Investments During Geopolitical Turmoil: Navigating Profits in Uncertain Times

In times when headlines scream of crises and conflict, savvy investors know turmoil can also spell opportunity. That’s right, even as uncertainty grips the globe, you can thrive in the chaos. You’re about to uncover the secrets to smart investing when geopolitical storms hit. Think of it as your guide to weatherproof your finances, where fear meets strategy. We’ll dive into safe havens that shield your cash from the world’s squalls. I’ll show you why gold glitters in gloomy times and how treasury bonds tie a safety knot around your nest egg.

Then we gear up with hedging tactics, let’s call them your financial armor against international spats. We’ll map out how cybersecurity and defense stocks could be your play, and why crisis-resistant sectors are the bunkers for your bucks. Not forgetting, we’ll dissect how spats with tanks and troops tug at market strings, especially for oil. Lastly, let’s tackle managing investment risks when maps get redrawn. Think navigating emerging markets or juggling currencies in conflict zones. Tighten your seatbelt; let’s dive into investments during geopolitical turmoil.

Assessing Safe Havens During Geopolitical Conflict

Understanding Gold Investment Dynamics

When fear hits markets, gold shines. But why? As tensions rise, so does gold’s allure. It’s seen as a safe store of value. When stocks drop, gold often climbs. This makes it a key hedge during hard times. Gold doesn’t rust or break down. And it has been valued for ages. It’s not just about wealth—it’s about safety too. Owning gold can be a strong move when the world feels unsure.

Gold investment in turmoil is a smart choice. Other assets might lose value fast. But gold tends to stand firm or even gain worth. This isn’t new. Folks have turned to gold in every sort of crisis. Think of it like a financial anchor. When winds blow, it holds you steady. Over time, gold has been less shaky than stocks or other investments. This doesn’t mean gold can’t drop in value. But history shows it’s more reliable when times get tough.

The Role of Treasury Bonds as a Safety Net

Now, let’s chat about treasury bonds. You can think of them as a safety net. When the world goes wild, treasury bonds often give you calm. They are loans to the government. Very safe loans, so most figure your money’s secure with them. During hard times, their value tends to rise. People and big money groups all tend to flock to bonds in a crisis. Why? They promise a return when lots of other things do not.

Treasury bonds as safety is a well-known play. Uncle Sam backs these bonds. That’s the U.S. government for those out of the loop. There’s a trust there that’s hard to shake. And they give you set payments over time. Bonds spit out interest like clockwork. You give a loan, you get those regular interest checks. When stocks plummet, bonds often do better. This makes them a fine hedge when you’re worried about geopolitical risks and markets.

So, if you’re looking to steer clear of risks, think about these. Whether you choose shiny gold or dependable bonds, both can offer cover. These are choices worth pondering if you’re guarding against rough times. When the going gets tough, smart moves in the market space can help keep your investments in line.

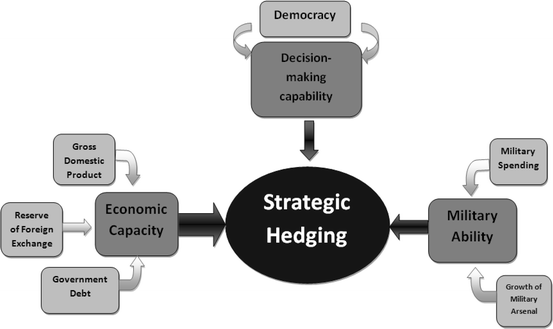

Hedging Strategies Amidst International Tensions

Diversification across Crisis-Resistant Industries

When the world gets shaky, we need to protect our money. One smart move? Scatter your investments. Think about crisis-resistant industries. These are areas that need to keep going, even when things are rough, like healthcare, utilities, and food. These sectors often stand strong while others suffer.

Let’s look at agriculture. We all need food, right? Even during conflicts, people have to eat. So, if you invest in agriculture commodities, you’re banking on something that will always be in demand. The same goes for pharmaceutical stocks. No matter what’s happening, sick people need medicine. These stocks may not hit it big like tech shares in a rush, but they stay more stable when troubles hit.

Now, real estate might wobble a bit when unrest stirs, but folks always need a place to stay. If you choose wisely, even in unstable areas, you can find gems that keep their value. It’s all about not putting all your eggs in one basket. If one part of your portfolio dips, the other parts can keep you afloat.

Deploying Hedging Techniques Using Cybersecurity and Defense Stocks

During turmoil, some sectors can actually do well. Take cybersecurity and defense. Sadly, wars and conflicts mean these industries get busy. This makes stocks in these areas kind of a safety net. They might even grow when others drop, helping to balance your risk.

Think about it. When nations quarrel, they bump up security and defense spending. If you own shares in companies that make military gear or protect against hacks, you could see gains. It doesn’t mean you want conflicts to happen — it’s just being prepared.

What about the scary word “hedging”? It sounds complex, but it’s really just making sure you’re not out of luck if things flip upside down. Pairing defense and cybersecurity investments with more chill ones, like in the energy sector, is smart. When oil prices jump because of global issues, energy companies often rake in more cash. You want some of that action, but not too much. It’s counter-weighting the risky bits with safer plays.

To wrap up, managing your portfolio in rough times is about balance. Don’t rush to gold or stuff cash under the bed. Broaden out. Include stocks that get a boost from the chaos, like defense and cybersecurity, but pair them with steady Eddie choices in crisis-resistant areas. This way, you’re set up not just to survive, but to come out on top, no matter the global drama.

And remember, changes in the world mean changes in the market. Keep your eye on the news. Understanding the world helps you know where to put your money. Stay sharp, stay diverse, and your investments can weather the storm.

The Impact of Military Conflicts on Global Markets

Analyzing the Military Conflict Economic Effects

When soldiers march and tanks roll, stock prices often take a hit. But why? Let’s talk simple and clear about this tough topic. War makes people worried. They think, “What’s next?” This fear can shake up our stock markets. Companies may struggle to get what they need because usual trade routes get cut off. Money that could boost businesses goes to defense instead.

So, what does this mean for your cash? Prices can go up – that’s called inflation. And the stocks you picked with care might fall in value. It’s like a puzzle with many pieces. Each piece matters. For example, if a factory making car parts gets damaged, not only cars but many things linked to cars will feel the pinch. It’s all connected.

War can bump up costs for goods, too. When it costs more to ship, it costs you more to buy. And if a country is in a real tough spot, other countries might not want to invest there. That can make things even harder for them to get back on their feet.

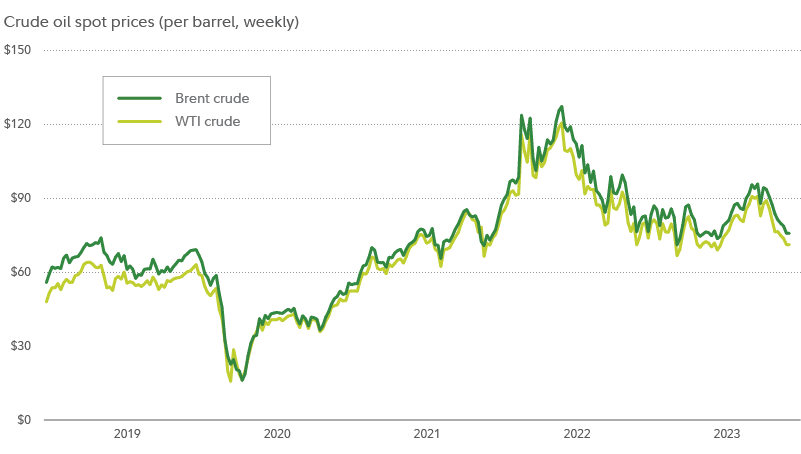

Energy Sector and Oil Prices during Geopolitical Upheavals

Now, let’s get into the energy game. Oil is a big deal. Wars can send oil prices sky high. Oil countries might not be able to pump out enough. Or they might not want to. When that happens, countries that need oil – that’s most of them – have to pay more. For you and me, that means pricier gas at the pump.

But there’s a twist. Did you hear about energy sector investment risk? It’s a gamble but can be a smart move. If you put some cash into energy stocks before prices go up, you could see some good money in return. It’s like buying umbrellas before a storm. When it rains, everyone needs one, and you’ve got them.

Look, investing in oil isn’t a sure thing. Prices dance up and down with the news of the day. One tweet or headline can change the whole scene. But if you’re sharp and keep an eye on the world, you can make moves that set you up well.

In short, military mess-ups shake things up big time. From what we pay for a snack to the cost to heat our homes. But with some know-how and a cool head, you can keep your money safe and maybe even see it grow. Just remember, it’s not just about picking the right stocks. It’s about watching the world, thinking ahead, and being ready for the ups and downs.

Investment Risk Management in Times of Geopolitical Uncertainty

Managing Portfolio Risks with a Focus on Emerging Market Volatility

When the world shakes with unrest, it’s smart to look closely at your money. Think of it like making sure your house can stand a storm. If you hear thunder rolling in from emerging markets, it’s high time to check your investments.

You might ask, “What’s a safe place to put my money during conflict?” Gold often shines here, like a sturdy umbrella. Markets may tumble, but gold often stands strong. Another good bet is treasury bonds. They’re like a warm, safe coat in bad weather.

But there’s more to explore than just gold and bonds. We must talk about spreading out risks, or as I like to call it, not putting all your eggs in one basket. It makes sense, right? If some areas get hit hard, others could stay okay and keep your money safe. That’s why we, as investors, love to diversify during chaos.

Currency Fluctuations and Investment Strategies for Conflict Zones

Money’s value can jump around like a scared rabbit in times of war and strife. When tanks roll, cash often runs the other way. So, what can you do? Think of it as dancing with the market. For instance, if you’ve got dollars and the conflict’s elsewhere, you might sit pretty. But if you’ve got cash from a hot zone, it could be time to move to a safer dance floor.

With each news flash of trouble or triumph, the worth of your cash can swing. You want to not just stay afloat, but also swim well through these wild waves. It’s about being clever with your cash, like switching to money that doesn’t get tossed around so much in conflicts.

Now, it’s not just about dodging the dips. It’s also about seeing which sectors might be like life rafts when the storm hits. Defense stocks can get a boost, as nations often spend more on security when things heat up. They can act like a sturdy life vest.

Energy deserves a look, too. Let’s say there’s a dust-up in a place that pumps a lot of oil. Prices may soar, like a kite catching a strong wind. That updraft could lift energy stocks with it.

In short, dealing with tricky times needs a cool head and some smart moves. Whether you’re a newcomer or an old hand at this, managing your money when the world’s in a tangle is about being careful, creative, and ready to act. Always keep an eye on safe spots, spread out risks, and stay nimble as you dance with the dollars. Your future self will thank you for it!

In this post, we dove into safety nets during tough global times. We looked at why gold shines when trouble stirs and how treasury bonds can be a shield. Then, we saw how smart picks in crisis-resistant markets and choosing strong cyber and defense stocks can set up a wall against risks.

We also unpacked how fights across borders shake up economies and lift or drop oil prices like a wild ride. Lastly, we tackled risk play in investments, spotlighting the ups and downs in new markets and how money shifts in hot zones can stir the pot.

My final take? When the world gets shaky, your money needs a steady hand. Keep your eyes wide, pick strong, lasting assets, and never bet all on one horse. Stay smart, stay safe. That’s how you win the investment game, even when peace seems far off.

Q&A :

How can geopolitical turmoil affect my investment portfolio?

Geopolitical turmoil can lead to significant volatility in financial markets as investors react to uncertainties and risks related to international conflicts, trade tensions, or political instability. Such events often result in a flight to safety, with investors seeking refuge in traditional safe-haven assets like gold or government bonds, which can cause fluctuations in asset prices and exchange rates. The performance of various sectors may diverge, with industries like defense potentially gaining and others feeling the negative impact of disrupted trade flows or resource scarcity.

What are safe-haven assets to consider during geopolitical crises?

During times of geopolitical crises, investors typically look to safe-haven assets that are believed to retain or increase in value. Common safe-haven investments include precious metals such as gold and silver, U.S. Treasury bonds, the Japanese yen, and Swiss franc due to their stability or the backing by strong economies. Real estate and certain stable, dividend-paying stocks may also be considered relatively safe options.

How can I diversify my investments in light of geopolitical risks?

Diversifying your investment portfolio can mitigate the risks associated with geopolitical turmoil. This involves spreading investments across various asset classes such as equities, bonds, commodities, and real estate, as well as across different geographic regions and industries. This strategy can help reduce the impact of a downturn in any single asset or market, providing a more stable overall return on investments.

Is it a good time to invest in emerging markets during geopolitical turmoil?

Investing in emerging markets during periods of geopolitical turmoil presents both opportunities and risks. While some emerging markets might offer attractive valuations and the potential for high returns, they can also be more vulnerable to geopolitical shocks. The key is to conduct thorough research, consider the specific country’s exposure to the turmoil, its economic fundamentals, and potential for growth. Consulting a financial advisor before making such investments is advisable.

What strategies can investors use to protect their investments during global conflicts?

To protect investments during global conflicts, investors can adopt various strategies such as rebalancing their portfolio to include a higher proportion of conservative assets, using hedging instruments like options and futures, or investing in sectors that are less likely to be affected by geopolitical tensions. Staying informed about global events, maintaining a long-term investment perspective, and being ready to adjust strategies as the situation evolves are also crucial for risk management.