CBDCs are shaking up finance, right down to the core. Imagine a world where your digital wallet doesn’t just hold cash, but a currency straight from the central bank. This isn’t just fancy tech talk; it’s the looming reality of central bank digital currencies – a new kind of money that could turn banking on its head. With bank disintermediation in the spotlight, everyone’s asking: will we even need banks anymore? In this dive into the digital dollars of tomorrow, we’ll explore how banks are fighting to stay relevant and whether they can keep up in the fast-changing world of CBDCs. Strap in; we’re unpacking whether banks will sink or swim in our digital future!

Understanding the CBDC Impact on Traditional Banking

The Shift in Banking Roles Prompted by CBDC Integration

Banks stand at a crossroad today. Central Bank Digital Currencies are rolling out. This brings big changes. What does this mean for your local banks? They might have to change how they work. Banks have always been where we save and spend money. CBDC could shake this up.

CBDC stands for digital money from a country’s central bank. Like the money in a bank, but no paper or coins. You need a safe digital wallet for CBDC. This way you store and use your money online. This is part of what people call “blockchain.” It’s a smart system that tracks all the digital money bags, so they’re very safe.

Let’s think about what this might bring. First, it’s faster to send money. Even to people in far places. Banks often help us move money. With CBDC, you might not need them as much. It could be just you and the other person. No middle-man.

This is where disintermediation comes in. A fancy word, but simple idea: cutting out the middle-man. In this case, the bank is the middle-man. Less work for them if there’s CBDC. Things like loaning money might not change much. But everyday things, like paying bills, could skip the bank. That’s scary for banks. They don’t want to lose that job.

How do banks stay needed? They adapt. They focus on what CBDC can’t do alone. Big stuff. Like checking if a loan makes sense. Answering your money questions. Being a guide when money things get complex.

Assessing the Risk of Disintermediation in the Banking Industry

Are banks going away? Not quite, but their jobs are changing. People always need smart advice on money. That’s banks’ strength. They can teach and advise about CBDC. When you use CBDC, they can help keep it safe. Security is key and banks are good at this.

Banks are part of our lives. They’ve been around before the internet, even before computers. So they’re experts in many things money. The risk is there. But banks can turn risks into chances. They can use CBDC to make new services. Help us with the things we need.

What’s the takeaway? CBDC may make some change. It might be bumpy for banks. But, they have a whole box of tools to deal with it. They can learn. They can change. So can we. Digital money is here. It’s different. But with banks’ help, it can be a good different.

Banks helped us before. They can keep helping us now. With CBDC, the way they help might change. But that’s okay. That’s how things get better. As long as banks keep learning and changing, they won’t get left behind. They won’t become obsolete. They’ll become new and fit for our digital future.

Exploring Digital Currency Banking Challenges

Navigating Operational Risks and Cybersecurity Concerns with CBDC Implementation

Central bank digital currencies are shaking up our old banking ways. They can change how money moves and who controls it. With this big shift comes big risks. Think of safety like with your phone or computer. But for money, it’s even more important. Banks have to be super careful to keep our cash safe in this new digital world. One slip-up and hackers could steal stuff. So, banks work super hard to stop this and make sure our money is safe with CBDCs.

Regulatory Frameworks Vital for CBDC and Financial Institutions

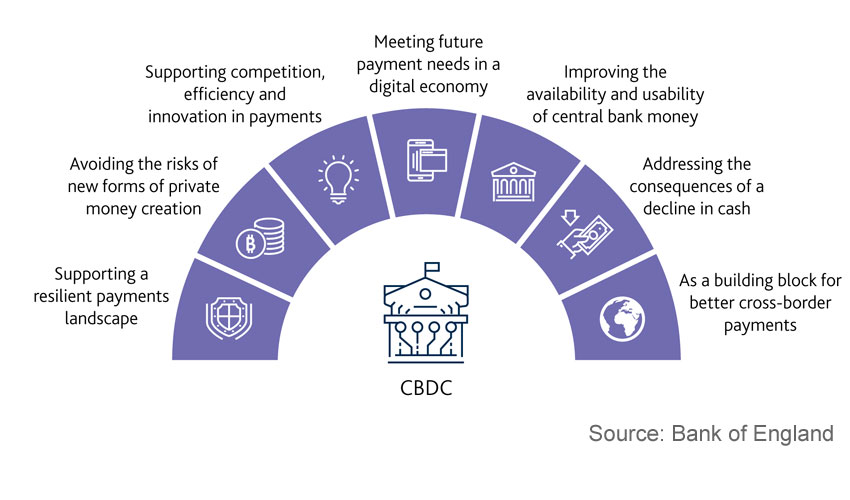

Laws for CBDCs are super important. They are like rules for a game. Without them, things could get messy. Banks and money people need clear rules to follow with CBDCs. This is to keep everything fair and safe for everyone. If we get this right, CBDCs could make banks even better. They could make sending and getting money fast and cheap. But we can’t rush it. We have to make it work for everyone and keep our money safe.

CBDCs can also bring new ways for banks to grow. They can make new services that use CBDCs. Banks need to think about how to do this. They need to get ready for change and find cool new ways to use CBDCs. They can also teach us, the people, about CBDCs. This can help us feel good about using them.

When we talk about CBDCs, some folks worry banks might go away. But that’s not the whole story. Banks can still be big players. They just need to change a bit. They can help handle CBDCs or give us other cool financial help. They have a chance to be the bridge between old money ways and new digital ones.

So, to sum it up, CBDCs bring new challenges like keeping our money safe from bad guys and making sure there are good rules. But they can also help banks do more for us. They just need to get set for the change and find smart ways to use the new CBDC tools. It’s all about making sure that we can trust CBDCs just like we trust the money in our pockets today.

Distinguishing Between Retail and Wholesale CBDC Models

Effects of Retail CBDC on Consumer Banking and Peer-to-Peer Transactions

As an expert, I see how retail CBDC changes how we bank. We use it like cash, but it’s digital. It makes buying and paying folks fast and simple. For example, paying a friend back is just a few taps on your phone. No need for a bank to step in. This cuts the middleman banks out of basic money moves.

This shift is big. Retail CBDC can make banks less central in our daily lives. Money is easy to move without them. Traditional banks now must adapt or risk becoming less useful. They might start offering new services like special savings plans or better customer advice.

The Role of Wholesale CBDC in Interbank Settlements and Cross-Border Payments

Now, let’s look at wholesale CBDC. This isn’t for everyday folk. It’s for the big money moves between banks. It’s like their secret tool to settle huge accounts fast and safe. With CBDC, banks can settle with each other any time, not just when the central bank is open. It’s a game changer for global trade, making payments zip across borders with ease.

Wholesale CBDC keeps banks in the picture but changes how they work together. They can move money in new ways, which could mean good things for customers. Banks might handle international deals quicker and maybe with lower fees in time.

In this digital push, we can’t forget risks. Hacks and tech failures can cause trouble. So, banks and regulators are working hard to keep things safe. We all want money to stay secure, even in its new digital home. It’s a tricky balance but one worth getting right for everyone’s wallet.

CBDC Transformation of the Banking Sector and Future Adaptations

The Evolving Functionality of Commercial Banks Amidst CBDC Emergence

CBDCs are shaking up how banks work. Banks used to be the middle men for cash. They kept our money safe and helped us spend it. Now, with CBDCs, the game is changing. CBDC stands for Central Bank Digital Currency. It’s like digital cash from a country’s central bank.

Will people still need banks if CBDCs catch on? Maybe, but banks will have to change. They’ll shift from keeping money to giving advice and other services. We already bank on our phones and computers. Banks will turn into helpers for tech stuff and money planning. They’ll help us use CBDCs in the best ways.

Right now, you might use an app for your banking. With CBDCs, you could pay someone as easy as sending a text. No bank in the middle. That’s great but raises questions. What if something goes wrong? What if there’s a glitch? Banks will aim to solve these tech troubles.

Central Banks Becoming Pivotal Players in the Financial Market Evolution with CBDC Integration

Imagine central banks, like the boss of money in a country, stepping into the ring. They’re big players when they start using CBDCs. It’s huge. They will run the CBDCs and make sure everything in the cash world ticks like clockwork.

Before, central banks dealt with big money issues and let banks handle the small stuff. With CBDCs, they’re in charge of the digital cash that we’ll all use. It’s not only about printing money but also keeping the digital cash safe and smooth.

When they get this right, we might buy stuff from all over the world easier. We might even trust worldwide trade more. But this is tricky. They must think about hackers, glitches, and keeping our money safe online. Central banks will work on these tech puzzles. They’ll make rules to keep our digital cash safe.

CBDCs could change what we think money is. But central banks and commercial banks won’t just vanish. They’ll tweak what they do. We’ll still need them for their brains, not just their vaults. The banks we know will turn over a new leaf. They’ll guide us through this digital cash jungle.

This CBDC stuff is complex. But one thing is clear: we’re heading toward a future where the words “bank” and “money” mean new things. We’re looking at big changes for central and commercial banks alike. But don’t stress. They’re adapting to keep cash in our pockets and our futures bright.

In this post, we explored how central bank digital currencies, or CBDCs, might change banks as we know them. We looked at how banks will have to shift what they do once CBDCs enter the stage. There’s a real chance banks will play a smaller role, and we need to watch this risk.

We also dived into the tough parts of making CBDCs work, like keeping them safe and fitting them into rules made for regular money. This is tricky stuff, and it matters a lot.

Then we talked about two kinds of CBDCs—those for everyday people and those for big bank deals. Both types will touch different parts of banking, from how you send money to friends to how banks move big amounts of money around the world.

At the end, we saw that banks have to evolve because of CBDCs. Central banks are stepping up; they’re shaping the way money moves. What’s next is still unfolding, but one thing’s clear: the way we think about and use money is zooming into the future, and we all need to keep up.

Q&A :

What is the role of CBDC in bank disintermediation?

Central Bank Digital Currencies (CBDCs) can potentially disrupt the current financial ecosystem by allowing central banks to directly transfer digital currency to consumers without the need for traditional commercial banks. This process, known as bank disintermediation, could reduce or eliminate the intermediary role banks play in financial transactions, affecting their business models and revenue streams.

How could CBDCs lead to bank disintermediation?

CBDCs provide a digital form of central bank money that could be accessed by businesses and consumers directly. If consumers opt to hold significant amounts of CBDCs instead of deposits in commercial banks, the banks could face a decrease in deposit funding. Such direct access to central bank money could circumvent the need for bank-mediated payment systems, thus leading to disintermediation.

What are potential impacts of CBDCs on commercial banks?

If CBDCs become widely used, commercial banks might experience a decline in deposit intakes, which are a crucial source of funding for lending activities. Banks could also see a reduction in earnings from payment processing fees. To adapt, banks may have to innovate and find new ways to provide value to retain customer relationships and revenue streams.

Can CBDCs and commercial banks coexist?

Yes, CBDCs and commercial banks can coexist. While the introduction of CBDCs presents challenges for traditional banking, it also opens up opportunities for banks to adapt and integrate the new technology into their existing services, such as developing new financial products or enhancing digital payment systems which could be seamless with CBDC infrastructure.

How do central banks view CBDCs and the risk of disintermediation?

Central banks are aware of the potential for CBDCs to cause disintermediation and are carefully considering this risk in the design of CBDC systems. Some approaches, such as tiered remuneration or quantitative limits on CBDC holdings, can be employed to mitigate the negative impact on commercial banks. Central banks are also considering CBDCs as a complement to, rather than a replacement for, traditional banking systems.