Imagine a world where digital cash changes how we bank. The rise of Central Bank Digital Currencies (CBDCs) marks a bold leap forward in finance, and how CBDC will affect banks is a burning question on every banker’s mind. We’re on the brink of a revolution that could either launch new banking opportunities or present risks that shake the very foundations of traditional banking. As we dive into the complexities of CBDCs, we’ll explore how they’ll shake up commercial banking operations, challenge banks to rethink their strategies, and demand a fresh look at financial stability. The era of CBDCs is more than just a new kind of money; it’s a call to action for banks to enhance their client relationships and embrace innovation. Follow me as we unpack this financial evolution.

The Impact of CBDC on Commercial Banking Operations

Transforming the Payments Landscape

CBDCs are changing how we bank today. They make moving money fast and easy. Banks used to be the only way money could move around. Now, with central banks stepping in with their own digital money, things are shifting. This isn’t just a tiny tweak—it’s a huge shift! It’s like going from mailing letters to sending instant messages.

So, what does this mean for banks? They must get on board with the new tech. Banks are working hard to make sure their own systems can work with CBDCs. They’re also trying to figure out how to give good service when customers might use CBDCs instead of bank accounts. It’s kind of like puzzle pieces that need to fit.

Adapting to Enhanced Financial Oversight

With CBDCs, the rules of money are changing. Central banks can see transactions more clearly. This is big for banks because it means they must be very careful and clear about where money goes.

Banks are now in a place where they must learn new rules. They are making sure they follow these rules so they can stay safe and trusted. Banks need to show they are good at managing risks, especially when it comes to keeping money safe. This part is really important for them to keep our trust.

So, banks are stepping up their game. They are getting better systems to meet these new requirements. They also make sure they have the right amount of money on hand to stay strong and ready for anything. It’s like they’re making sure they have enough steps in place so they don’t fall.

When it comes to dealing with other countries, more work is needed. Banks are figuring out how to use CBDCs to send money across borders. This could make things cheaper and quicker!

What’s clear is that banks have to think ahead. They must be ready to face these changes. They need to make sure they can still help us like they always have, even as CBDCs become a big part of our lives. It’s like they have to learn to ride a new bike while keeping the old one running too.

CBDC Implementation: Challenges and Strategic Approaches for Banks

Integrating CBDCs with Existing Banking Models

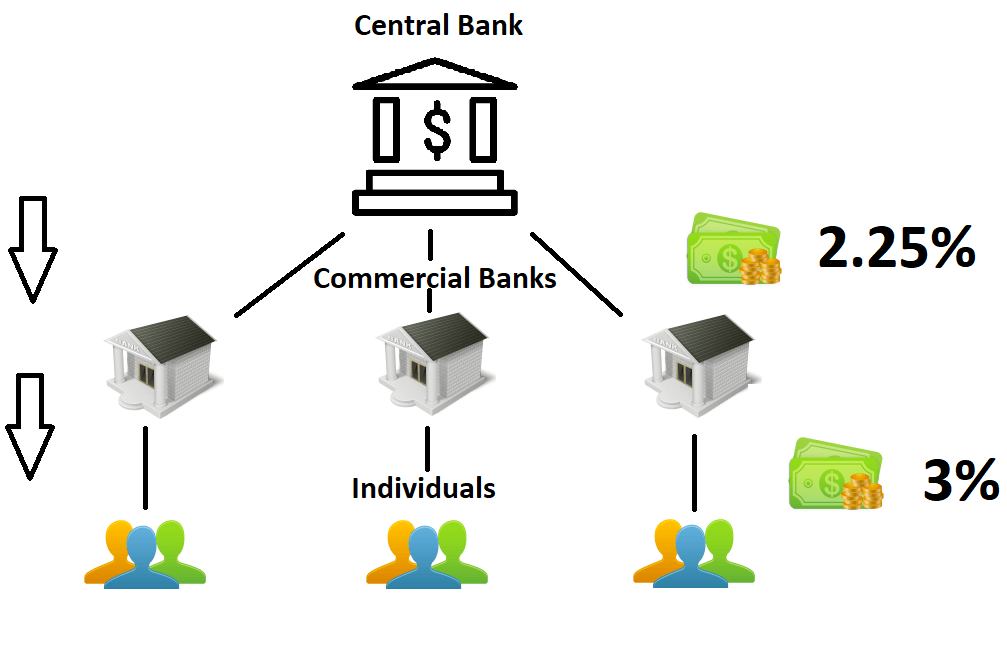

Banks face a big test: fitting new CBDCs into old ways. CBDC stands for Central Bank Digital Currency—it’s like cash but digital and comes straight from a country’s bank. This means, folks can have money in a form that’s easy to use online or with a phone. The trouble for banks is to get this new type of money to work well with the current systems. They must think hard about how to do this without making a mess of things.

Bank folks need to talk and plan a lot. Why? To make CBDCs and normal bank stuff work close and well. This means changing computer stuff and how they handle money. Also, they need to keep customers happy and safe while they bring in CBDCs.

Navigating Revenue Implications and Competitive Dynamics

Alright, let’s chat about money. CBDC could change how banks make profits. People might choose to use CBDCs more than regular bank deposits. This could lead banks to have less cash to lend out. Banks like to lend because it’s a way they can make money. So, they’ll need new ideas to stay good at making money.

Big word: competition. Banks aren’t just against other banks now. They might be up against CBDCs too. It’s like having a new player in the game. Banks must step up their game to keep their customers. How? By giving them reasons to stay. Maybe better services or cooler tech. Things that make people think, “Wow, these bank folks are really trying to help me out.”

But, hey, let’s not just talk risks. CBDCs could do good stuff too. If banks get it right, they could use CBDCs to move money around the world faster and cheaper. This is super for people who send money to family in other countries.

So, banks need some solid plans to face these challenges. They’ve got to be smart and quick to adapt to the changing world. It’s not going to be easy. But it’s what they need to do if they want to stay in the game and keep on being important in the money world.

There’s a lot banks can do to be ready. They can look at their tech and see where they need to make it better. This tech stuff should help them handle CBDCs without any trouble. They’ll also want to keep their eyes peeled for any new rules about digital money. It’s important to play by the rules to avoid trouble. Plus, they should look at how they talk to their customers. They need to explain things well, so everyone knows what’s going on.

In the end, it’s all about being prepared. Banks that plan ahead and get things in order for CBDCs could win big. They can give their customers something new and exciting, all while keeping their spot as the go-to for money needs. It’s a tough road, but with the right steps, banks can show they’re up for the challenge!

Financial Stability in the Face of CBDC Introduction

Assessing Liquidity Management Post-CBDC

Imagine a world where money moves with a tap. This world is not far off. Central Bank Digital Currencies, CBDCs for short, are a big deal. They will change how we bank. Right now, banks hold our cash. They use it for loans and other services. When CBDCs come in, we might see a shift. People might hold their money in digital wallets instead. This means banks could have less cash on hand. Why does this matter? Well, banks need cash. It’s vital for their health.

CBDCs could make banks rethink how they manage money. Banks need liquid cash to meet customer demands. If a lot of cash goes digital and moves to CBDCs, banks need a new plan. They could try holding more assets that they can quickly turn into cash. Or, they might offer better rates to keep our cash with them. A key point here is that banks must stay liquid. This means they need enough cash or assets they can quickly sell.

Another part of this change is about having back-up plans. Banks must think ahead. They must know how to handle quick shifts in the cash they have. This means testing out scenarios. What if everyone moves their money at once? How fast can they get more cash? CBDCs push banks to make better plans.

Interoperability Challenges between CBDC Systems and Legacy Infrastructure

Now, let’s talk about working together, or interoperability. This is a fancy word for different systems talking to each other. Banks have old systems. And they work just fine with regular money. But with digital cash coming in, things get tricky. Can the old and new systems get along? They have to. If they don’t, we could face problems. Things like paying for stuff could slow down.

Old bank systems are like a classic car. They have history and do their job. But if we want to race with the latest cars, we need updates. Banks have to make sure they can handle CBDC transactions. They can’t just throw out the old systems. They have to join them with the new digital world. And that’s hard.

Think about when you buy a coffee. What if you could pay with digital currency straight from the central bank? The coffee shop needs to be able to take that digital money. This means their bank must handle this new type of cash. All systems, old and new, must work as one.

In short, banks are in for a ride. They have to manage money with CBDCs in mind. And they have to make sure everything can work together. If they don’t get it right, we could have slower payments and other issues. But if they nail it, banking could be faster and easier for all of us. Digital cash is coming, and banks must be ready.

Redesigning Bank Client Relationships in the CBDC Era

The Transformation of Retail Banking Services

Banks have long been the solid rock of our finances. They keep our money safe and help us pay for things. But there’s a big change on the horizon: CBDCs, or central bank digital currencies. These are like the digital bucks that might one day come from our country’s own bank.

Now, let’s talk about how this shift could turn things upside down for the banks we use every day. With CBDCs, the way banks offer services might have to change a lot. Imagine walking into a bank and, instead of talking to a person, you just tap your phone and poof! Money moves like magic.

Central bank digital currencies also mean banks might have to find new ways to make money. They can’t just rely on our deposits or loan interest like before. They may start to offer cooler things, like instant money moves across the globe or ways to pay for things without hassle.

Here’s the thing, though – CBDCs might make things a bit rocky for banks at first. Banks have to figure out how to fit these new digital dollars into what they already do. Plus, they have to do it without messing up all the good stuff they already offer us.

Innovation in Cross-Border Payments and Client Interaction

Getting money from one country to another can be like running through an obstacle course. It’s slow and expensive. But guess what? CBDCs could clean up this mess. Think fast, cheap, and super easy money transfers all over the world. Yep, that’s what CBDCs might bring to the table.

Better cross-border payments are just the start. Banks will get to use CBDCs to make talking to us, their clients, more personal. This means they could use new tech to make sure they understand what we need and help us out in real-time. We’re talking about a world where banks know you, get you, and are there for exactly what you need when you need it.

But hold on, it’s not all sunshine and rainbows just yet. Banks will need to step up their game. They’ll need tough security to keep our digital cash safe from sneaky hackers. And they have to stick to the rules the big guys—like governments and central banks—set for using these flashy new digital currencies.

So, what’s clear is this: Banks can’t just sit back. They’ve got to dive into the deep end with CBDCs or risk losing out to others who will. It’s a big chance for them to shake things up for the better but also a moment when they’ve got to be careful to keep our trust and keep our money safe. The CBDC wave is coming, and how banks ride it will change the way we see and use money forever.

We’ve explored how CBDCs could reshape banking, from daily payments to big financial systems. Banks must adapt to these digital currencies, facing new rules and how money moves. They need smart ways to blend CBDCs with old methods, tackle profit issues, and stay ahead in the market.

Banks also have to manage cash flow carefully once CBDCs are live. They must work well with both new tech and what they used before. This calls for teamwork among banks, tech firms, and governments.

Lastly, banks will change how they serve you. They’ll find new paths in person-to-person payments and across borders. CBDCs promise a bold future in banking. Get ready for exciting changes that could make dealing with money smoother for us all.

Q&A :

How will CBDCs impact traditional banking?

The introduction of Central Bank Digital Currencies (CBDCs) is expected to significantly affect traditional banking systems. CBDCs may alter how banks engage with money, including deposit-taking, lending, payment services, and overall financial intermediation. Banks may have to adjust their business models to accommodate a new financial ecosystem where digital currencies play a central role.

Can CBDCs replace traditional bank deposits?

While it’s not clear if CBDCs will replace traditional bank deposits, they might offer an alternative form of secure digital money guaranteed by the central bank. This could potentially make them more attractive than commercial bank deposits for some customers, especially during times of financial uncertainty. Banks will have to innovate to provide added value to retain customer deposits.

What are the potential risks of CBDCs to commercial banks?

One potential risk is the disintermediation of commercial banks, as customers might prefer to hold CBDCs directly with the central bank, reducing the banks’ deposit bases. This reduction could limit the ability of banks to create credit and could lead to a decrease in profitability. Additionally, there could be increased competition from fintech companies that can seamlessly integrate CBDCs into their platforms.

How might CBDCs change the way banks interact with customers?

CBDCs could lead to a more digital-focused banking environment, requiring banks to invest in technology and enhance their digital services. Banks may need to develop new services around CBDCs to maintain customer relationships and remain competitive. This may include sophisticated digital wallets, enhanced security features, and innovative customer service solutions.

What are the advantages of CBDCs for banks?

Despite the challenges, CBDCs could offer several advantages to banks, such as the opportunity to streamline payment systems, reduce transaction costs, and lower risks associated with cash handling and management. Banks could also leverage CBDCs to tap into new revenue streams, enhance digital product offerings, and collaborate with central banks to improve financial stability and efficiency.