As an expert, I often hear buzz about Central bank digital currency and financial stability. Let’s cut to the chase: Could this digital twist to money be a game-changer for how stable our cash stays? Imagine money that’s smart—built to dodge economic slumps and keep banks on their toes. I’ve got the scoop to spill, and trust me, it’s not just tech talk. It’s about our wallets and world markets getting a facelift with something called CBDCs. Are they the superheroes of finance we’ve waited for? Or will they trip and fall flat? Stick with me, and let’s dive into what CBDCs could mean for our money’s future.

Understanding the Impact of CBDCs on Financial Stability

Exploring the Relationship Between CBDCs and Economic Resilience

Money talks, folks. And these days, it’s going digital. Central bank digital currencies – let’s call them CBDCs – are a hot topic. They could make our economy tougher, like a tree that bends but doesn’t break in a storm. Central banks are thinking hard about this. They can create safe digital money that doesn’t crash computers or banks. That’s good for you and me.

CBDCs help by making payments fast and easy. Say goodbye to waiting for checks or wire transfers. Money moves in a flash, without big fees. That’s a win for regular people and for businesses big and small. And everyone can use it, even if they don’t have a bank nearby. Now that’s smart banking.

CBDC Design Features that Enhance Systemic Stability

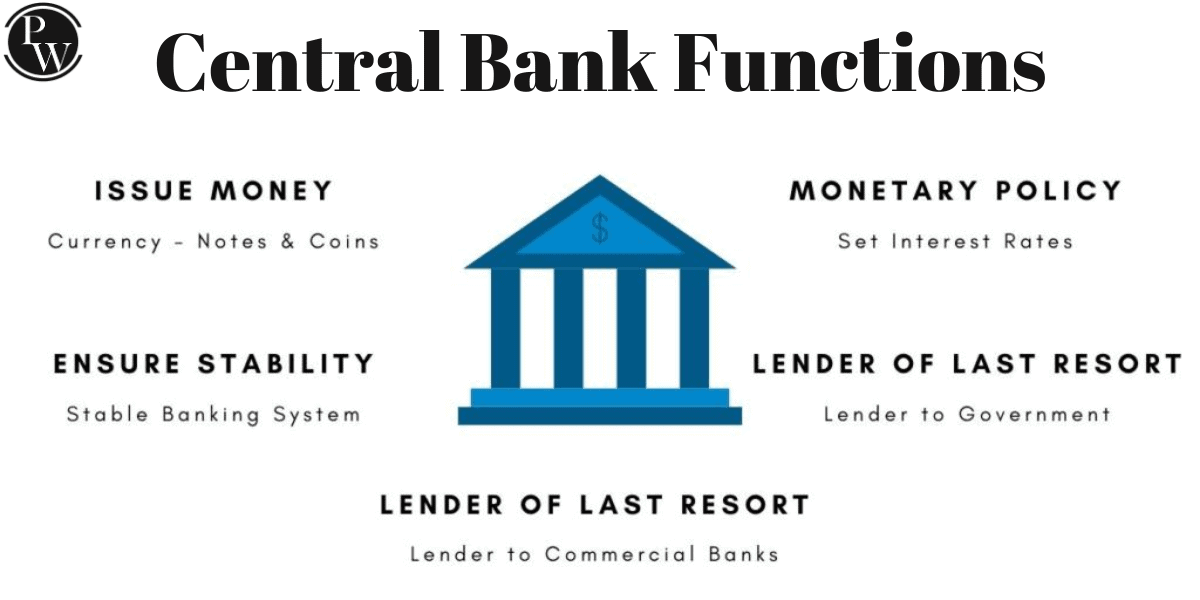

When we talk CBDC, design is king. We want digital money that stands strong like a castle against all sorts of trouble – from tech glitches to sneaky hackers. Central banks have their work cut out for them. They need to build digital money that’s solid and keeps its value, so people trust to use it just like coins and bills.

Smart design also means preparing for scary money moments – like bank runs. That’s when lots of people try to get their cash out at once. CBDCs must be set up to stop these from happening. How? By keeping plenty of digital cash ready to go, so nobody panics.

Keeping your money safe is top priority. CBDC security measures are like a high-tech lock and key for your digital dollars. No sneaky business allowed. It’s all about making sure your digital money is as safe as it can be, so you can sleep at night without worrying about your cash.

Got it so far? Great! Remember, CBDCs aren’t just fancy tech – they’re a new way to think about and use money. And central banks have a big job ahead. They need to make sure CBDCs fit with the money we’ve got in our wallets today. They must work well together, or it’s like having puzzle pieces from different boxes – it just doesn’t make sense.

In short, CBDCs could be a big boon for financial stability if done right. They’ve got to be tough, safe, and play nice with all the money stuff we have now. Keep an eye out – digital dollars might just be coming to a wallet near you. And when they do, they’ll be working hard to keep your money safe and our economy steady as she goes.

The Implications of CBDCs for the Traditional Banking Sector

How CBDCs Could Affect Bank Runs and Liquidity

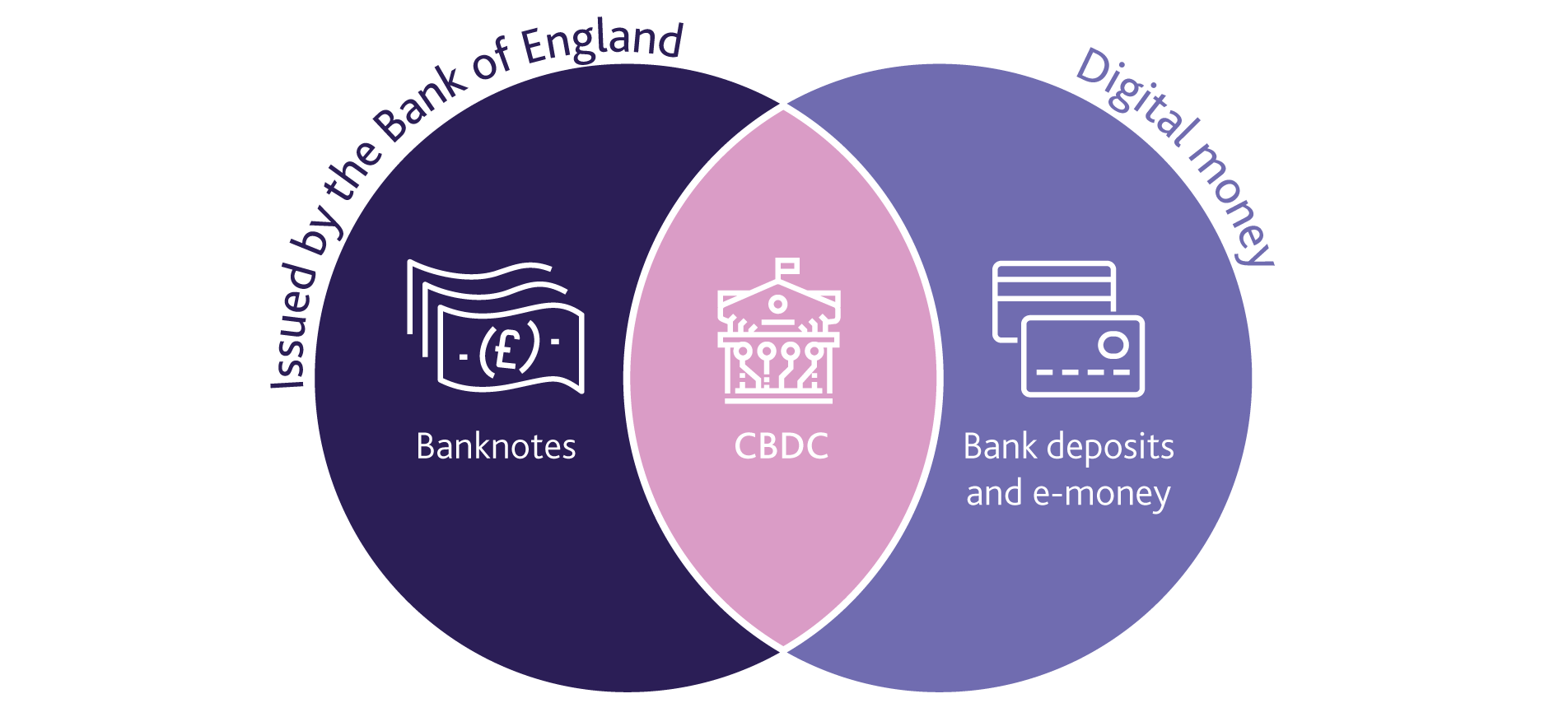

Picture this: a digital dollar, safe and easy, right in your pocket. That could be our future with central bank digital currencies, or CBDCs. Central banks hold the big bucks and set the money rules. They’re thinking about making their own digital money. This is like the cash we have now, but it’s all online.

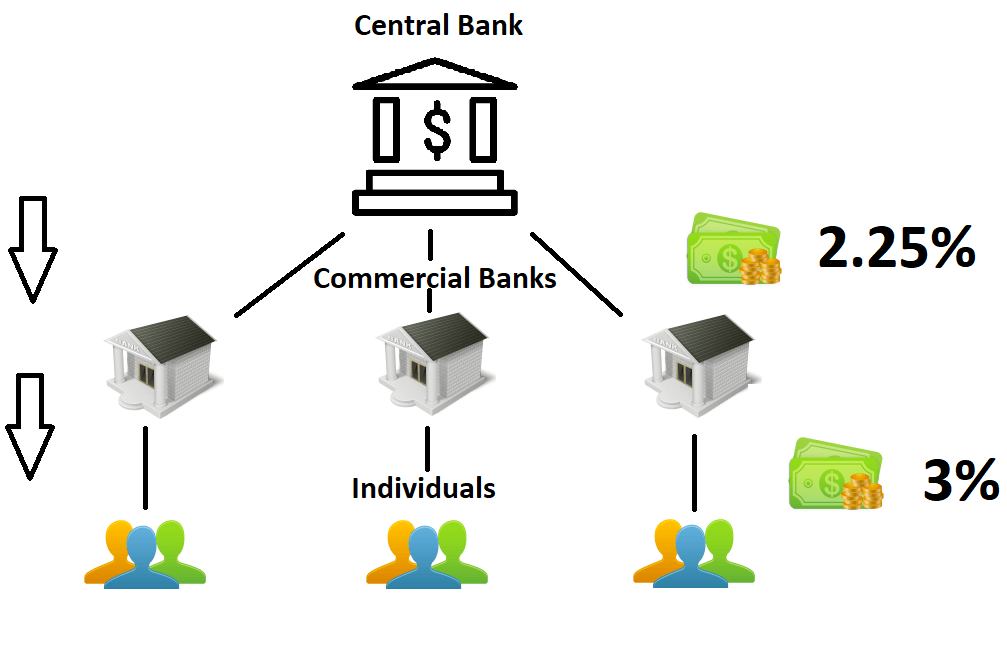

Now, bank runs happen when people worry and rush to pull cash from their banks. This could change with CBDCs. CBDCs are made to be stable and quick to get. So, in scary money times, CBDCs could help keep calm and avoid panic. But there’s a twist. If everyone picks digital dollars over bank accounts, banks could get in trouble. They need deposits to make loans and keep the economy humming.

The Role of CBDCs in Promoting Financial Inclusion and Competitiveness

CBDCs are not just cool tech. They can also help people who don’t have bank accounts. Millions don’t, but with CBDCs, more could join in on digital bucks without needing a bank. This could fire up competition. Banks would need to step up their game to offer better deals than what CBDCs give.

It’s a big deal for places far from banks, too. They could hop online and pay or save with CBDCs, quick and easy. It’s about fair chances with money for all. If done right, CBDCs could help everyone have a shot at saving and spending, no matter where they live or how much they earn.

So, CBDC thinkers need to design them smart. This means making sure they work with what we’ve got now, like banks and cards. Plus, they need tight security to keep our cash safe. It’s all about balance. We need to keep banks in shape while letting digital dollars bloom.

CBDCs could stir things up in banking. They bring hopes of snappier payments and open doors to all, but also fears over bank dramas. We’re heading into new money lands, but careful steps can keep things steady.

Navigating the Digital Currency Landscape: Risks and Regulations

Managing the Systemic Risks Associated with Digital Currencies

Let’s talk about money – but not the kind you keep in your pocket. Central banks around the world are thinking about making their own digital money, called central bank digital currencies (CBDCs). I want to show you why this is a big deal and how we can dodge the dangers that come with it.

Central bank digital currencies impact on stability because they’re tied to a country’s money system. They’re like having dollars or euros, but in digital form. When we talk about digital currency systemic risks, we mean the things that could go wrong and mess up the whole money system. Things like computer hackers or money moving too fast from old-school banks to new digital wallets.

Now, when we design a CBDC, we have to make sure it keeps things stable. That means creating rules so that the digital dollars are safe to use, just like the paper ones. If we get this right, CBDCs can help people pay and get paid really fast and without much cost.

Monetary policy CBDC era is about how central banks manage money. The big brain folks at these banks need to think about how much money is out there and keep things like prices steady. With digital currencies, they have new tools like being able to track money better and make changes more quickly.

So, what is digital currency risk management? Well, it’s all about having plans in place for the ‘what ifs.’ Like, what if everyone tries to take their money out of the bank at the same time? We call this a bank run. This could be a huge risk if people move their money into a digital currency all at once. That’s why CBDC financial stability implications are serious biz, and we’ve got to be careful.

We can’t forget about digital money and economic stability either. Having digital currency can be a big bonus for buying and selling things online or sending money to family far away. And for the folks who don’t have a bank account? CBDC and financial inclusion are pals. It means more people might be able to join in the money game, without needing a traditional bank.

Crafting a Legal Framework for CBDCs That Safeguards Privacy

Now let’s chat about staying safe and private with digital money. Privacy and CBDCs need to shake hands. We need a CBDC legal framework that says clearly how we’ll keep everyone’s money story secret.

Digital currencies can tell someone a lot about what you buy and where you spend your dough. And I tell you, privacy concerns with CBDC are no joke. We’ve got to set up strong walls to keep that info safe.

With this digital shift, central banks have to stick to their promise: to keep our money system solid and shield our privacy. So, my central banks pals are busy making a CBDC strategy that makes it simple, safe, and private to use our new digital dollars.

Got questions on digital wallets for CBDC or central bank blockchain technology? Remember, when it comes to money, it’s our job to make sure we’re stepping forward with care. We’re shaping a future where digital money works for everyone – keeping our cash in line and our secrets safe.

The Future of Cross-Border Payments and Monetary Policy in the CBDC Era

Ensuring Interoperability in Cross-Border CBDC Transactions

Money moves around the world every second. What if it were easier and safer? Imagine sending cash from the US to Japan as easy as a text message. That’s the promise of central bank digital currencies, or CBDCs, for cross-border payments. But, one big question stands: How do CBDCs from different countries work together? The answer: interoperability. This is tech talk for making different systems play nice with each other.

For success, countries need a common language for their CBDCs. Like people talking in English at an international airport. This way, digital dollars or euros can move smoothly from one place to another. We must set rules that all CBDCs should follow. Think of it as playing a game with friends. Everyone needs to know the rules to have fun.

Digital currency risk management is key too. Moving money across borders opens doors for fraudsters and hackers. We must build strong digital locks and walls to keep bad guys out. These are the CBDC security measures that need top focus.

Central banks have to think hard about these things. They have to make sure digital money helps us all and does not cause money hiccups between countries. This is where digital currency governance steps in.

How Central Banks Can Adapt Monetary Policy for the Digital Currency Revolution

Now, let’s chat about central banks, the big players in our money world. They pull the strings to keep things running smooth. Like when you play a video game, they try to keep the economy’s score up. But here comes CBDC to shake things up!

Central banks must tweak their monetary policy tools for the digital age. They must learn new tricks to manage money supply and interest rates in the CBDC era. It’s not just about printing money anymore. Soon, they could push a button to create digital money.

One major worry is bank runs. This is when lots of people want their money back at once. This can cause trouble. Central banks need to think: Could CBDCs make this better or worse? They must tread carefully. They don’t want a stampede at the digital dollar door.

They also need to consider CBDC financial stability implications. Will digital currency make our banks and cash more solid or shaky? They must nail this to avoid a mess.

Central banks want everyone to have a shot at using this new money, too. That’s CBDC and financial inclusion. From rich folks in cities to farmers in small villages, everyone should be able to tap into CBDCs.

Overall, as a Central Bank Digital Currency Policy Strategist, creating a safe and fair digital money world is my daily quest. CBDCs can be a real game-changer for how we all handle our cash across the globe. If we get it right, digital money could help make our wallets and economies stronger than ever.

We’ve explored a lot today about Central Bank Digital Currencies, or CBDCs, and their effects. We saw CBDCs can make our economy stronger. They’re built to keep our financial system steady. We also learned that CBDCs might change how our banks work, but they could help more people get banking services and create fair play in finance.

We talked about the risks of digital money and how laws must protect our privacy. We can’t forget that. It’s important. Finally, we looked at how CBDCs will make sending money to other countries smoother and change the way central banks control money.

So, what’s my final take? CBDCs look promising. They could really help us all. But we need to be smart. We have to watch for risks, make good rules, and always remember to keep money safe and fair for everyone. Let’s get ready for the digital money future – it’s coming fast, and it’s exciting!

Q&A :

How does a central bank digital currency affect financial stability?

Central bank digital currencies (CBDCs) have the potential to significantly impact financial stability through various mechanisms. CBDCs could enhance the efficiency of payments and settlements, potentially leading to a more stable financial environment. However, they could also pose risks if not carefully implemented, such as increasing the likelihood of bank runs during crises, as consumers may rapidly convert bank deposits into CBDCs. The design and regulation of CBDCs will be critical in managing these risks.

What are the potential risks of CBDCs to the traditional banking system?

The introduction of CBDCs could disrupt the traditional banking system in several ways. For one, CBDCs might compete with bank deposits, potentially leading to a decline in the amount of deposits that commercial banks hold. This drop in deposits could limit banks’ ability to lend money, thereby affecting their primary source of income and increasing the cost of loans for consumers and businesses. Additionally, it can shift the balance of how monetary policy affects the economy, which could require new approaches and tools for stabilization efforts by central banks.

Can Central Bank Digital Currencies improve the efficiency of payment systems?

CBDCs have the potential to greatly improve the efficiency of payment systems by offering a digital form of central bank money that can be transferred quickly and securely. They can minimize transaction costs, reduce settlement time, and enhance cross-border transactions. Moreover, since CBDCs would be backed by the central bank, they carry reduced credit and liquidity risks, which could lead to a more reliable and efficient payment system.

How do CBDCs interact with existing monetary policies?

The introduction and implementation of CBDCs need to be carefully considered within the context of existing monetary policies. CBDCs could give central banks new tools for implementing monetary policy by enabling more precise control over the money supply and interest rates. They could also provide a new mechanism for distributing funds directly to consumers, potentially streamlining quantitative easing strategies. However, central banks will have to tread carefully to ensure that CBDCs complement rather than undermine current monetary policy frameworks.

What role could Central Bank Digital Currencies play in cross-border payments?

CBDCs could revolutionize cross-border payments by allowing for more direct and efficient transactions between countries. They have the potential to reduce the need for intermediaries, lower transaction costs, and speed up cross-border settlements. CBDCs can also address issues related to exchange rate risks and regulatory compliance. Nevertheless, the success of CBDCs in cross-border payments relies heavily on global cooperation and standard-setting to ensure interoperability between different countries’ digital currencies.