How the Stock Market’s Weekly Performance Affects Your Portfolio

Wondering, “How is the stock market performing this week?” You’re in the right place. As stocks dance to the week’s rhythm, it’s crucial to track S&P 500, Nasdaq, and Dow Jones movements. They are like the heartbeats of your portfolio’s health. Key economic indicators and trader sentiments are the pulse, sending signals that should guide your next move.

Whether it’s blue-chip stocks stealing the spotlight or the tech sector making waves, the impact trickles down to your investments. This week, healthcare and energy stocks have stories to tell. Tune in, make smart moves, and let your portfolio thrive even in uncertain financial waters. Get ready to digest the stock market’s weekly report, and use these insights to propel your investments forward.

Overview of Stock Market’s Weekly Performance

Analyzing the S&P 500, Nasdaq, and Dow Jones Current Trends

The stock market’s moves can keep you on your toes. And this week is no different. The S&P 500, Nasdaq, and Dow Jones are like thermometers for the market’s health. They show how stocks are doing as a group. Take the S&P 500. It’s a mix of 500 big US companies. If it goes up, that’s good. Means those big players are playing well. The Nasdaq is tech-heavy. It leans on how tech companies do. And the Dow Jones? It’s 30 big companies. When they’re happy, the Dow smiles. This week, keep an eye out for any zig or zag. All three tell a story of the market’s mood.

Key Economic Indicators and Trader Sentiments Impacting Stocks

Money makes the world go round, right? Well, that’s true for the stock market, too. Economic indicators are clues. They help figure out where the market might head next. Think of job reports or new homes getting built. They can tell if folks are spending or saving. And traders? They read these clues. They’re quick to feel happy or worried. That feeling spreads. You see it in stock prices changing. Watching these signs gives you hints, too. If traders are buying lots, prices might go up. But if they’re selling, hold on tight. Prices could drop. Follow these signs. They’re like breadcrumbs leading you to what might happen next in the market.

Equity Performance Review and Market Movers

Spotlight on Blue-Chip Stocks and Tech Sector Dynamics

Want to know how blue-chip stocks and tech are doing? Look here each week. Many eyes watch these heavy hitters. They show us the market’s health. This week, tech stocks had us on a roller coaster. Big names like Apple and Microsoft swung. Why? Think about investor mood and big world events. They shape these swings.

Keep a close watch on stock market updates. They reveal changes in the game. Your portfolio feels this. If Apple dips, your tech shares might too. Use weekly financial analysis to make smart moves. Good news or bad, the tech world sets the pace.

What about other blue-chips? They had mixed results. Industries differ, so do their stocks. But they all weigh heavy on the S&P 500 weekly performance. This index is like a snapshot of the market. If it goes up or down, that’s big news.

Now, you might think, “Why care about these giants?” Well, they can guide your next step. If they tumble, maybe it’s time to hold off. If they leap, you could grab the chance. Always check market trends this week before you act.

Healthcare and Energy Stocks: This Week’s Highlights and Lowlights

Moving on to healthcare, this week was a wild ride. Each week brings new tales. Some stocks soared; others took a hit. Market movers in this space often link to news. Maybe a drug got approved, or a trial failed. These moments make or break healthcare stocks.

Let’s chat about energy. Prices swing with global cues. Think oil, gas, and renewables. If energy costs rise, energy stocks often do. If costs fall, stocks might slide. This week, Wall Street week in review would show a mixed bag. Investors react to these shifts fast. Keep your eyes peeled on market reports to stay sharp.

Utility stocks, often steady, saw some waves too. Not as wild as tech, but still worth your time. They can balance your bets when tech or healthcare wobble.

Think of your stocks like a team. Each player adds their strength. They work together to win. If one falls short, others can back them up. Your job? Coach them well. Balance your team. Use stock analysis to know their moves.

Picking stocks needs care. Use trading volume stats to see what’s hot. Market sentiment indicators help too. They tell you if people are buying with zest or holding back.

This week, we saw it all. Some stocks jumped high. Others slumped low. It’s a game of numbers. See who’s gaining. Avoid the biggest losers in stocks. Make sure you know the current stock valuations. This helps you buy low and sell high.

End each week smarter than you started. Take what the market taught you. Make your plays for the next. Investing is part art, part science. Mix sharp analysis with clear thinking. Then watch your portfolio grow.

Investment Insights From This Week’s Financial Data

Trading Strategy Considerations Based on Market Volatility and Trading Volume

The stock market tells us tales. Tales that show how our money moves and changes. Have you checked the numbers that matter this week? Let’s dive into the trading volume stats and market volatility that stir the pot.

Imagine the market as a busy city street. The more people, the busier it gets. That’s what trading volume tells us. When a lot of stocks change hands, big shifts can follow. And this can shake up your own cash. In weeks with high volume, you might need to strap in, ready for a bumpy ride.

Now, think about a heart monitor. When it spikes, something big is happening. The market volatility index does just the same. A big leap shows us fear or big news. And it can mean chances for you or a sign to hold tight.

When we match volume with those spikes, we get a clear picture. This tells us if we should buy or sell. Or sometimes, do nothing at all. No matter what, these signs help us decide how to steer our money to safety or into the race. It pays to keep an eye on these beacons in a sea of numbers.

Earnings Reports and How IPO Performances Influence Portfolios

Now let’s chat about the report card for companies, known as earnings reports. They show us if a company has hit its marks or missed out. When these come out, stocks can jump or fall. They are key players in how your funds grow or shrink.

Think of it as a school test result that all your friends wait for. Good scores light up eyes and lungs with cheers. Bad ones, well, create silence or boos. When you know the score, you can decide – cheer on or back away.

What about fresh faces in the crowd? The new stocks, the IPOs. When a company goes public, it’s like a debut. All eyes are on it. Will it rise like a star or flop? It matters to you because it can touch the ball we all play with – the market. And that ball can push your stocks one way or the other.

Money loves good news and runs from the bad. So, watch those reports and new stock shows. They can give you the map to hop on a wave or to stay on the beach. And in the vast ocean of stocks, we all want our boats to ride the waves just right.

Remember, it’s not just about knowing. It’s about understanding what the signs tell us. Each telltale number whispers hints about tomorrow. Peek into them, and you peek into the future of your wallet. That’s what keeps us glued to Wall Street’s ups and downs. As we say in the trade, keep your ears down and your eyes on the prize.

Adapting Your Portfolio to Market Trends and Forecasts

Impact of Global Market Fluctuations and Currency Exchange on Investments

Think of the global market like the sea, with waves that can lift or drop a boat. These waves are market trends this week. If a country’s money value drops, your US stocks can seem costlier to them. This might mean less demand for such stocks. So, if you own a lot of these, your portfolio might lose value. This is one way how currency exchange rates affect your stocks.

For example, if the dollar is strong, someone in Europe will need more euros to buy American stocks. This could lead to fewer buyers, and prices might fall. If you watch the weekly financial analysis, it can show you these changes. By knowing this, you can decide if you should hold on or sell part of your stock.

Always keep an eye on stock analysis reports. They can tell you how the stocks you own are doing. If you own tech stocks and a report says they might go down, think about your next move. Maybe sell some or maybe wait it out. Make sure you stay updated on technology stocks updates.

Central Bank Decisions and Trade Negotiations: Anticipating the Market’s Response

Now, let’s talk about the folks who make big money moves – central banks. When central banks change interest rates, it shakes up everything. Stock market updates often tell us what they might do. If rates go up, borrowing costs more. People and companies then spend less. This can drop stock prices.

Trade talks between countries can also shake things up. If countries can’t agree, this can hurt markets. Keep in mind, trade negotiations impact stocks a lot. When countries get along, trade flows. This is good for stocks. But if talks go bad, watch out. Stocks can take a hit.

So, watch out for these things. Look at the stock market benchmarks like the S&P 500 weekly performance. See what market sentiment indicators are saying. Based on that, make a trading strategy this week. Maybe you’ll need to sell some stocks, buy others, or just wait.

Remember, it’s like being a captain of a ship. You’ve got to steer your portfolio well. Watch the tides and winds, which are your economic indicators affecting market. Keep your eyes on what investors do too. They tell us investor reactions based on what’s happening. This helps to know what might come next.

By keeping up with weekly financial analysis, you’re setting yourself up for a smoother sail. You’re ready for big waves or calm seas. Get to know your market movers. Look at your equity performance review. Use this knowledge for your next move. Your portfolio will thank you for it.

In this post, we dove deep into this week’s stock market action. We saw how the S&P 500, Nasdaq, and Dow Jones are moving, and what economic signs and trader feelings mean for stocks. We also shined a light on big-name and tech stocks, plus healthcare and energy shares. Our chat on trading plans, based on market shakes and trade numbers, aimed to prep you for smart moves. Plus, we talked about how earning news and new stock launches might change your investment mix.

We checked how global changes and money rates alter your investing. We also thought about how big bank moves and trade talks could steer the market. My final take: keep an eye on these trends, and adapt your portfolio to stay ahead. Smart choices now can lead to wins later. Let’s use this info to grow our money. Keep learning, keep investing, and stay sharp in the stock game!

Q&A :

How has the stock market trended this week?

The stock market’s performance can fluctuate throughout the week due to various factors such as economic data releases, corporate earnings reports, and global events. It’s vital to look at stock indices such as the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite to get a broad sense of the market’s direction. Additionally, sector-specific news and changes in investor sentiment can also significantly impact weekly performance.

What factors have influenced the stock market’s performance this week?

Several elements can impact the stock market in any given week. Key economic indicators, like inflation rates, job reports, and GDP growth, can sway investor confidence. Market analysts also watch for political stability, central bank policy decisions, and international trade developments. Earnings reports from major companies can provide insights into the health of different economic sectors, influencing how stocks move.

Are there any standout sectors in the stock market this week?

Some sectors may experience more robust growth or declines in a particular week, depending on the market climate and industry-specific news. For instance, technology, healthcare, energy, or finance sectors could outperform others based on factors such as innovation breakthroughs, regulatory changes, commodity prices, or shifts in consumer behavior. Monitoring sector-specific indices and ETFs can give a clearer picture of which areas are outperforming or underperforming.

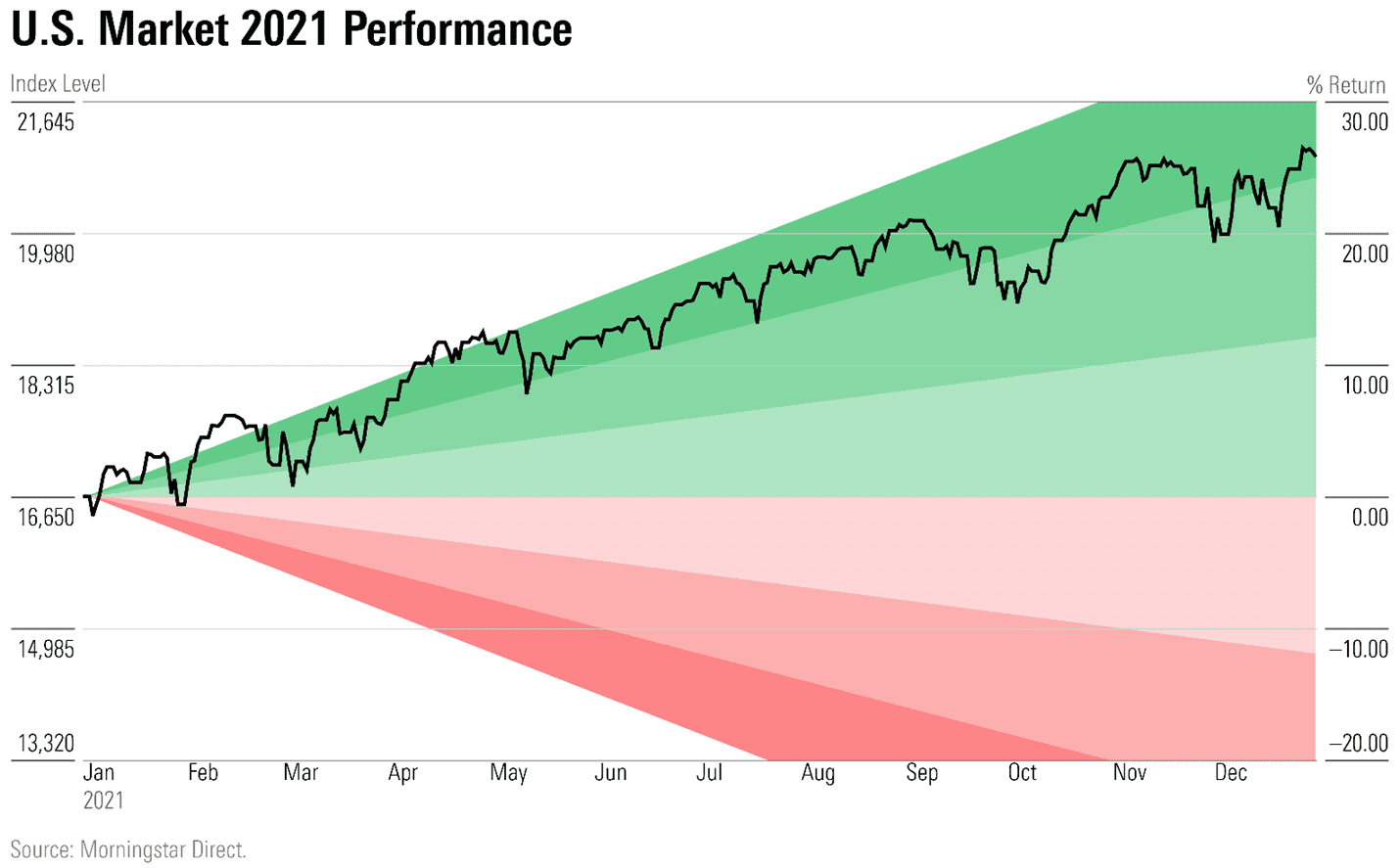

How do this week’s stock market fluctuations compare to historical trends?

It’s helpful to compare the current week’s market movements to historical trends to gain perspective. Stock market volatility can be contextualized by looking at similar time frames in the past or by considering long-term averages. Analysts often use tools like the VIX index to measure volatility and compare it to historical levels, providing insight into whether the current market volatility is unusual or in line with historical patterns.

What strategies are investors adopting in response to this week’s stock market performance?

Investor strategies can vary widely, from short-term trading tactics to long-term portfolio adjustments. Some investors may adopt a more defensive stance by investing in stable value stocks or increasing their cash holdings. In contrast, others might look for growth opportunities among stocks that have dipped in price. Additionally, some investors might consider diversifying their portfolios or using options strategies to hedge against market volatility.