How to Shield Your Finances: The Digital Payments Security Checklist

Let’s be real, thieves are sneaky, and the digital world is their new playground. The truth is, you must know how to protect your data when using digital payments. Without smart steps, your cash could be at risk. What if I told you that fighting off digital pickpockets is simpler than you think? No high-tech jargon, just our rock-solid security checklist worth its weight in saved dollars. Keep reading, and let’s bulletproof your digital dough together.

Understanding the Basics of Digital Payment Security

The Role of Encryption in Protecting Financial Transactions

You might wonder, what’s encryption? It’s like a secret code for your data. When you buy stuff online, your info turns into a code. Only the right person can read it. Think of it as whispering to a friend. Others hear noise, but your friend hears everything clear.

Why does it matter? Well, lots of folks are out to grab your card info. That’s bad news bears. With encryption, nosy crooks can’t make sense of your details. It’s a super shield for your cash online.

Keep an eye on this: always check if a site uses encryption before paying. A little lock icon near the web address is your clue. Click it to check the security certificate. Stay away if you don’t see one.

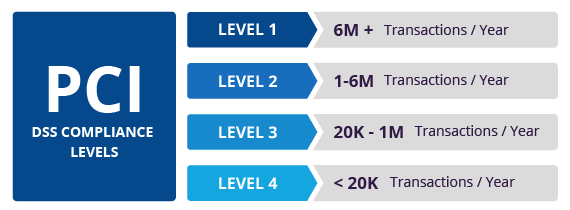

Importance of PCI DSS Compliance for Secure Payments

Now, let’s chat about PCI DSS. It stands for Payment Card Industry Data Security Standard. It’s a set of rules to keep your card safe. Any store or site that takes card payments has to follow it.

Think of it like the rules of soccer. Without rules, the game’s a mess. PCI DSS keeps everyone playing fair and safe. It makes sure they guard your card data like treasure. This way, hackers have a hard time scoring against you.

So, how can you be sure sites are PCI DSS pals? Often, they’ll brag about it on their website. If you’re not sure, it’s cool to ask them. No shame in that game. You’re just protecting your treasures.

Remember to trust your gut. If a site looks shady or too good to be true, it might just be. Stick with names and places you know and trust. Your cash and peace of mind are worth it.

That’s the lowdown on digital payment security. Use that lock icon to check for encryption. And make sure places where you shop respect PCI DSS. You’ll be banking and buying safer than ever.

Fortifying Access: Authentication and Password Management

Implementing Multi-Factor Authentication for Payment Security

Using multi-factor authentication (MFA) is a must-do today. What is MFA? It’s using two or more checks to prove it’s you. This can be a code on your phone, your fingerprint, or even your face! Why use MFA for payments? It adds a tough layer of security. If someone steals your password, they still can’t get in. Scary stories of stolen money happen less when you use MFA.

With MFA, even if a hacker gets your password, they’re stuck. They need your phone or your fingerprint too. That’s nearly impossible for them to get. It’s like having a secret hand-shake with your payment app. Only you know it, so only you get through. You’re safe, your money’s safe, and hackers are not happy.

Strong Password Policies and Their Impact on Data Safety

Now let’s talk passwords. We all use them, but not everyone knows how to make a strong one. A strong password is like a sturdy lock on your front door. The better it is, the safer your home – or in this case, your money. What’s a good password? It’s long, unique, and has a mix of letters, numbers, and symbols. Don’t use easy guesses like “password” or your birthday.

Bad guys love easy passwords – they can crack them fast. But when your password is tough, they hit a wall. Think of your password as a secret code that guards your cash. You don’t want just anyone figuring it out, right? That’s why you need a good one. A good password keeps sneaky thieves away, so you can sleep easy knowing your data is tucked in tight.

Always change passwords if you hear about a data breach. It’s annoying but key to keeping bad actors away from your money. Check for breaches and change those passwords – better safe than sorry. And try not to reuse passwords. If you use the same one everywhere and one site gets hit, it’s like giving a thief the keys to your house.

Use different passwords for each site, especially for banking and shopping. It’s like having different keys for every door you have. It takes more effort, but it’s worth it. Remember to keep your passwords secret. If you must write them down, keep them in a place only you know. This way, you’re the boss of who gets in and who doesn’t.

In conclusion, use MFA and strong passwords to keep your money safe. Make them tough to guess and change them if there’s a breach. This is your money we’re talking about, so take these steps seriously. They’re easy to do and make a huge difference in your financial safety. Your future self will thank you for taking care of your cash now!

Safeguarding Your Transactions: Mobile and Online Payment Precautions

Choosing Secure Mobile Payment Apps and Gateways

To keep your money safe, pick secure apps and gateways for paying. Start by checking the app’s reviews. They should be mostly positive. Look for recent, real person reviews to trust them. Next, see if the app uses encryption. This scrambles your data, so hackers can’t read it. Only use apps that encrypt your information both when it’s being sent and when it’s not moving. Also, make sure the payment gateway follows the payment card industry data security standard, also known as PCI DSS. This means they follow rules to protect your credit card details.

Make sure apps update often, too. Regular updates fix security holes. Also, use a VPN when on public Wi-Fi to hide your details. This makes it harder for thieves to steal your info. Your phone should also lock with a code or fingerprint. This stops others from using your payment apps if they grab your phone.

Best Practices to Avoid Digital Payment Fraud and Identity Theft

To fight fraud, use multi-factor authentication. This asks for more than one proof that it’s really you. Like a code on your phone and your password. This way, even if someone steals your password, they can’t pay with your info. You could also use a one-time password or a biometric scan like your fingerprint.

Create strong passwords, too. They should be hard to guess. Mix letters, numbers, and symbols. Don’t use things people could guess, like your birthday or “password”. And don’t write them down where others can find them. Change your passwords often. Once a month is good. Make each one different for each website or app.

Watch your card statements closely. Look for payments you didn’t make. This can show if someone’s stolen your details. If you see a payment you don’t know, call your bank right away. They can stop the payment and protect your account.

Be on guard for emails or calls asking for your info. These could be phishing scams. They trick you into giving out your private details. Don’t click links in emails if you’re not sure they’re safe. If you get a call asking for your details, hang up. Call the company back with a number you know is real.

Before paying online, check the website address. It should start with “https” and show a lock icon. This means it’s secure. Only pay on these sites. Don’t save your card number on websites. Even if it’s faster to pay next time, it’s not worth the risk.

Always log out of payment apps and websites when you’re done. This stops others from getting into your account. Keep these tips in mind whenever you make a digital payment. They’re your shield against fraud and theft, and they’ll help keep your finances safe and sound.

Staying Updated: Ensuring the Safety of Your Payment Software

The Significance of Regular Payment Software Updates

Always keep your payment apps up to date. This means, as soon as you get an update alert, take action. Why? Because those updates fix holes that let hackers in. Old apps are easy targets for bad guys wanting your card info. Remember, you’re the front line in keeping your money safe.

Updates are not just about new features. They’re mainly about security patches. These patches cover weak spots before they become big problems. Think of it like fixing a leak in your roof before it rains. You don’t wait for a storm to flood your home. So, don’t wait for a thief to steal your cash. Check for updates at least once a week. It’s a quick job that makes a big difference.

Utilizing Tokenization and Privacy Tools for Additional Security

Next, let’s talk about tokenization. This tech turns your card details into a code. Even if a hacker gets this code, they can’t use it to shop. It’s like having a decoy wallet that throws off pickpockets. Cool, right?

Make sure your payment app uses tokenization. It’s a sign they care about keeping your data safe. Every time you buy something, this tool is on guard. It shields your bank info from prying eyes.

Privacy tools are your buddies in the fight to keep your cash safe. Use VPNs when you’re on public Wi-Fi to put up a wall around your data. It’s like whispering your secrets in a noisy place. No one can overhear your business.

Strong passwords are also key. Mix letters, numbers, and symbols. Change them often. Keep them to yourself. Don’t make it easy for crooks to guess your keys to the vault.

Finally, keep an eye out for fishy emails or texts. These might try to trick you into giving away your secrets. Don’t fall for it. Never share your codes, pins, or passwords.

Staying safe with digital payments is all about taking charge. Keep your apps fresh, use smart tools, and stay alert. Your financial safety is worth that effort.

In this post, we’ve tackled how to keep your money safe when you pay online. We started by looking at digital payment security, focusing on how encryption keeps your transactions safe. We also discussed why meeting PCI DSS standards is key for secure payments.

Next, we explored how better passwords and using several steps to confirm who you are can protect your accounts. Remember, strong passwords are your first defense line, and using many ways to prove it’s you adds extra security.

We also went over tips for choosing safe mobile payment apps and smart habits to prevent fraud and theft. Be choosy with apps and stay sharp to spot scams.

Lastly, we learned why updating your payment software is crucial. Updates fix security holes, and using tokenization means your details are hidden.

Stay smart with these steps, and you can shop and pay online with peace of mind. Protecting your money and info online isn’t tough if you know what to do. Thanks for reading, and stay safe out there.

Q&A :

How can you safeguard your financial information during digital transactions?

Securing your financial details starts with utilizing strong, unique passwords for each payment app or service and enabling two-factor authentication wherever possible. Always ensure that your device’s operating system and applications are updated with the latest security patches. Avoid using public Wi-Fi for financial transactions and consider using a dedicated virtual private network (VPN) for added security.

What measures should be taken to enhance security for digital payment apps?

To enhance the security of your digital payment apps, always download them from trustworthy sources such as official app stores. Regularly check app permissions to ensure they only access necessary information. To further strengthen security, use biometric authentication like fingerprint or facial recognition if supported, and log out from the app after completing your transactions.

Are there practices to avoid to keep your digital payment data secure?

For maintaining the security of your digital payment data, avoid clicking on suspicious links, especially from unsolicited emails or messages claiming to be from financial institutions. Do not share sensitive information like PINs or passwords, and be wary of unsolicited phone calls or messages asking for such details. Also, stay clear of making payments on unsecured or unknown websites.

What steps should be taken if you suspect your digital payment information has been compromised?

If you suspect any compromise of your digital payment information, act swiftly by contacting your bank or the payment service provider to alert them and possibly freeze the affected accounts. Change your passwords immediately and monitor your account for any unauthorized transactions. It’s also advisable to report the incident to the relevant cybercrime authorities in your area.

Can updates on smartphones and payment apps improve payment security?

Yes, regularly updating both your smartphone’s operating system and your financial apps is crucial for payment security. Updates often include patches for security vulnerabilities that have been discovered since the last version. By keeping your devices and apps current, you minimize the risk of data breaches and reduce the exposure of your financial information to potential threats.