Ever wondered why some investors stay ahead while others get left behind? It’s because the importance of financial market analysis cannot be overstated. This deep dive is your key to unlocking wealth. Whether you’re a newbie or a seasoned pro, understanding markets means better decisions and, yes, more money in your pocket. So let’s unveil these secrets together and turn analysis into power!

Understanding the Role of Financial Market Analysis

Deciphering Investment Risks and Returns

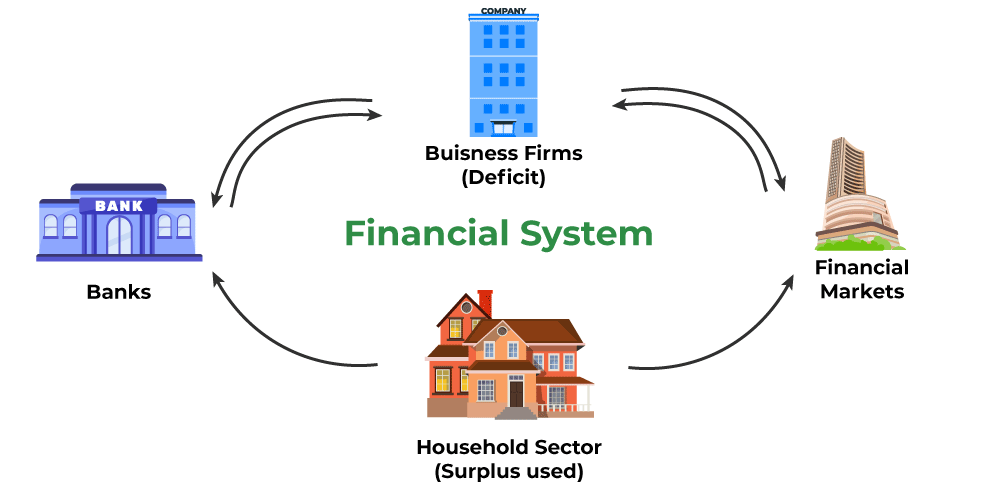

Think of the last time you made a big buy. You did your homework, right? Same goes for investing. To grow wealth, we must grasp financial market trends analysis. It helps us spot chances to make money and avoid costly mistakes. Analyses lead us to wise choices. They keep us updated on what’s hot and what’s not in the world of cash, stocks, and more.

We use tools to predict how investments will do. This is critical for deciding when to buy or sell. Think of it as a weather report, but for your money. Investing with no analysis is like driving blind. It’s risky and can lead to lost cash.

The Synergy Between Economic Indicators and Investment Strategy Planning

What’s the thing with economic indicators? They’re like signs along the road. They guide us in making smart money moves. When we plan investment strategy planning, these signs show us the way. They tell us about the economy’s health and where it might go next. They can warn us about rough times ahead or hint at good times to invest.

For example, job reports can tell us if people are working and spending. This helps us know if businesses may grow. Lower interest rates can mean cheaper loans, leading to more businesses and home buying. This could lift the stock market as well. Connecting the dots between these signs and our money plans is key.

In simple words, market analysis lets us peek into the future. It helps us make solid bets on where to put our dollars. It’s a puzzle, sure, but we use the pieces—like stock market research importance—to build a picture of what might come.

Understanding financial data isn’t just for money pros. It’s vital for anyone wanting to guard and grow their wealth. Assessing investment risks is step one to safer and smarter investing. Each step, armed with wisdom from the markets, boosts our money’s power. We look at the past to predict the future, using history as our guide.

Clear as day, the benefits of market analysis shape our financial journey. They keep us sharp and ready to snag opportunities. They also remind us to step back when the risk is too high. Teaming up economic indicators with solid planning is like having a treasure map. You still need to follow it and watch for traps, but it leads to riches.

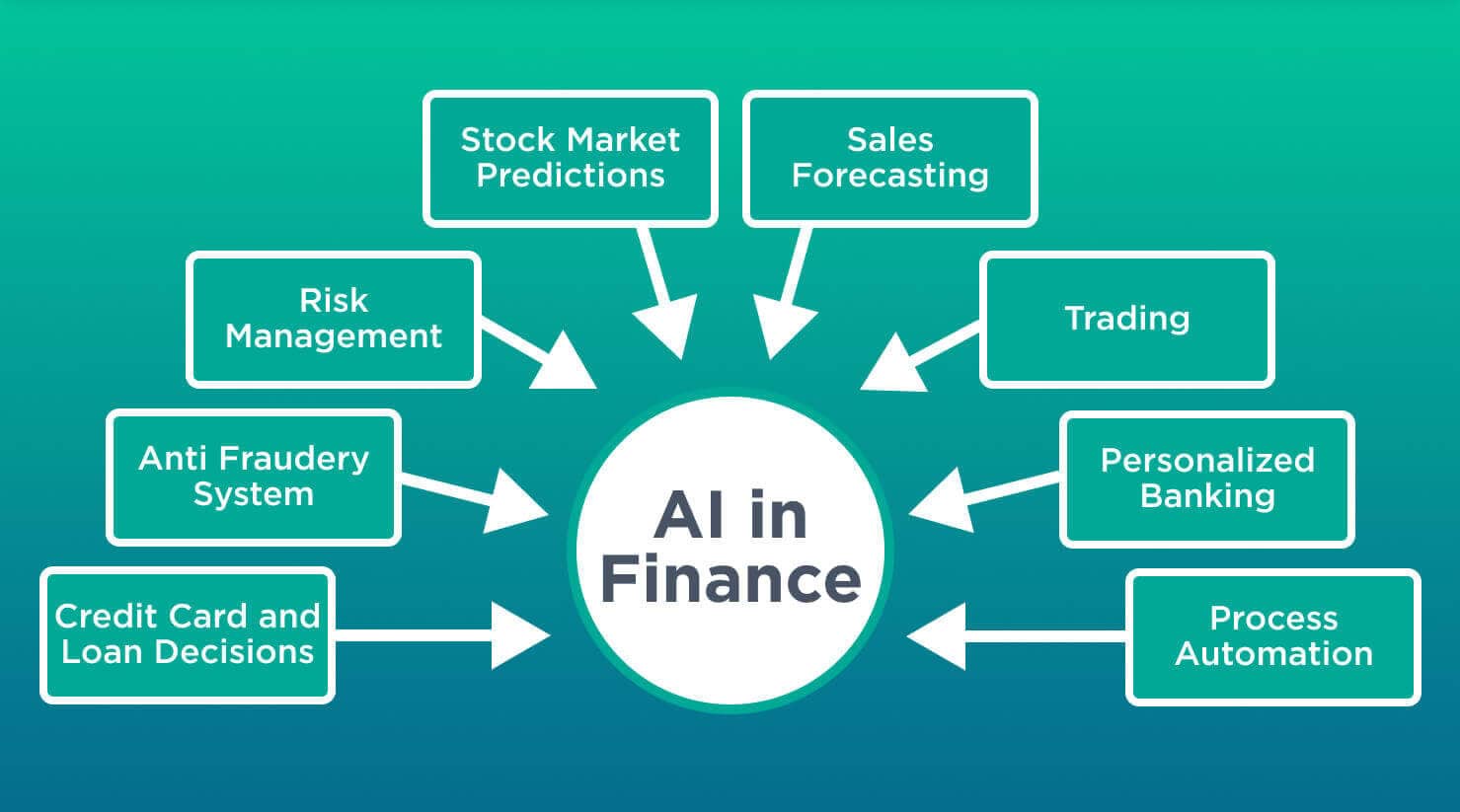

By cracking the code of financial news impact, we stay two steps ahead of the game. True pros take this as their bread and butter, but it’s something we all can learn. This is not just talk; it’s the real deal for taking charge of your financial future. Market sentiment evaluation, asset valuation techniques, and analyzing financial statements—these aren’t just fancy terms. They’re our toolkit for winning in the wild world of investing.

So, let’s keep sharp, make learning about money a habit, and remember: with knowledge as our ally, our wealth won’t just grow—it will soar.

Illuminating the Art of Investment Strategy Formulation

Merging Financial Forecasting Methods With Market Trends

When we make plans to grow our money, looking at market trends is a must. These trends show us the health of different markets like stocks, bonds, or even real estate. By using financial forecasting, we can guess where these trends might go. Imagine you want to go sailing. You’d check the weather right? That’s like using forecasts in finance. By doing this, you won’t be caught off guard by a storm.

But why blend forecasts with trends? It’s simple. Trends can tell us what’s hot or not, but forecasts can give us a sneak peek into the future. It’s like looking at the road ahead through binoculars. They can help us see if there’s a turn coming up or if the road is straight for miles. We use this info to make smart choices today for a better tomorrow.

So, when making plans for your investments, pay close attention to market trends. Then use forecasting to guide you through them. This one-two combo helps you plan better and hopefuly lets you sleep easy at night.

The Balance Between Technical Analysis and Fundamental Insights

Now, let’s chat about two main ways to look at financial data: technical analysis and fundamental insights. Technical analysis is like checking your car’s speed and gas gauge while you’re driving. You’re looking at patterns and numbers to guess what might happen next. Fundamental insights, though, are more like looking at your car’s engine or the company that made it. You’d want to know if they’re strong and can last the long ride.

Having both views is key. With technical analysis, you watch how prices move and use those patterns to make decisions. On the other hand, fundamental insights make you dig deep. You ask why a company is worth your investment and look at their earnings and debts.

Some folk might favor one method over the other. Yet, both are important when making your investment plans. Together, they help you get a clear picture of where your money might grow the most. It’s a bit like having a map and a compass when you’re lost in the woods. You need both to find your way out and get to where you want to be.

Understanding both types of analysis can be a game- changer. You’re no longer just going with the flow. Instead, you’re making calls based on good info. This could help you make more money or avoid losing it. So, take time to learn both well. It will help you a bunch when planning where to put your money. Remember, being smart with your investment strategy is not just about making money. It’s also about not losing it.

The Backbone of Informed Investment Decisions

How Qualitative and Quantitative Analyses Drive Portfolio Performance

To grow your money, you must grasp financial market trends. This means looking at numbers and stories behind them. Quantitative analysis deals with hard data, crunching numbers to see patterns. Qualitative analysis adds context, understanding the ‘why’ behind the ‘what’. They both play key roles.

Smart money folks blend both ways to make solid choices. They look at charts and also ask: what’s happening in the world that affects these numbers? This mix helps you get a full picture. It lets you make bets on the future with more confidence.

Let’s say you’re eyeing a tech stock. Numbers might tell you it’s risen fast. But qualitative analysis will ask: is there a new gadget everyone loves? Is there strong leadership in the company? You need both sides to make wise picks.

Interpreting Financial Statements for Future Market Positioning

Knowing how to read financial statements is like seeing the health of a business. Income statements, balance sheets, and cash flow statements are key. They show you how much money a firm is making, what it owns, and how cash moves.

When you understand this, you can guess better what the business will do next. Will it grow big? Hit trouble? You need this info to choose stocks wisely. You also see if a business owes too much or if it’s storing cash for hard times.

For example, a firm that’s selling more than last year sounds good. But looking closer, if it spends too much to make sales happen, that’s a red flag. This is why digging deep into financial data is a must. It guides you in knowing which firms will stand strong in the long run.

Understanding financial data isn’t just about numbers. It’s about spotting tales of success or signs of trouble early. It sets you up to act before others catch on.

Market analysis is your best tool to stay ahead of the game. It leads to choosing the right investments at the right time. And that’s how you keep winning at the wealth game. You don’t just save your cash; you make it work for you.

Building Financial Resilience Through Market Intelligence

Aligning Financial Risk Management With Market Volatility

Smart money moves can make or break your wealth. Think of the stock market like a wild ocean. Sometimes it’s calm; other times, it’s all storms and high waves. Here’s the kicker: you can learn to sail through it all with the right skills. Understanding financial data is just like reading a map before you set sail. It helps you not lose your way when the water gets rough.

Market trends come and go. One day a stock is up, the next it’s down. By analyzing financial statements and the latest financial news impact, we can spot patterns. Patterns are clues. They tell us when to hold tight and when to jump ship to save or grow our funds.

A big part of this is assessing investment risks. How? We measure how much money we might lose against how calm or wild the market looks. Sometimes we want to take a chance for a big win. Other times we play it safe. This balance keeps our money growing even when the market dives and jumps.

The Critical Importance of Financial Literacy in Wealth Accumulation

Let’s talk about financial literacy. It’s a fancy way of saying “knowing about money.” Here’s what’s cool: the more you know, the more you can make. Knowing how cash flows and grows is a super power.

So, what’s the deal with investment strategy planning? It means making a game plan based on facts, not just gut feeling. We look at numbers, charts, and reports. With these, we make smart choices, like finding the best time to buy or sell.

Also, we’ve got tools to guess the future of stocks, called financial forecasting methods. These tools help us see what might happen next. We can’t see the future, but we can make really good guesses. This helps us stay one step ahead.

That’s the treasure of financial market trends analysis. It digs up hidden gems of info that can lead to gold. Or, in grown-up talk, it finds key insights that can boost your bucks. When you get how money works, you get more of it. It’s as simple as that.

Every day, experts and computers examine economic indicators. These are signs that show if the economy is doing well or not. Think of them like weather reports for your cash. They help us decide if it’s a good day to make moves or to wait.

To wrap it all up, understanding market cycles and the effects of market volatility is key. By keeping an eye on market sentiment evaluation, we can sense the mood of other investors. This tells us a lot about what might happen next.

Oh, and one more thing. Ever heard folks talking about “buy low, sell high”? That’s kind of the golden rule. It means we aim to buy stocks when they’re cheap and sell when they’re pricey. But to do that, we need to know the true worth of things, using asset valuation techniques.

There you have it. Tame the wild market ocean by learning to sail with knowledge. The more you know, the better you do. And that, my friend, means more coins in your chest.

Remember, every sailor was once a learner. So, start small, learn lots, and watch your treasure grow!

In this post, we explored the nitty-gritty of financial market analysis. We looked at how risks and returns tell us about smart investing. We also saw how economy signs shape our investment plans. Then, we went on to the craft of making these strategies. It’s all about matching forecasting tricks with what the market’s doing and finding a sweet spot between tech tips and solid facts.

We dived deep into how both crunching numbers and understanding stories help our money grow. Plus, reading financial reports can guide us on where the market’s headed next. And finally, we learned how to stand strong when the market shakes and why knowing your money stuff inside out is key to building wealth.

In short, smart investment moves come down to solid analysis and staying sharp. Keep these lessons close, and you’ll be set to make informed choices that can lead to a stable and prosperous financial future. This stuff matters, so take a beat, think it over, and get ready to play the investment game with confidence.

Q&A :

Why is financial market analysis critical for investors?

Financial market analysis is a vital tool for investors as it helps them make informed decisions based on the study of past and current market trends, economic data, and other pertinent factors. Understanding the dynamics of the markets can lead to more strategic investment choices, risk management, and the potential to maximize returns on investment.

What are the main components of a thorough financial market analysis?

A comprehensive financial market analysis typically includes several core components: economic indicators (GDP growth rates, employment data, inflation, etc.), company fundamentals (revenue, earnings, management effectiveness, etc.), sector trends, and market sentiment. Examining these elements allows for a holistic view of the financial environment and potential investment opportunities.

How does financial market analysis benefit day-to-day trading?

For day traders, financial market analysis is fundamental. It allows traders to spot patterns, trends, and anomalies in market behavior quickly, which can lead to timely trades and quick decision-making. Recognizing these opportunities and acting on them efficiently can significantly affect the profitability of day-to-day trading operations.

Can financial market analysis predict market movements accurately?

While financial market analysis employs various models and tools to forecast market trends and valuations, it cannot predict market movements with absolute accuracy. Unexpected events, market sentiment, and global economic changes can impact market behavior. Nonetheless, a thorough analysis can provide probabilistic estimates that guide investors in making better-informed decisions.

What role does financial market analysis play in risk management?

Financial market analysis is fundamental in identifying potential risks and crafting mitigation strategies. By understanding market volatility, credit risks, and economic trends, investors can better assess the level of risk associated with particular investments and adjust their portfolios accordingly to manage exposure and safeguard their financial positions.