In a world where digital is the new normal, keeping your cash safe and making the most out of it are real game-changers. Enter Benefits of Central Bank Digital Currency (CBDC): a financial frontier that brings with it a promise of rock-solid security and peak efficiency. Ever wondered what it could mean for your bank account to not just survive, but thrive in the digital age? Let’s unpack how a CBDC could beef up your financial security, slash banking fees, and make sure every penny works harder for you. Dive in and let’s explore together the tangible perks this could offer to your wallet, and to the economy as a whole.

Enhancing Financial Security and Efficiency with CBDC

Improved Monetary Policy Through Digital Currency

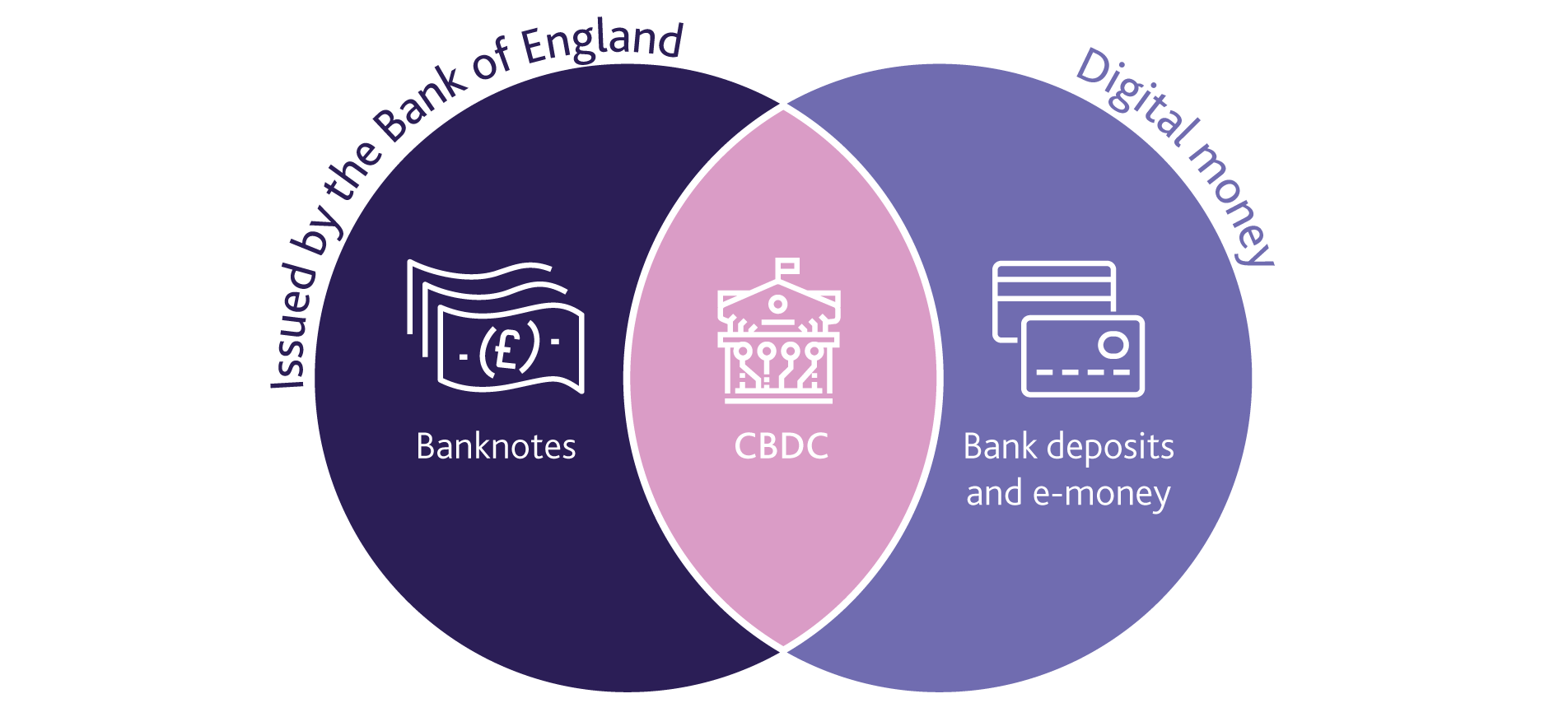

When money goes digital, some cool things happen. Central banks get a new tool: CBDC. This stands for central bank digital currency. Unlike normal cash in your wallet, CBDC works online, like in video games, but for real stuff. Think of it like special internet money that only the central bank can make. This jazzes up how they handle money rules for the country.

Now, why is this a big deal? Well, with this new money comes shiny pluses. One is better rules on how money flows. This means the folks running money stuff can react super quick if they need to fix the economy. They can send money straight to people or businesses fast, without waiting for lots of days. This digital trick helps in tough times like when many are out of work or prices fly high.

Reduced Banking Costs with CBDC

Hold on to your hats, because CBDCs also cut down costs big time. Banks and other money places spend lots building and running systems to move money around. With CBDC, these costs go down. It’s cheaper to send, get, and keep track of money. No need for piles of paper or plastic cards. It’s all on computers, smooth and easy.

Let’s talk shop. When banks save on costs, good things happen for everyone. They can offer you better deals, like lower fees or more interest on savings. Fewer fees mean you keep more of your cash. It’s nice, right?

So, kids, just like that game where you build stuff block by block, CBDC helps build a money world that’s safer and works better. And who doesn’t want more coins in their pocket for the cool stuff?

Expanding Inclusivity and Economic Stability

CBDC and Financial Inclusion

Imagine money that reaches everyone. That’s what central bank digital currency, or CBDC for short, can do. This isn’t just regular money. It’s like a supercharged dollar, or whatever your country uses, but it lives on a computer. Now, why does this matter? Well, it’s a game-changer for people who’ve never had a bank account.

So, how does CBDC boost financial inclusion? It’s simple. CBDCs make it easier for everyone to get and use money. They’re for folks in the city and folks who live far from banks. They’re for people who have smartphones and even for those with basic phones.

With CBDCs, we could see far fewer people left out of the money loop. That means more folks can buy things they need, save money, or even start businesses. This could be huge for families that find regular banks confusing or too far away.

Money from a central bank can do so much more. Going digital means sending money over borders gets easier and cheaper. That’s great for people who work far from home and send money back to their families.

Now, let’s talk safety. Everyone wants to keep their money safe, right? CBDCs can help with that. They use fancy computer tech that tracks every single digital dollar. This cuts the risk of someone making fake money and keeps your cash secure.

But what about privacy? No sweat. Central banks are serious about keeping your money details under wraps. That means you can spend without worrying about who’s watching.

Digital Currency and Economic Stability

Now, how about keeping our money calm and steady? That’s what we mean by economic stability. When money is stable, prices don’t jump around, and you can plan for the future.

Digital currencies can help with this big time. They let central banks do their job better. This means they can react super fast to what’s happening in the economy. If things start to go sideways, they can step in quickly to settle things down.

Think about what happened when COVID-19 hit. Governments tried to help out by giving people money. If they’d had CBDC, they could’ve sent it straight to people’s phones, quick and easy.

Another awesome thing about CBDCs is they’re really good at playing fair. They don’t pick favorites. That’s why they can be a strong alternative to cryptocurrencies like Bitcoin. Unlike cryptocurrencies, CBDCs have the central bank’s backing, making them super stable.

Plus, digital money means you can buy stuff way faster. That’s good for shops and good for you! It means no more waiting for days for a check to clear. And if you’re into tech, get this: CBDCs could even work with smart contracts. They’re like regular contracts, but they do the deal-making themselves when certain conditions are met. Pretty cool, right?

In the end, CBDCs are all about making life easier and fairer for everyone, with money that’s safe, quick, and reaches even the farthest corners. And they could make our economy stronger and more dependable for all of us. Now that’s something worth getting excited about!

Streamlining Payments and Fostering Transparency

Faster Payments with Central Bank Digital Currency

Imagine sending money like a text message. With central bank digital currency (CBDC), it’s that fast. Money moves in seconds. No more waiting for days for a check to clear. No need for middlemen to send cash across borders. CBDC makes money zip from person to person with just a tap. This isn’t just a small perk. For businesses, it means they get paid fast. This helps them to keep cash flowing and to pay their own bills on time. For families, it means sending emergency money now, not tomorrow.

CBDC uses technology kind of like the web. It cuts out delays. It’s built to be quick, running night and day. This means your money’s never “asleep.” Banks close, CBDC doesn’t. Plus, it’s a game changer for people far from banks. Now, they can join in too. All they need is a phone. This brings everyone closer to a world where money moves as fast as info does on the internet.

Now, let’s talk about how CBDC can actually make payments faster. Think of it as having a direct line to the bank’s “vault”. Your digital wallet links right to this vault. So, when you pay someone, it’s like handing them a digital cash note, straight from the vault to their wallet. It’s a direct swap, with nothing slowing it down.

Traceability of Central Bank Digital Money

Now, how do you know your money’s safe and going where it should? With CBDCs, every penny has a story. This makes it hard for bad folks to cheat the system. Dirty money hates the spotlight, and CBDCs are like having a flashlight on all the time. When money is traceable, it stops a lot of shady deals in their tracks.

The big win here? Fewer crimes, like fraud and theft. The money-tracing powers of CBDCs scare thieves away. Money can be tracked, so stolen cash is often too risky to touch. CBDCs keep a record of every payment like a detailed diary. This means we can watch all CBDC money, to make sure it’s not sneaking into wrong hands.

And when I say well-tracked, I mean it’s a smooth system where you can see the money’s path, just as you track a package online. It’s not about spying on what you buy. It’s about making sure the money’s not lost or stolen. Knowing where your money is and where it’s been builds trust. It also helps businesses and even whole countries know that their money systems are clean.

The traceability ties back to fighting corruption too. Governments and aid groups can watch CBDCs go right where they’re needed. Gone are the days of money “getting lost” on its way to help people. This means more help gets to those in need, with less waste.

In short, with faster transactions and traceability, CBDC helps in making payments that are not just quick, but also are honest and safe. It brings everyone into the loop, and keeps their hard-earned money secure.

Innovating for a More Equitable Financial System

CBDC Fostering Financial Sector Competition

Central bank digital currency (CBDC) brings a fresh wave to our money world. Banks must now step up their game. This means we all win with better services. With CBDC, new tech pals join the money fun. They offer cool apps and money tools you’ll love.

Think of a race. Banks are like fast cars. CBDC is the new track. The race gets more exciting. You get to choose your champ. More choice for us is great! This keeps everyone sharp and creative. One amazing thing is how it cuts our costs. Low fees and services save us cash. That’s money back in our pockets.

Now, let’s dive into the dollars and cents. Banks have big buildings and need many workers. That costs a lot. But CBDCs don’t need those. They run on tech, which is cheaper. When banks use CBDC, they save money. Then they charge us less. Sounds good, right?

CBDC and the Unbanked Population

Imagine a world where everyone can easily use money, even without a bank. That’s CBDC’s promise. Many folks don’t use banks. They live too far or don’t have enough bucks. CBDC can change that. It reaches them through phones and computers. Cool, isn’t it?

Here’s how it works. A safe digital wallet holds your money. You don’t need to travel miles to a bank. Or stand in long lines. You can pay bills or send cash to family with a few clicks. It’s safe and quick.

Digital cash like CBDC helps everyone. It gets people into the money game. This means they can start saving or building a business. It’s a big deal for growth and making life better. And guess what? It also means kids can get money smarts early!

This is not just a dream. Some places are trying it out. And it works! People are getting a fair chance at money stuff. With CBDC, doors open wide for all. We all get to play in the big money game.

To sum up, CBDCs stir up good change. They make banks hustle. They look out for our wallets. And they invite everyone to the money party. With tech and heart, CBDCs make sure no one’s left outside. They’re the new beat in our money march!

In this post, we dived into how Central Bank Digital Currency (CBDC) could change our money game. We looked at how it makes policy better and slashes bank costs. It could let more people in and make our economy more stable. CBDC might speed up payments and let us see where money goes. It’s about fair play and helping those without a bank.

My final take? CBDC isn’t just new tech. It’s a chance to make things work for all. Let’s be smart and use it right.

Q&A :

What are the main advantages of central bank digital currency (CBDC)?

Central Bank Digital Currencies (CBDCs) offer several potential benefits, including increased transaction speed and efficiency, as well as lower costs. They can streamline payment systems and make the transfer of money quicker and more reliable. CBDCs also have the potential to enhance financial inclusion by providing access to financial services for people without traditional bank accounts. Additionally, they can improve the security and resilience of payment systems by reducing the risk of fraud and counterfeiting.

How does CBDC differ from traditional money?

CBDCs differ from traditional money in that they are digital forms of a country’s official currency, issued and regulated by the central bank. Unlike banknotes and coins, CBDCs exist only in electronic form and are designed to complement current forms of currency rather than replace them. They leverage technology to enable immediate and transparent transactions, often on a peer-to-peer basis, unlike traditional money, which requires intermediaries for electronic transfers.

Can central bank digital currency improve financial inclusion?

Yes, CBDCs have the potential to significantly improve financial inclusion. By offering a digital means of payment and storage of value that is directly provided by a central bank, people who are unbanked or underbanked can participate in the digital economy without needing to go through traditional financial institutions. This can be particularly beneficial in areas where access to banking services is limited, thus encouraging more equitable financial participation among all segments of the population.

Are there any risks associated with central bank digital currency?

While central bank digital currency brings a host of benefits, there are indeed potential risks associated with its implementation and use. These could include cybersecurity threats, privacy concerns, and the impact on conventional banks and financial institutions. Additionally, there might be challenges related to technology implementation, monetary policy management, and the potential for increased central bank control over citizens’ financial transactions. It’s important to address and mitigate these risks to ensure that CBDCs can be safely integrated into existing financial systems.

How might CBDCs change the future of banking?

CBDCs could transform the future of banking by reshaping how payments are made, money is created, and monetary policies are implemented. They might lead to the development of new financial products and services, facilitate more direct transmission of monetary policy, and provide central banks with better tools for controlling economy-wide financial conditions. Traditional banking models might have to adapt, as CBDCs could reduce the need for some intermediary functions that banks currently provide, thereby changing the role banks play in the financial system.