In today's fast-paced world, the **Benefits of Digital Payment Platforms: The Ultimate Convenience Booster**

simply cannot be overstated. Imagine zipping through checkout lines with a quick tap or click. No more fumbling for cash or waiting for change! These platforms are reshaping how we manage money, paving the way for a seamless shopping experience. I've watched them turn tedious transactions into effortless exchanges, and I'm here to tell you how they'll boost your daily life. With digital transactions, you have security at your fingertips and convenience in your pocket. Get ready to dive into a world where commerce runs smoother than ever.

Streamlining Commerce with Cashless Transactions

The Rise of Contactless and Mobile Payment Solutions

Cashless transactions are here. They make buying and selling smooth. How? They let you pay with just a tap or click. This means no digging for cash or waiting for change. Contactless payment systems and mobile payment solutions let you pay fast. Just wave your phone or card over a reader. That’s it!

And guess what? More people are using mobile wallets now. With your phone, you can pay for almost everything. Plus, you can keep track of your money better. And you know what’s great? You don’t need to carry a bulky wallet around.

Mobile payment solutions are safe, too. They use strong security to protect your info. This means you worry less when you buy stuff.

Optimizing the Checkout Process with E-payment Security Features

Now, let’s talk about e-payment security features. They’re key to a smooth checkout. Online shops use secure payment methods to keep your money safe. How do they do this? With special tech that checks for anything odd. This way, you can shop without fear.

E-payments are not just safe; they’re also super quick. Fast payment processing helps you avoid long lines. It’s a win for shops too. They can help more people in less time. This means more sales and happy customers.

The convenience of e-payments is clear. They save you time. You can buy what you want from anywhere, at any time. Online payment gateways make this easy. Just click and you’re done. This is perfect for our busy lives.

Plus, there’s more good news. Cashless transactions often have lower transaction costs. Why? Because they cut down on handling cash. For small businesses, this saves money. And let’s not forget how e-payments help the planet. They mean less paper for bills and records. That’s right, digital payments are eco-friendly.

In the end, digital wallet benefits go beyond just buying stuff. They help make shopping a breeze. You get in and out with what you need, fast. This keeps both buyers and sellers smiling. So, ready to tap, pay, and be on your way? Welcome to the age of cashless transactions!

Enhancing Convenience Through Digital Payment Technologies

The Integration and Efficiency of Online Payment Gateways

Think about shopping online. Want a faster, safer way to pay? Online payment gateways are your friend. They let you buy stuff without cash or checks. Just a few taps on your phone or clicks on your computer, and you’re done. That’s the magic of digital transactions.

With online payment gateways, you get quick and easy checkout every time. Say goodbye to long lines at the store. And the good news? They work 24/7. So, no need to rush to the bank during your lunch break.

These platforms come with top-notch security too. They protect your money like a guard dog. We’re talking about strong secret codes that keep your cash safe. No one can peek at your money matters. You pay with peace of mind.

Also, if you’re not a fan of math, these gateways help you out. They keep track of what you spend. So, you can see where your money’s going over time. Helpful, right?

More people can join in too. Even if you live far from a bank, you can still pay with a tap. And if you’re running a business, it’s simple to take money from customers in different countries. Digital payment gateways make selling worldwide a breeze.

Think lower transaction costs are a dream? With e-payments, it’s real. No more fees that come with handling cash. Keeping more of your money feels good, doesn’t it?

Accelerating Transaction Speed with Fast Payment Processing

Have you ever been in a rush to pay a bill? Digital payments speed things up. They’re lightning fast. No more waiting for checks to clear or cash to count. Tap, and your bill is paid. This speed makes life easier when you’re in a hurry.

Mobile payment solutions are like having a bank in your pocket. They work fast, so you spend less time on payments and more on fun stuff. Most payments happen in seconds. So you can grab your coffee and go on a busy morning.

Contactless payment systems? They’re like magic. Just wave your card or phone near the reader, and poof! You’ve paid. No swiping, no PINs. Speedy and simple. This gives you more time for yourself.

But what about security with all this speed? No worries. Fast doesn’t mean risky. The smart tech behind these payments is always on guard. It keeps your money safe from sneaky thieves. So you can be quick without concern.

In short, e-payments are about making life less complicated. They give me, the digital payment nerd who loves this stuff, more time to do fun things. And they can do the same for you. Fast, secure, and oh-so-convenient – that’s how we roll with digital payment technologies.

Advancing Security in Digital Financial Transactions

Robust Secure Payment Methods to Tackle Fraud Risk

Fraud is a big worry when it comes to digital money. We all want to know our cash is safe. That’s where secure payment methods come in. They cut down on fraud risk and let us shop without stress. How? By using clever tech to protect our data. Each time we buy something, these tools check for signs of fraud. That way, they can stop it before it happens.

Mobile payment solutions and contactless payment systems are key players here. They use special codes every time you pay. These codes change, so it’s hard for bad guys to copy them. This tech is not just cool. It’s a shield that keeps our money safe.

Think of digital wallets. They’re like a strongbox for your money. You can take it with you on your phone. It locks your cash away with encryption. That means it turns your payment info into a secret code. Thieves can’t use it, because they can’t read it. Plus, it’s super fast. You tap, pay, and you’re done. No need to dig for coins or write checks.

The Role of Encrypted Digital Wallets in Financial Inclusion

Now, let’s chat about digital wallets and how they help more folks get banking tools. Not everyone can just walk into a bank and open an account. But, lots of people have a phone. Encrypted digital wallets turn that phone into a bank. People anywhere can now join the money world, safe and simple.

Here’s how it works. You get an app for a digital wallet on your phone. You add your payment details inside. It’s all locked up with encryption, super-tight security. You can get money, send it, and pay for things, all in a few clicks. It’s not only easy. It’s bringing people who were left out into the fold of financial services.

Let’s not forget about lower transaction costs. Brick-and-mortar banks need lots of money to run. Digital wallets don’t. They cut out the middle man. That means they can charge you less when you send money or pay bills. That’s more cash in your pocket for other things. Plus, these wallets track your spending. No need for paper and pens. It’s all there in the app. You can make smart choices with your money.

Fast payment processing is another win. The old way of paying took time. Mailing a check or waiting in line at the bank eats up your day. With a digital wallet, sending cash is as easy as a text message. Quick and no fuss.

Wrapping up, the world of e-payments is full of promise. With secure payment methods, we can keep our money safe. And with digital wallets, anyone with a phone can join in. No more just wishing you could get with the times. Digital payments open the door wide to a whole new way of dealing with cash. They’re your ticket to the big league of commerce, fast and secure.

Fostering Financial Innovation and User Satisfaction

Boosting the User Experience with Seamless Payment Platforms

We’re all about making life easier. That’s what seamless payment platforms do. They link up with banks and stores in a snap. Money moves with a few clicks. No more digging for cards or cash. Folks love the easy life. That’s why they vote big yes for digital wallet benefits. You tap your phone, and bam, coffee’s paid for. This is cashless transactions at their best. And let’s not forget mobile payment solutions. You can split dinner bills, send cash gifts, or pay rent from anywhere. Just pull out your smartphone, hit a few buttons, and it’s good to go.

What’s the big draw? It’s all about that convenience of e-payments. Who wants to write checks or count cash? Imagine buying a birthday gift on a bus ride home. Or paying for a parking spot without leaving your car. It’s like having a magic financial wand in your pocket.

Levering Reward Programs and Subscription Models for Long-Term Engagement

Now, let’s talk treats and smart spending. Think about the buzz of getting points or cash back. That’s what reward programs in digital payments do. Each tap can mean money back, or points for the next buy. It’s a win-win. You’re spending anyway, why not gain something back, right?

But that’s not all. We’re in the age of ‘subscribe and chill’. Subscription model payments make life smooth. Pay once, and enjoy stuff month after month. No need to remember due dates or late fees. Music, movies, apps – all on auto-pilot. Simple. Smart. Sorted.

Digital platforms aren’t just a fancy trend. They’re reshaping how we think of money and worth. They’re making spending, saving, and even making money better for all. Now that’s true financial innovation for user satisfaction.

In this blog, we dove deep into the awesome world of cashless payments. We saw how tapping your phone to pay is on the rise and how it’s changing shopping for the better. Keeping your cash safe is key, and that’s where top-notch security steps in to keep your money locked tight. We also checked out how paying online gets easier every day, with super-fast payments taking the lead.

But wait, there’s more. Digital wallets aren’t just cool, they’re solid as a rock, fighting off the bad guys. And let’s not forget, these gadgets and apps are not just about paying. They’re also about making shopping fun, giving you perks, and keeping you coming back for more.

So what’s the big deal? Cashless payments are huge. They save us time, keep our money safe, and let us shop without a hitch. It’s clear they’re here to stay, and they’re only going to get better. Get ready for a future where checking out is just a quick tap away!

Q&A :

What are the main advantages of using digital payment platforms?

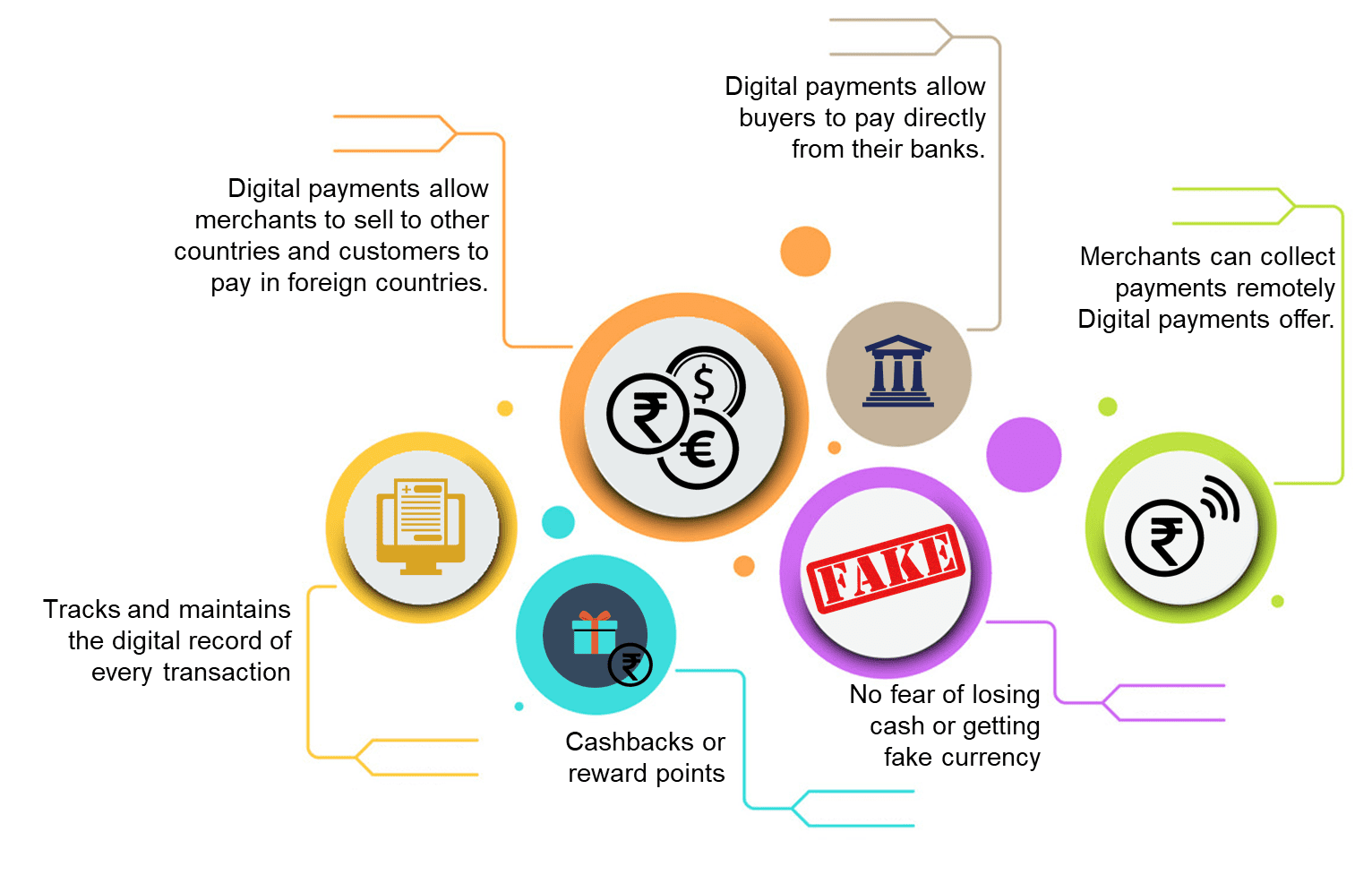

Digital payment platforms offer a multitude of advantages that cater to the needs of modern consumers and businesses alike. One of the primary benefits is convenience, as these platforms allow for quick and easy transactions without the need for physical cash or checks. They also provide enhanced security features, reducing the risk of fraud by using encryption and other protective measures. Moreover, digital payments can lead to better financial tracking and management since all transactions are recorded electronically, facilitating easier budgeting and accounting.

How do digital payment platforms enhance financial security?

Digital payment platforms enhance financial security through multiple layers of encryption and authentication protocols. They often require users to input passwords, use biometric verification, or two-factor authentication to authorize transactions, which significantly lowers the risk of unauthorized access. Additionally, since transactions are processed electronically, there’s no need to carry cash, which can be lost or stolen. Many digital payment platforms also offer real-time monitoring and instant notifications of transactions, allowing users to quickly detect and report any suspicious activity.

Are there cost savings associated with using digital payment platforms?

Yes, both consumers and businesses can experience cost savings by using digital payment platforms. For consumers, digital payments can often mean lower transaction fees compared to traditional banking methods or credit card transactions. Businesses may save money on transaction fees as well, and they also benefit from reduced handling costs associated with cash management. Moreover, digital payments can lead to a decrease in overhead costs by streamlining billing and payment processes, and sometimes by qualifying for additional discounts provided by the digital payment service providers.

Can digital payment platforms improve transaction speeds?

Absolutely, one of the most significant benefits of digital payment platforms is the improvement in transaction speeds. Unlike traditional banking transactions that can take days to process, digital payments are usually instantaneous or get processed within a few hours. This rapid transaction time is beneficial for both consumers, who gain immediate access to their purchases or payments, and businesses, whose cash flows improve due to faster receipt of payments.

What impact do digital payment platforms have on customer experience?

Digital payment platforms can have a profoundly positive impact on customer experience. They offer a level of convenience and flexibility that traditional payment methods often cannot match. Customers can make purchases or complete transactions 24/7 from anywhere, without the need for physical interaction or visiting a bank. These platforms also often remember customer information and preferences, leading to a smoother, more personalized checkout process. Lastly, the integration of loyalty programs and rewards within digital payments can enhance the customer experience by providing additional incentives for use.