Is ESG Investing Right for Me? Money talks, they say, but what do your dollars say about your values? With ESG investing on the rise, you might wonder if your portfolio could do more than just grow—it could go green, champion social issues, or back ethical governance. But can you really have your (sustainable) cake and eat it too? Let’s tear down the hype and find out if ESG investing aligns with your wallet and your world.

Determining if ESG Investing Aligns With Your Financial Goals

Assessing ESG Investment Benefits and Advantages

You want to know if ESG investing is smart for you, right? Let’s talk facts. ESG investing is growing fast. It means putting your money in companies that care for the planet, treat people well, and run a tight ship. And it’s not just feel-good stuff. It can also help you make money. The big plus? ESG investing can match or beat regular investing. With ESG, you can feel good and maybe make good money too.

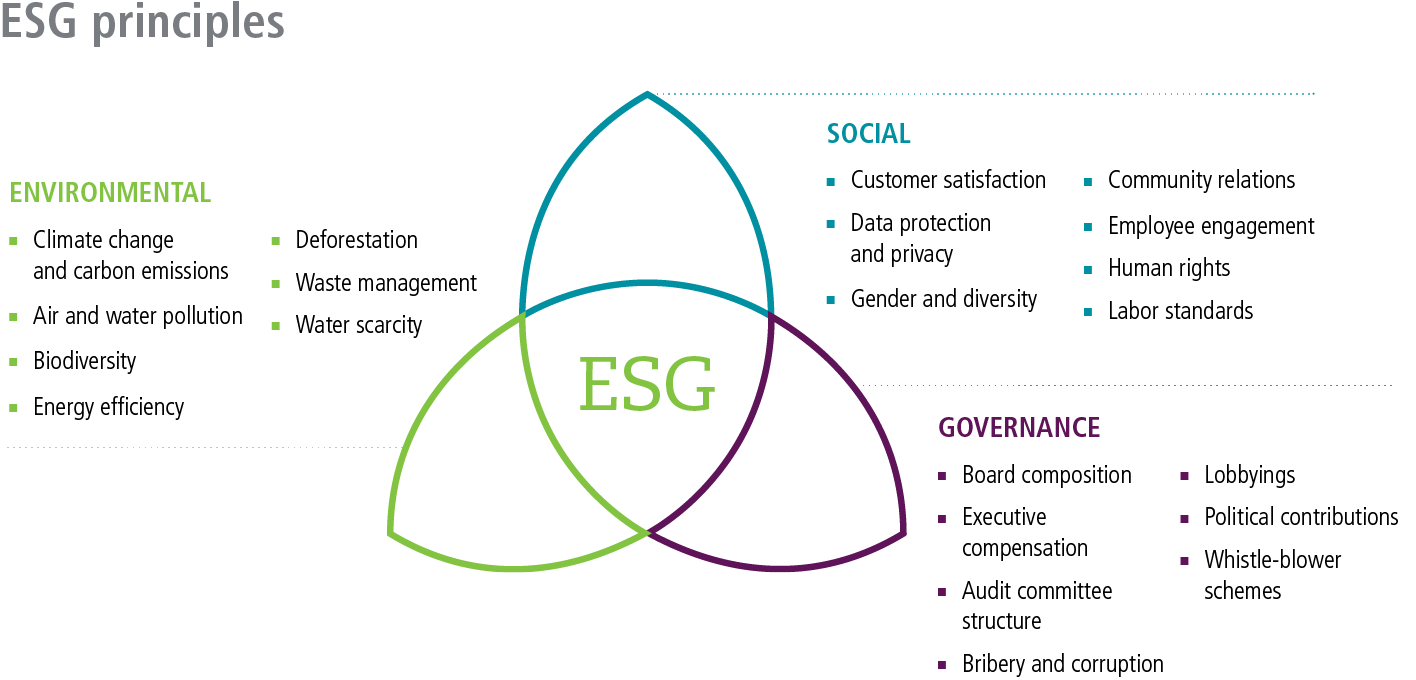

Let’s dig deeper. ESG criteria analysis helps find firms leading the way in green practices and treating people right. Are they cutting pollution? Are they fair to workers? Do they have a solid team at the top? We check all these boxes with ESG. When we pick stocks or funds, ESG helps us choose strong firms that also do good. These choices can really pay off. Often, companies that score high in ESG are smart picks for the long haul.

Now, get this — ESG investing helps the world while it could help your wallet. More people get this now and want their investments to show what they stand for. Some worry they’ll make less money with ESG. But that’s just not true. Many ESG funds do just as well or better than other funds. It’s time to throw that old myth away. Want quick growth and to back your beliefs? ESG might just be your ticket.

Analyzing Your Personal Values and Investment Strategy

Before diving in, let’s check if ESG lines up with your game plan. Ask yourself: What matters most to me in a company? You might care a lot about the earth or how a firm treats its staff. Maybe you like firms that are clear and honest about how they run the show. If that sounds like you, ESG could be your match.

Next, think about where you want your money to go. Do you like the idea of betting on the future, like with renewable energy funds? Or does backing companies that help solve social issues speak to you? If yes, green investing principles are right in your lane. With ESG, you can push the world to be better, one dollar at a time.

Now, you might hear that ESG investing is new and not tested enough. But don’t you buy it. ESG has been around for years. It’s got a solid track record, and it’s here to stay. Understanding ESG scores and how they’re put together will help you sort the strong players from the weak ones. And remember, ESG can help keep your money safe, too. It spreads bets across different sectors, which means less risk for you if one area hits trouble.

Finally, check out the folks running the firm. Good corporate governance—like having smart, strong leaders—can make or break your investment. ESG looks at this super close. Companies that are open and fair tend to last and grow. So, it’s smart to back them.

In the end, your money is powerful. It can build a better world while it works to build your future. If that idea gets you going, you may just find that ESG investing is your kind of smart move.

Understanding the Foundations of ESG Investing

ESG Criteria Analysis and Rating Systems

Think of ESG like a check-up for companies. It looks at how they do good or bad with the planet, with people, and how they run things. Smart ESG investing means picking companies that pass this check-up with high scores. These scores come from ESG rating agencies. They show us which companies care about more than just money. Some companies are greener, help communities, and have good leaders. They are the ones you want in your ESG investment.

Let’s say you want to invest in a company that is good for the environment. You would look at its ESG score. You might see a score for how much it pollutes or uses clean energy. This helps you choose better for the planet. The same goes for how they treat their workers and how honest they are.

Navigating ESG Compliance, Reporting Standards, and Regulations

Imagine there are rules for going green and being nice in business. That’s what ESG compliance and reporting standards are. They set the bar for what’s enough and make sure companies show their ESG work to all. These rules change sometimes. This means companies have to stay sharp and so do investors. You must know the latest to make sure your ESG picks are still top-notch.

Some folks worry ESG investing might mean less money made. That’s not true. ESG funds can do as well as, or even better than, regular ones. They look at risks other funds might miss, like climate change or bad bosses, which can hurt a company’s cash flow.

Investing in ESG is about lining up your cash with your values. You back up what you care about with your money. This could be by saying no to polluters or yes to companies that look after their workers.

In the end, ESG isn’t a fad. It’s about planning for the future. It covers Earth-friendly projects like wind farms and keeping an eye on social and leadership issues. ESG helps you do good and could still make you money. It’s a win-win. Plus, more and more people want to invest this way. This is making companies take notice.

To wrap it up, for ESG investing to make sense for you, think about what matters to you outside of just dollars and cents. Look at how well a company does on its ESG examination. Stay on top of the rules so your investment choices remain sound. As time goes on, doing right by the planet and people could mean doing right by your wallet too.

Evaluating the Financial Implications of ESG Investments

Comparing ESG Funds Performance with Traditional Investments

People often ask if ESG funds can keep up with regular ones. Yes, they can. Many ESG funds match or outdo their peers. This shows in various studies and market reports. They look at long-term trends and daily numbers. These funds don’t just hold up; they are often ahead.

This success comes from how ESG funds pick stocks. They use special rules, like caring for the planet and treating people well. This means they invest in companies that think about tomorrow. These companies often stay strong, even when markets get rough. So, their stocks keep doing well over time.

For example, a green energy company might do better as the world uses less oil. A firm that treats workers right may keep them longer, saving money. This is how ESG criteria analysis guides where these funds invest. They look for solid, forward-looking firms with good scores on planet care, how they treat people, and how they run things.

Impact of ESG Factors on Portfolio Diversification and Risk

When you hear “don’t put all your eggs in one basket”, think of portfolio diversification. It’s smart to have different kinds of investments. Why? If one type has trouble, you’re not stuck. ESG funds are great for this mix. They often focus on new areas like wind or solar power. This can help your savings stay safe and grow.

ESG investments can lower risk in your stock picks, too. They tend to stay more stable when markets dip. This is because ESG criteria take into account more than just money. Things like a company’s impact on the world really matter. So, firms that rate high on ESG tend to be well-run. They handle challenges better and treat risks seriously.

Let’s not forget about ethical investment strategies. For some, knowing that your money supports good causes is a big deal. It feels right to align values with investments. You can sleep better at night, knowing you help make a positive change.

But it’s not just about feeling good. Such firms often avoid fines from breaking rules or laws. Because they run cleanly, they sidestep many problems. So, your investment is safer.

Understanding ESG scores is key. These scores come from how a company does on planet care, people, and leadership. Higher scores can mean a smarter choice for your money. These firms don’t just follow the law. They go beyond, doing more good and avoiding harm.

In sum, ESG investing fits well into smart money plans. It can help keep your savings safe and grow them, all while doing right by the world. Plus, it’s a path toward a future that values both people and our planet. It shows that making money and making a difference can go hand in hand.

Advancing Your Knowledge in ESG Investment Strategies

Debunking Common Myths of ESG Investing

Do ESG investments mean lower returns? No, that’s not true. Many believe this myth. But sustainable investing has shown to match or even beat traditional investing returns. By picking stocks that score high in ESG, you’re not just doing good. You’re also investing in companies that are likely to succeed in the long run. These firms are often better at avoiding risks tied to environmental, social, or government issues. They are ready for changes, like new laws that protect the environment.

To fully grasp ESG investment benefits, it’s crucial to let go of myths. One big myth is that ESG is just a trend. It’s not. As more people care about the planet and fairness, more money goes to ESG funds. Investors are not just looking to make money. They want their investments to reflect their ethical values too.

Active Engagement and the Role of Shareholder Advocacy in ESG Funds

Now, you might wonder, what else can I do besides picking ESG stocks? As an investor, you have power. Shareholder engagement is key here. This means using your say as a part-owner of a company to drive change. You can vote on big topics that set the company on a sustainable path. This could be about fair wages, keeping the air clean, or good company leadership.

Investors in ESG funds are part of something larger. They join other shareholders to ask for changes at annual meetings. Together, they can push companies to act right and take care of people and the planet. This is not just good for the world. It’s also good for the business and can lead to better financial returns with ESG.

So, what is the truth about ESG investment risks? Like all investments, ESG funds can go up and down. But understanding ESG scores can help you see these risks and make smart choices. Companies with good ESG scores are often more careful and plan better for the future. This can mean they are less risky to invest in.

Remember, ESG investing is not just about right now. It’s about looking ahead. It’s a way to align values with investments. When you choose ESG, you help build a better world for tomorrow and potentially boost your own financial future. Critics say ESG investing is complicated. It’s not. You can start by learning how ESG criteria analysis works. Trust your smarts and values to guide you through your ESG investment process.

In the end, know that ESG investing is a choice to invest with your heart and head. Understanding ESG scores can help you pick the right stocks. It helps when you know which companies are doing good for the world. They are the ones that could do good for your wallet too. Keep in mind, learning about ESG investing is ongoing. There’s always something new to learn about putting your money where your values are.

In this post, we explored how ESG investing can match your money goals. We saw the plus sides of ESG and weighed them against your own values and how you like to invest. We dug into what ESG means and how it’s graded. We also looked at the rules you have to follow when you pick ESG.

We compared how ESG funds do against normal investments. We talked about how ESG can change the mix and safety of your investment pile. At the end, we busted some myths about ESG and learned how you can really get involved with your ESG funds.

Here’s the deal: ESG investing is more than a trend; it’s a smart move for many. If you care where your money goes and want it to work for good, ESG might fit you well. If you’re still not sure, keep learning and talking to pros. The right choice depends on you.

Q&A :

What is ESG Investing and who should consider it?

ESG Investing refers to the practice of incorporating Environmental, Social, and Governance factors into the investment decision-making process. This approach is designed for investors who are not only focused on financial returns but also want to support companies committed to positive societal and environmental impact. Investors keen on aligning their investments with their personal values may find ESG investing particularly suitable.

How does ESG Investing impact financial performance?

While ESG Investing emphasizes ethical considerations, numerous studies have shown that integrating these factors can also lead to comparable, if not better, long-term financial performance. By focusing on sustainable practices, companies may reduce risks and benefit from improvements in operational efficiencies, reputation, and consumer loyalty, which can, in turn, lead to enhanced profitability.

Can ESG Investing really make a difference?

Yes, ESG Investing can make a difference by channeling capital towards businesses that prioritize responsible practices. This can encourage companies to improve their actions regarding environmental protection, social responsibility, and empowering governance, potentially leading to broader social and environmental benefits.

What should I look for in ESG investments?

When considering ESG investments, look for companies or funds with robust ESG criteria and reporting practices. Evaluate their performance on ESG metrics, transparency in their sustainability reports, and their impact on the environment and society. Additionally, check the alignment of the investments with your personal values and whether the investments have the potential to meet your financial goals.

Are there risks associated with ESG Investing?

Like any form of investing, ESG investing comes with its own set of risks. These can include market risk, regulatory changes, and the risk of overconcentration in specific sectors that are deemed “ESG friendly.” Also, as the field is evolving, there could be discrepancies in how companies report and evaluate ESG criteria, leading to potential misinterpretations. As always, it’s important to perform due diligence and possibly consult with a financial advisor.