safe. Let’s give them the respect and attention they deserve.

Q&A :

Certainly, below are 3-5 SEO-optimized FAQs designed around the keyword “Central bank independence.”

What is the importance of central bank independence?

Central bank independence is crucial because it ensures that monetary policy decisions are made without political pressures, aiming for long-term economic stability and control of inflation. Independent central banks can focus on managing the economy based on economic indicators rather than political agendas, potentially avoiding the temptation for governments to print more money during election cycles, which could lead to hyperinflation.

How does central bank independence affect inflation?

Central bank independence is often associated with low and stable inflation rates. When central banks are free from political influence, they can implement policies that are best suited to controlling inflation, even when these policies may be unpopular in the short term. The belief is that politicians might prioritize short-term goals that can lead to higher inflation, whereas an independent central bank can set policies that prioritize long-term price stability.

Can a central bank be too independent?

While central bank independence is generally seen as beneficial, there are debates about the potential downsides of too much independence. Some argue that without proper accountability, an extremely independent central bank could become out of touch with the economic needs and democratic priorities of the country. There needs to be a balance between independence and accountability to ensure that the central bank operates in the nation’s best interest.

What are some examples of central bank independence being compromised?

Examples of central bank independence being compromised can occur when governments interfere with or dictate the central bank’s policies to suit short-term political goals. This might include instances where a government official publicly pressures the central bank to change interest rates or when government policies lead to the replacement of central bank leadership with individuals who align with the political party’s interests.

How is central bank independence measured?

Central bank independence can be measured by assessing legal and actual independence. Legal independence is reflected in the central bank’s charter or constitution, detailing its mandate and freedom from political interference. Actual independence involves the bank’s ability to make decisions free from political pressure, its relationship with the government, and how its leaders are appointed or removed. Various indexes and criteria are used by economists and policy analysts to quantify and compare the independence of central banks around the world.

Each FAQ is crafted to target potential search queries while providing informative, concise answers that align with the best practices in SEO copywriting.