The Rise of Fintech in developing economies is changing the game. Imagine living where banks are miles away and few. Now, tech brings banking to your screen, simple and quick. It’s a world where your phone is the new wallet and sending money is as easy as a tap. No more long lines or waiting days to get things done. That’s the power of fintech, and it’s taking over fast. Let’s dive into how it’s rewriting the rules of finance and offering a brighter money future to places where it’s needed the most.

Understanding the Fintech Revolution in Emerging Markets

Key Drivers of Fintech Adoption

People in growing economies are now using their phones to bank, pay, and save. This change is huge. They skip old bank ways and jump right to new tech. This helps everyone move forward fast. Mobile banking and digital payment systems let people handle money with a tap. Even those far from banks can now keep money safe and pay bills easy. This is changing lives in big ways. The rise of mobile wallets shows just how much people want easy, safe ways to store cash.

Fintech startups are finding new ways to reach people and their money needs. They get folks who don’t have banks to start saving and borrowing with just a phone. This helps people start small businesses and grow them. With online lending, folks can get loans fast to help their dreams grow. It makes sense that these new services spread so fast.

But it’s not just about having smart ideas. For fintech to grow, it needs money too. Funding fintech startups is about backing brave new ways to fix old problems. It helps them grow and reach more people. Smart money backs these tech dreams and helps them come to life.

Addressing Challenges for Scaling Fintech

To grow big, fintech has to face some tough stuff. It’s got to win trust from people and follow rules to keep everyone safe. The fintech regulatory environment is key. It makes sure fintech firms play fair and clear. Think of it like setting up rules for a new game. Everyone needs to know how to play and what’s off-limits.

Building fintech that many can use ain’t easy. It needs bright minds that know tech and money. There’s a push to teach more about fintech. This makes sure there are clever people to run it. Fintech firms also have to make sure using their services is a smooth ride for all. This means their tech should be simple and easy for many folks.

Another big goal is making a cashless economy work. By moving money without cash, things get quicker and safer. Plus, when tech handles money, small fees on each dollar can help cut down on costs. This helps people keep more of their money.

Peer-to-peer payments and microfinance are also part of this new world. They let folks share money and help each other grow. It’s a new way of looking at helping out neighbors and friends.

To wrap up, this fintech wave is huge. It is reshaping how money moves in these growing lands. It’s all about giving more power to people over their cash. And at the end of the day, this kind of change makes life better for all.

Fintech and Financial Inclusion: Bridging the Gap

Mobile Banking and Digital Payments: A Path to Accessibility

Imagine living far from a bank and carrying money is unsafe. Fintech makes life easier! With mobile banking, folks in small towns can send cash, pay bills, and save money right from their phones. You don’t need a fancy bank account. It’s like having a bank in your pocket!

But how does mobile banking work? Easy! You use an app to check your balance, send money, and more. It’s quick, simple, and safe. No more long trips to the bank! This magic tool helps millions who never had a bank before. It’s a big step for people’s money needs.

Now, think about buying stuff. It’s a snap with digital payments! You just tap your phone and boom, you’ve paid for your groceries or a taxi ride. In busy cities or quiet villages, folks are skipping the cash and paying with their phones. It’s the new way to shop and it’s spreading fast.

Empowering the Unbanked with Fintech Solutions

In many corners of the world, banks are rare like a unicorn. But fintech is changing that. It’s like a superhero for people with no banks. Fintech comes swooping in with tools like apps and online loans. And it doesn’t stop there!

Digital wallets let you store and spend money without a bank. People use them all the time for buying and sending money. It’s as simple as sending a text. And there’s more. Fintech helps folks get loans and start businesses. Even if you’re far from the city, you can dream big and fintech helps make it happen.

But why is fintech growing so fast in places like this? Money is hard to handle without a bank. Fintech throws down a rope to help you climb out of trouble. It brings new chances to folks who were left out. They can now step into the world of money like never before.

Let’s not forget, kids are learning about fintech too! Schools teach how to use these cool tools. Everyone’s getting smarter about money, and that’s a win for everyone.

So there you have it. Fintech is not just fancy tech talk. It’s a lifeline for millions who had no banks. It gives power to the people, letting them join in and grow. It’s not magic, but it sure feels like it when you see what it can do!

The Impact of Fintech on Local Economies

Fostering Small Business Growth through Fintech

Fintech firms are changing the game for small businesses. They make life easier for shop owners and entrepreneurs in emerging markets. By offering easier access to money, fintech helps these businesses grow. Many startups now get the money they need more easily. This is because online lending platforms look at their business differently than old-school banks do. They use smarts and data to give loans faster.

So, a street vendor with a good sales record could get a loan in minutes. This quick cash lets them stock up and sell more goods. And the best part? More small businesses mean more jobs. It’s like a chain reaction that boosts the local economy.

The Role of Fintech in Enhancing Remittance Services

Now, let’s talk about remittance services. Migrants send money home using these services. This money is a lifeline for many families in developing countries. But traditional ways are slow and costly. This is where fintech steps in.

Fintech makes sending money home cheaper and quicker. With mobile wallets, people can move money with a few taps on their phones. And they don’t need a bank account. This is huge for people in remote areas. Companies also use blockchain to make everything safer. This tech keeps a clear record of each deal. That means less chance for mistakes or fraud.

Crowdfunding platforms also fit into this picture. They let local projects get funding from people worldwide. People who wish to help can directly support a cause. These tools are great for growth. They mean more cash moving in the economy.

So, fintech isn’t just tech talk. It’s a real-life helper for folks in emerging markets. It keeps cash flowing and jobs growing. And that’s a win for everybody.

The Future of Financial Technology in Developing Worlds

Integrating Blockchain for Financial Transparency

Imagine a world where all your money moves safely. Thanks to fintech, we’re getting there! In places where banks are few, fintech’s growth brings hope and new tools. One such tool is blockchain. It makes tracking money easy and clear. But what exactly is blockchain? At its core, blockchain is like a digital ledger. Picture a notebook that writes itself and lets everyone watch. That’s blockchain!

Businesses use blockchain to find every penny, fast. This matters in developing worlds. It helps stop fraud and builds trust. When people trust where their money goes, they use fintech more. More use means more growth. In other words, blockchain isn’t just for techies. It’s for everyone who wants to see their money’s path.

Now let’s think about who needs fintech most. This goes beyond big cities. Farmers and small shop owners can join in too. Mobile wallets let them send and get cash using just a phone. In places with no banks, mobile wallets shine. They make life simpler and safer.

With blockchain, these transactions are not just simple. They’re see-through. This means no hidden fees or secrets. And it doesn’t stop there. Online lending gets easier. If a farmer needs seeds, he doesn’t need to hoard cash. He can borrow online, with clear terms, and grow his farm.

Educational Initiatives and the Role of Fintech in Economic Development

Now, we know that fintech is changing money matters. But for it to work, people need to know how to use it. This is where education steps in. Fintech companies are teaching folks how to use apps and more. They’re reaching out to schools and communities. They know that when people learn, they can improve their lives.

Education helps us use fintech in smart ways. It also shows us why fintech is a friend to growth. Let’s take a closer look. Take a small business, for example. They can now keep track of sales and cash without a sweat. This means they can plan, save, and get loans to grow.

And it’s not just businesses. Families can use fintech to save for school or a home. They can pay bills without stress. These are big steps in growth. Fintech brings tools, but education makes them work for everyone. When communities learn, they grow stronger. They build better lives with fintech.

In the end, it’s all connected. Education, finance, and growth come together, thanks to fintech. As we keep teaching and learning, fintech will reach new heights. And as it grows, so do our chances for a richer future. It’s an exciting time, and we’re right in the middle of it!

In this post, we explored the fintech shift in growing markets. We looked at why fintech is catching on fast, how it’s tackling big problems, and helping with money access. Then, we saw how mobile tech and new tools give people who lack bank accounts a fresh start. We also covered how local businesses and families sending money can benefit.

The future sparkles with promise. Think of blockchain for clearer money trails and teaching folks to make the most of fintech. This is more than just tech talk; it’s a real change in how we save, send, and grow our money. Fintech is not just an industry buzzword; it’s a tool for economic power. Thanks for reading, and let’s watch how fintech redraws the map of global finance.

Q&A :

How has fintech impacted the economies of developing countries?

Fintech, or financial technology, has significantly impacted developing economies by enhancing financial inclusion. It has enabled individuals and businesses without access to traditional banking services to participate in the financial system through mobile payments, peer-to-peer lending platforms, and affordable remittance services. Fintech solutions have also promoted economic empowerment by facilitating microloans for entrepreneurs and small businesses, thereby fostering economic growth.

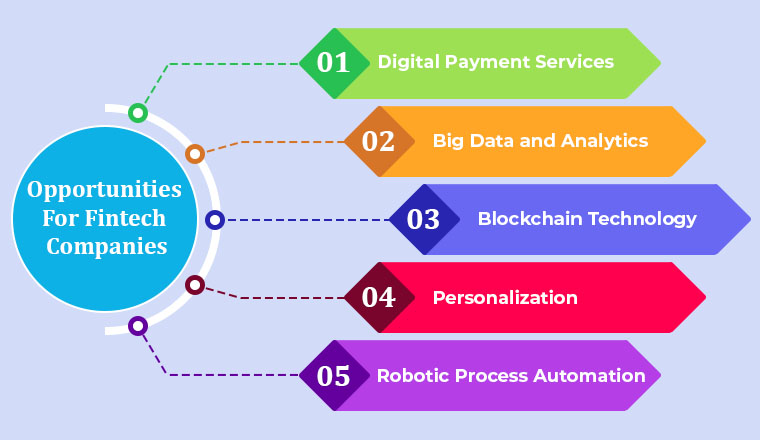

What are the main drivers behind the rise of fintech in developing economies?

Several key drivers contribute to the rise of fintech in developing economies. Firstly, widespread mobile phone penetration has provided a platform for mobile-based financial services. Secondly, a traditionally underserved population by conventional banks has led to a demand for innovative financial solutions. Thirdly, the agile regulatory frameworks in some developing countries have encouraged fintech innovation. Lastly, younger populations are more tech-savvy and open to adopting new technologies.

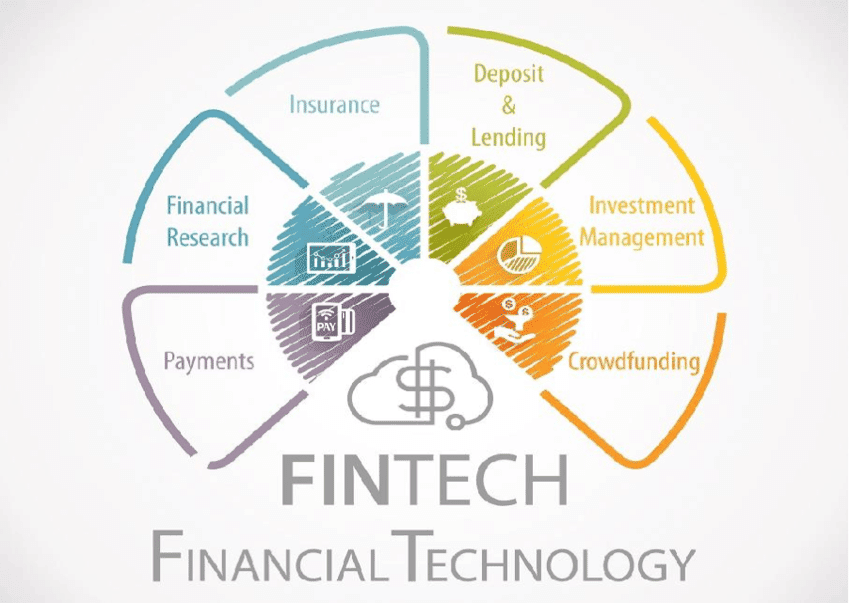

Which fintech services are most popular in developing countries?

In developing countries, the most popular fintech services include mobile money and payment services, which allow users to carry out financial transactions such as payments and transfers using their mobile devices. Peer-to-peer (P2P) lending and crowdfunding platforms are also prevalent, providing alternative financing options. Additionally, Microfinance and insurance tech (InsurTech) have gained traction, offering customized microloan and insurance products that cater to the needs of individuals and small businesses.

How does fintech contribute to financial inclusion in developing economies?

Fintech contributes to financial inclusion by using technology to reach unbanked and underbanked populations in developing economies. By simplifying the process of opening and using financial accounts through mobile phones or the internet, fintech companies can offer services at lower costs and with greater convenience than traditional banking. As a result, individuals with limited access to banking services can now save, borrow, and make payments electronically, which facilitates their participation in the formal economy.

What challenges does fintech face in developing economies?

Despite its rapid growth, fintech in developing economies faces several challenges. Infrastructure limitations, such as inadequate internet coverage and unreliable power supply, can impede the accessibility and stability of fintech services. Lack of consumer trust and understanding of new financial technologies can also be a barrier to adoption. Furthermore, regulatory challenges, including the need for legal frameworks that protect consumers while fostering innovation, and the risk of cyber threats and financial fraud, must be managed effectively.