Monetary policy and inflation—are two powerful forces shaping our wallets and the world. Imagine holding the reins, steering an economy through the stormy seas of rising prices and financial turmoil. That’s the daily grind of central banks worldwide, tasked with mastering the art of inflation control without stifling growth. In this no-fluff guide, “Monetary Policy Mastery: Taming Inflation in Today’s Economy,” you’ll gain insider insights into how interest rates and quantitative easing play pivotal roles in this delicate balance. Dive in, as we decode complex processes into plain talk, setting you on a path to understanding the high-stakes world where money policy meets market pulse.

Understanding the Role of Central Bank Policies in Inflation Management

The impact of interest rate adjustments on inflationary pressure

Central bank policies are key in managing inflation rates. When prices rise too fast, life can get tough. Jobs might vanish, and your cash buys less. Interest rate adjustments help cool things down. Raising interest rates can tame inflationary pressure. It’s like taking away some of the fuel that lets the inflation fire burn too hot. More interest means loans cost more. So, people and businesses spend less, and demand slows.

Picture it this way: A car speeds up if you hit the gas. But if you tap the brakes, it slows down. Inflation is like the car’s speed. The central bank’s interest rate is the brake. By fine-tuning the brake pressure – the interest rate – banks can help slow or speed up economic growth and inflation. But it’s tricky; push too hard and things might stop too fast, hurting jobs and growth.

Managing these rates is a lot like walking a tightrope. It takes skill and focus. The Federal Reserve System often takes action, adjusting rates to keep the economy steady.

Utilizing quantitative easing to mitigate deflation risks

Now let’s chat about deflation risks – when prices drop. It might seem nice at first, but it’s not good for the economy. That’s where quantitative easing comes in. This is when the central bank buys assets, like government bonds, to pump money into the economy. Think of it like planting seeds in a garden to grow more plants.

Quantitative easing can kickstart spending and investment. It helps when times are tough, and regular methods, like lowering interest rates, aren’t enough. It’s like if the brake pedal (interest rates) is already on the floor, but the car hasn’t slowed down (people aren’t spending). So, the bank decides to give out more gas (money) to ensure the car keeps moving.

It’s a powerful tool that must be used carefully to avoid too much inflation. If too much money flows in, prices could climb too fast later. So, central banks watch closely, making sure they don’t overdo it.

These two methods – interest rate adjustments and quantitative easing – are part of a bigger plan. This plan, often called an inflation targeting strategy, aims to keep inflation at just the right level. Not too high, not too low.

By controlling inflation and keeping it in check, we aim for price stability goals. This helps us avoid hyperinflation – when prices shoot up rapidly – which can be really scary. It can make money worth much less very quickly, and no one wants that.

Central banks use many signs, called inflation indicators, to decide their moves. They look at things like the consumer price index (CPI), which tracks how the cost of stuff we buy changes over time. They also look at the core inflation, which doesn’t count food and energy prices. These can jump around for reasons other than inflation, like bad weather hurting crops.

In a nutshell, central bank policies like adjusting interest rates and using quantitative easing are vital in handling inflation. They’re the tools that help make sure our economy works well for everyone.

The Balancing Act of Controlling Inflation and Encouraging Economic Growth

Inflation targeting strategy – a dual mandate perspective

Central banks face a tricky job. They must tame rising prices, yet foster growth. The Federal Reserve, the U.S.’s central bank, has a dual mandate. This means it aims for stable prices and strong jobs. To do this, it sets an inflation target. This is usually around 2%. Staying close to this target helps. It keeps our money’s worth steady and boosts our trust in the economy. When prices rise too much, we call this inflation. It lowers the value of our money. This makes buying things like food and toys more expensive.

Fiscal policies and their interplay with monetary measures in inflation reduction

Fiscal policies play a big part too. These are government spending and tax plans. They work with central bank policies to manage inflation. When the government spends more or slashes taxes, people have more cash to spend. This can push prices up. So, the central bank may raise interest rates to balance things out. Raising rates makes borrowing costlier. This encourages saving over spending. It cools off inflation. But, the bank must be careful. If rates go too high, it can slow down growth.

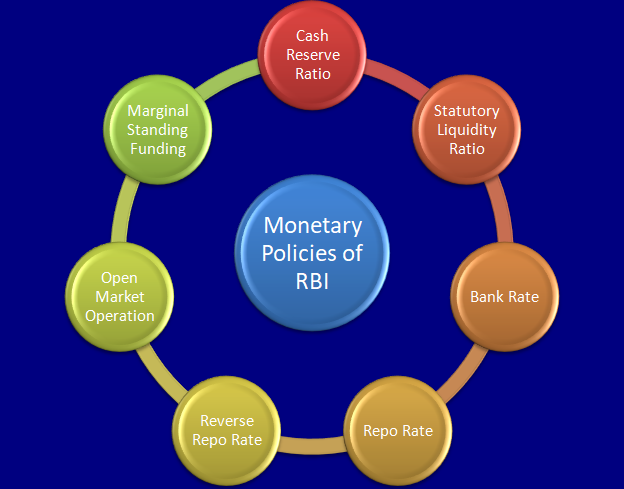

Central banks also use other tools like cash reserve ratios. Banks hold a slice of deposits they can’t touch. Changing this amount affects how much money banks can lend. More lending can boost growth but may also stoke inflation. Less lending may curb inflation but can dampen growth.

Controlling inflation needs a mix of moves. It’s like being a DJ. You’ve got to know when to turn up some tunes like spending. And know when to dial down others, like lending. Get it right, and the economy hums along happily. But, miss a beat, and things can go off-key fast.

Central banks must watch indicators like the consumer price index (CPI). This tracks how prices change for household goods. It’s like a shopping list that shows if things are getting costlier. A jump in CPI often means inflation’s on the rise.

But, it’s not just about today. Central banks must think ahead. They try to guess where inflation will be in the future. It’s a tough job, like predicting the weather. They use models and trends to make their best guess. They adjust their strategies based on what they think will happen.

They also keep an eye on employment. Too few jobs can be a sign the economy’s not growing enough. But, too many jobs can push wages and prices up too fast. That’s when inflation kicks in.

So, managing inflation is no small feat. It’s a balancing act. Central banks and governments aim to keep our economy stable. But, they must pivot quickly when things change. With the right moves, we can enjoy a stable economy that grows just right – not too fast, not too slow.

The Federal Reserve’s Actions and Their Global Implications

Deciphering the Federal Reserve System’s policy decisions on price stability

The Fed takes steps to keep prices stable. They change interest rates to do this. A high rate can slow down inflation. But this may also slow down growth. The Fed must balance these two.

When the Fed lowers rates, borrowing is cheaper. This can boost spending and jobs. Yet, if too much money chases few goods, prices can rise. Inflation can get too high. The Fed aims for a just-right inflation rate. They target a 2% yearly rise in the prices we pay.

The Fed also looks at the consumer price index (CPI). This index shows how much the price of everyday things has changed. When the CPI is high, it means stuff costs more than before. The Fed uses this info to decide on rate changes.

Now, let’s talk about the whole world. The Fed’s choices affect other countries too. If our rates rise, global money can rush here. This can push other currencies down. A strong dollar can hurt other nations’ trade.

Next, we have the wholesale price index (WPI). It tracks the price change for sales between businesses. When WPI rises fast, it can be a hint. It might mean that consumer prices will jump soon after.

Evaluating the effectiveness of controlling money supply and open market operations

Open market operations are key. The Fed buys or sells government bonds to do this. It’s like a big-money lever. To raise money in the system, the Fed buys bonds. To lower it, the Fed sells them.

This bond trick helps the Fed manage how much cash banks have. More money at banks means they can lend more. Less money means they lend less. By moving this money lever, the Fed can steer the economy.

What is this open market operation? It’s the Fed’s way to control money moving around. It’s big in making sure our economy grows well but not too fast.

Bond buying can also help in a pinch. When times are tough, the Fed may buy lots of bonds. This is called quantitative easing. It puts more money into banks and the economy. This can help when the economy is stuck.

But there’s a catch. If the Fed puts in too much money, prices can rise too much. This is inflation. And if they don’t do enough? We could face deflation. That’s when prices fall. It may sound nice, but it can mean less business and job cuts.

In the end, the Fed uses these tools to try and hit the sweet spot. They want stable prices and a growing economy. It’s not easy, and it affects the whole world. The money supply and these open market moves are big deals. They’re as crucial as the air we breathe, but for our money and jobs.

Forward-Looking Approaches to Inflation Expectations and Stability

Strategies for managing inflation expectations and enhancing currency stability

Central banks play a big game of expectations. They must tame the wild beast we call inflation. When prices rise too fast, the money in your pocket buys less. That’s a problem. Luckily, we have some tricks up our sleeve to keep inflation in check, and it starts with what you expect to happen tomorrow.

Think of inflation like a rumor. If everyone expects prices to rise, they act in ways that push prices up. Businesses hike their prices, and workers want more pay. The central bank steps in with a clear message to calm everyone down. It says, “We’ve got this,” and sets an inflation target, a goal for where they want prices to stay. People then trust prices won’t soar and act cool. This trust helps keep money stable.

Now, the bank has tools to use. One big tool is adjusting interest rates. High rates can slow down spending and chill inflation. Low rates can kickstart spending if prices aren’t rising enough. It’s like walking a tightrope – too much or too little, and you fall off.

Another tool is public speaking! Yes, central bankers talk, and people listen. They explain plans for keeping prices stable. They say buying or selling government bonds helps control how much money is out there. Their words can be as strong as their actions. It helps people understand what’s coming. No big surprises mean no wild jumps in prices.

Core inflation analysis and the interpretation of consumer and wholesale price indexes

We’ve got two neat yardsticks to measure inflation – the Consumer Price Index (CPI) and the Wholesale Price Index (WPI). They are lists of prices for stuff we buy or sell. We check these lists to see how much prices have changed. This gives us the lowdown on how inflation is acting.

Core inflation is a sneaky thing. We strip out food and energy prices because they jump around a lot. By looking at everything else, we see the true trend. It’s the story behind the noise. We peek at this every month to get the real scoop on inflation.

The Consumer Price Index looks at things like bread, TVs, and doctor visits. What families buy. Wholesale Price Index checks the cost to make things, like metal, fuel, and machines. What factories buy. Put them together, and we get a full picture. When these numbers go up, it’s a sign. The central bank might need to act to keep prices from running too fast.

All this tracking and measuring and strategy is about keeping money good. So you can plan and buy without worry. It’s about making sure the dollar (or your currency) holds up over time. That’s how we aim for a stable economy where everyone can win.

It’s like a big game of chess with prices and policies. We must think ahead and move smart. With the right moves, we keep that balance – stable prices, solid economy. That’s the goal. And that’s how central banks wrestle with inflation, trying to pin it down just right.

In this post, we dove into how central banks fight inflation and keep the economy healthy. We saw how they adjust interest rates and use special tools like quantitative easing. We also learned about the tricky job of controlling inflation without hurting growth, taking a look at how fiscal policies work with monetary efforts.

Then, we touched on the big role the Federal Reserve plays worldwide. We broke down how their choices affect prices and looked at how they manage the money in the market. Lastly, we tackled ways to keep inflation expectations in check and what core inflation tells us about prices overall.

So, keep in mind, balancing inflation and growth is complex but crucial. And the central banks’ moves? They matter to us all. Whether you’re saving, buying, or just living day to day, understanding these policies can help you make smarter decisions. It’s a big puzzle, but now you’ve got some of the main pieces.

Q&A :

How does monetary policy affect inflation?

Monetary policy influences inflation by managing the supply of money and the level of interest rates in the economy. When a central bank, such as the Federal Reserve, implements an expansionary monetary policy by lowering interest rates or buying securities, it increases the money supply, which can stimulate economic activity but also has the potential to lead to higher inflation. Conversely, a contractionary monetary policy, achieved through raising interest rates or selling securities, can decrease the money supply and help control inflation but may slow down economic growth.

What are the tools of monetary policy used to control inflation?

The primary tools that central banks use to control inflation include adjusting policy interest rates (the cost of borrowing), conducting open market operations (buying or selling government securities), and modifying reserve requirements (the amount of funds banks must hold in reserve). Central banks may also use forward guidance to communicate future monetary policy intentions to influence financial conditions and inflation expectations.

Can monetary policy become ineffective in controlling inflation?

Yes, there are scenarios where monetary policy may become less effective in controlling inflation. For example, if the economy is facing stagflation—simultaneously experiencing stagnation and inflation—traditional monetary policy tools might not be as effective. Additionally, in the case of supply-side shocks, such as a sudden increase in oil prices, monetary policy adjustments alone might not be able to contain inflation without causing significant harm to economic growth.

What is the relationship between monetary policy and inflation targeting?

Inflation targeting is a monetary policy strategy aimed at keeping inflation around a predetermined target level or within a certain range. Central banks use various policy instruments to adjust the money supply and interest rates to ensure that inflation stays close to the target. The relationship is characterized by a proactive approach to managing inflation expectations and maintaining price stability, which is fundamental for achieving long-term economic growth.

How do changes in monetary policy signal future inflation trends?

Changes in monetary policy, particularly in the central bank’s guidance and actions, can signal the bank’s expectations of future inflation trends. For instance, a central bank may raise interest rates if it anticipates higher inflation, signaling its intent to cool down the economy and keep prices stable. Market participants closely monitor these changes in monetary policy as indications of the central bank’s outlook on inflation, which in turn affects financial markets and economic decisions.