Slash your costs and reclaim control – the benefits of financial disintermediation for consumers are too good to ignore. Imagine bypassing the middleman in your financial life. No bulky fees, no waiting in lines, just you taking charge of your hard-earned money. We dive deep into how cutting out banks and brokers not only saves you money but puts you in the driver’s seat of your financial journey. Get ready to unlock cost savings and truly own your financial choices like never before.

Understanding Financial Disintermediation and Its Direct Impact on Consumers

Identifying the Cost Advantages: Saving on Intermediation Margins

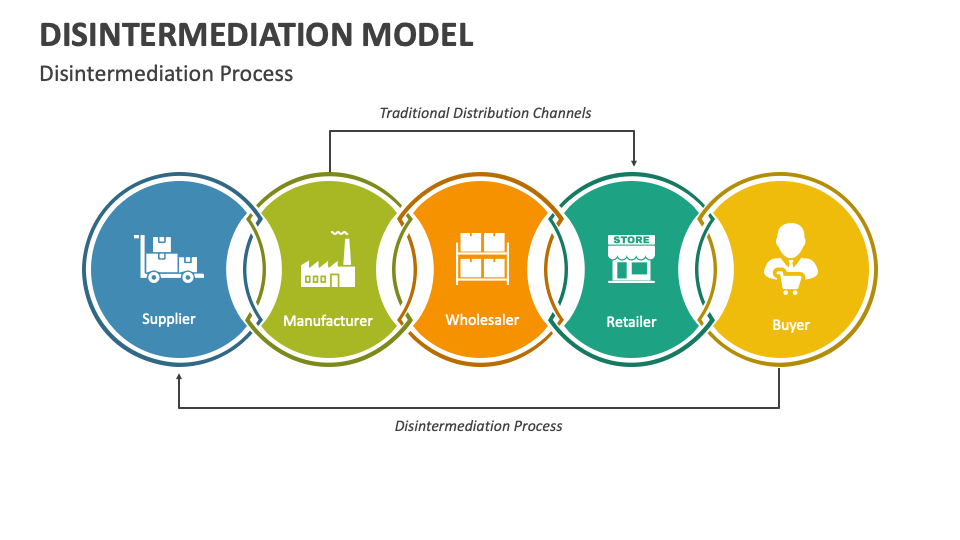

When we skip the middleman, we save money. It’s that simple. Here’s a fresh take: imagine buying veggies directly from a farmer. Now, apply that to your money. Banks are the shops, and we’re the buyers. By bypassing banks, we pocket the ‘shop’s’ cut. In other words, consumer savings from bypassing banks flourish.

You earn more because your savings aren’t chipped away by bank fees. This means higher interest on savings. So, more of what you earn, stays yours. It’s not just talk; it’s money in your pocket. Direct lending benefits you because it’s like handshakes between two folks — none else. Lower transaction costs follow, which lighten the load on your wallet.

In the loan world, things get even brighter. Let’s ask a question: What happens when you cut out costly bank processes? The answer: Loan costs drop. Because you’re dealing directly, reduced financial intermediary costs let you keep more money.

Fostering a Culture of Personal Finance Control

Now, let’s chat control. It’s sweet to call the shots, right? Well, here’s where personal finance control jumps in. With no bank curbing your choices, you’re the boss.

Ever checked out online borrowing platforms? If you haven’t, you’re missing out. Online platforms for borrowing offer cool tools. They help with loans without fuss and red tape. This, my friends, is financial empowerment. It means you’re in the driver’s seat, making solid, informed choices.

And get this, fintech innovations for consumers are a gold mine. They’re helping us wield our money with confidence. They show us that fine blend of tech and finance — a combo that’s reshaping our money habits for the better.

In this time when every penny matters, understanding how skipping bank queues can line your pockets, is gold. Aim for reduced reliance on traditional banks and savor the power of managing your money, your way.

Not only does this put you in charge, but it changes the game. It’s financial autonomy for individuals — no strings attached. You steer your financial ship wherever you fancy.

And so, we wrap up our chat today. Remember, parting ways with the bank middleman doesn’t just feel good, it also pads your wallet. Keep gripping that control and let your money do more for you. It’s simple, it’s savvy, and it’s seriously smart.

The Rise of Alternative Investment Platforms and Higher Returns

Exploring Direct Lending Benefits and Higher Interest on Savings

Direct lending lets you lend money directly to others. You often earn more than with a bank. It cuts out the middle person, so you keep more of what you make. You connect with borrowers online. They may use your money for homes, school, or starting a company.

Think about peer-to-peer lending. It’s like lending money to a friend for more returns. Your money can grow faster without a bank. Many sites help you lend safely. They check the borrower’s credit and take care of paying you back.

Now, higher interest on savings is a big deal here. Without banks in the way, you make more from interest. This beats what banks pay you to keep your money with them. Instead of the bank using your cash to make loans, you are the banker here. You pick who to lend to and can earn more.

Analyzing Peer-to-Peer Lending Advantages and Crowd Funding Opportunities

Peer-to-peer lending shines in offering you more control and options. It bypasses regular banks. This means lower fees for everyone. You pick who to lend to based on their story or needs. You can spread your money out, lending little bits to many. This can lower your risk if someone can’t pay back.

Crowdfunding is another path. People with ideas for products or businesses ask for small amounts of money. You can give money to help them start. If they do well, you get rewards or even a part of the profits. It’s not just about money; it’s about being part of something new and exciting.

Both these ways show how tech is changing the game. Sites and apps make it easy to put your money to work. You help others and can make more than with traditional saving. It’s a win-win.

Remember, with great rewards come risks too. Lending money always has the chance of not getting paid back. So, do your homework. Check out who you’re lending to. Spread your investments to lower risk. Start small if you’re new to this. Watch your money, and don’t put all your eggs in one basket.

This way of investing and saving is growing fast. It’s a clear sign of how we take charge of our own finance futures. We’re not stuck with just banks anymore. We have choice and power in where our money goes. Embrace it, use it wisely, and watch your savings grow.

How Blockchain and Fintech Innovations Fuel Consumer Empowerment

Enhancing Transaction Security and Eliminating Bank Fees for Users

Have you ever thought about how much you pay in bank fees? Too much, right? Now, imagine keeping that money. Fintech and blockchain are making this real. They’re like the super tools that fight high fees and security woes. No more fees just to use your money. No more worries about sneaky fraudsters.

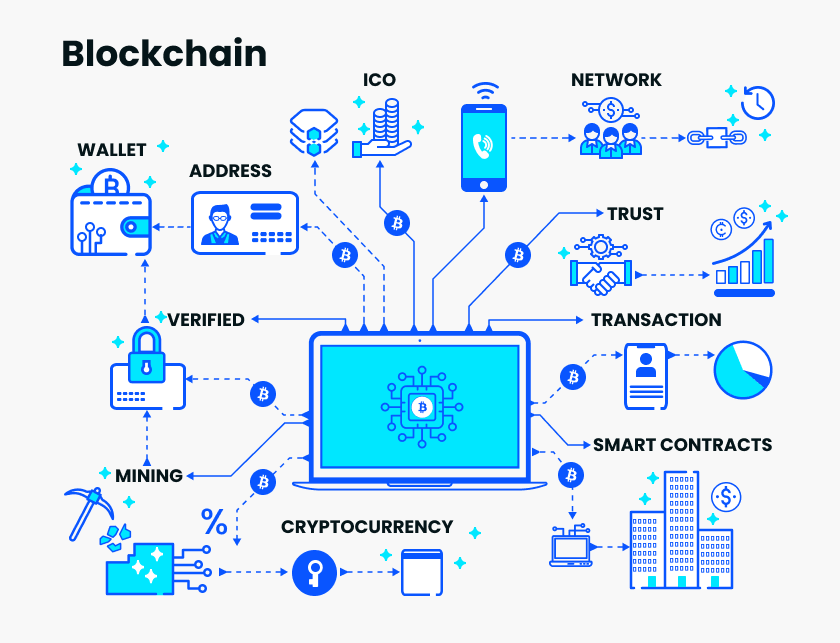

Blockchain tech is a game-changer. It’s all about making things safe and smooth. You see a transaction? You can trust it. It’s like having a personal guard for your cash. This guard never sleeps, always keeping your money safe as can be. No middleman means it’s just you and your money. Things get done quicker and safer.

Democratization of Finance: Accessibility and Financial Empowerment Through Decentralized Finance

Finance sounds stuffy, but it’s not. It’s your money and your power to grow it. That’s what fintech does. It spreads the power through tech everyone can use. It’s like sharing the keys to the treasure chest. With decentralized finance, we all get a key.

Money power to the people, by the people – that’s the heart of it. Think about buying a share of a dream project. Or lending some cash and earning interest. Online platforms let you do that easy-peasy. It’s lending and borrowing with no big bank hoop-jumping.

We’re not just throwing around fancy terms like ‘fintech’ and ‘blockchain’. It’s all about making you the boss of your cash. Big banks and slow systems out, speed and power to you in. When our money works for us, without a pricey go-between, we win. It’s the smart, new way to think about your dough.

Advancing Market Efficiency and Financial Autonomy

Embracing Financial DIY Tools and Consumer-Centric Banking Alternatives

We all want to be in charge of our money, right? Using financial DIY tools makes this happen. These tools make managing money simple and fast. No need for a bank to tell us what we can do. We can watch our money grow on our terms.

When it comes to savings, who doesn’t want more? Going past banks means, we often see higher intere

Another win is lowering fees we don’t need. Why pay a bank for something we can do on our own? Those fees add up, taking money from our future. By using online platforms, we say goodbye to those fees. It’s just sensible.

Then there’s blockchain. It might sound complex, but it’s a friend to our wallets. It helps us cut out the bank and keeps our money safe. We get to be in the driver’s seat, with tech that keeps our cash secure.

The Comprehensive Benefits of Reducing Reliance on Traditional Banks

Moving away from traditional banks is a game-changer for us. We save on a lot of costs that seem small but are not. Without banks, we say hello to reduced intermediary costs. This move pumps up our investment returns. More money finds its way into our pockets.

Peer-to-peer lending is another area where we stand to win without banks. We can get loans from real people, often at rates better than banks offer. And for those with extra cash, lending to others can give solid returns. It’s a two-way street of benefits.

Crowd funding lets us support new ideas or even grow our own. It opens doors to opportunities without needing a bank’s nod. This way, anyone with a great idea has a shot at success.

In summary, by embracing these alternatives, we aim for more control and better returns. We don’t need banks the way we used to. We’re stepping into a space where our money works for us, without all those extra costs. It’s about being smart with our cash, using tech and new ways to make our money go further. It’s a future where we’re all financially stronger, together.

In this post, we’ve tackled how cutting out the middleman in finance helps your wallet. You’ve seen how saving on fees means more cash stays with you. We’ve also shown that taking charge of your own money is powerful and smart.

We then dove into the world of alternative investments. Direct lending and peer-to-peer platforms can up your earnings, and crowd funding lets you support exciting projects.

Next, we explored how blockchain and fintech shake things up for the better. They offer tight security and trash needless bank fees, making finance fair for all.

Lastly, we looked at how to do your own finance work and dodge old-school banks. This means you can expect to see your money grow and your stress shrink.

Every step here nudges you towards being your own finance boss. That’s a win for you and your future. Keep these tips close and watch your money work harder for you.

Q&A :

What exactly does financial disintermediation mean for consumers?

Financial disintermediation refers to the process where consumers directly use investment markets for their financial needs, bypassing traditional banks and financial intermediaries. This can lead to several benefits for consumers, including reduced fees, lower interest rates on loans, higher returns on investments, and more control over financial decisions.

How do consumers benefit from financial disintermediation?

Consumers can benefit from financial disintermediation through increased savings from lowered or eliminated intermediary costs, competitive lending rates due to the absence of a middleman, and access to a wider range of investment opportunities. Additionally, this direct approach can offer more transparency and a simplified process for the consumer.

Can financial disintermediation affect the rates consumers receive on savings or loans?

Yes, financial disintermediation can positively affect the rates consumers receive. Without the need to pay intermediaries, consumers can often find higher interest rates for savings accounts and lower rates for loans. This is because the cost savings from bypassing traditional financial institutions are passed on to the customers.

Is financial disintermediation safe for consumers?

Financial disintermediation carries both benefits and risks. While it can offer greater returns and cost savings, consumers also assume more responsibility for their financial decisions. The safety can depend on the stability of the chosen investment platforms and the due diligence performed by the consumer. It’s important to research and understand the risks associated with any financial product or service.

What role does technology play in the financial disintermediation of consumer finance?

Technology plays a crucial role in the financial disintermediation of consumer finance by facilitating the direct connection between borrowers and lenders, enabling peer-to-peer lending platforms, and allowing for the creation of online-only banks and investment services. It also provides consumers with tools for better financial management and decision-making, further empowering them in the disintermediation process.