Money’s future is at our doorstep, and it’s a game-changer. Central bank digital currency is making waves, gearing up to revolutionize how we think about cash. Imagine a world where every transaction is swift, every policy change is seamless, and where your wallet lives right in your smartphone, safe and sound. Stick with me, and I’ll walk you through what CBDCs are, why they’re not just an upgrade but a direct flight to financial evolution, and how they’re built on the rock-solid backbone of blockchain. Dive deep into the nitty-gritty—get the lowdown on their design for tomorrow’s market, their role in the global finance dance, and how they’re paving the golden road to adoption for nations. Are you ready to unwrap the future of money?

Understanding Central Bank Digital Currency (CBDC)

CBDC Advantages and How They Transform Monetary Policy

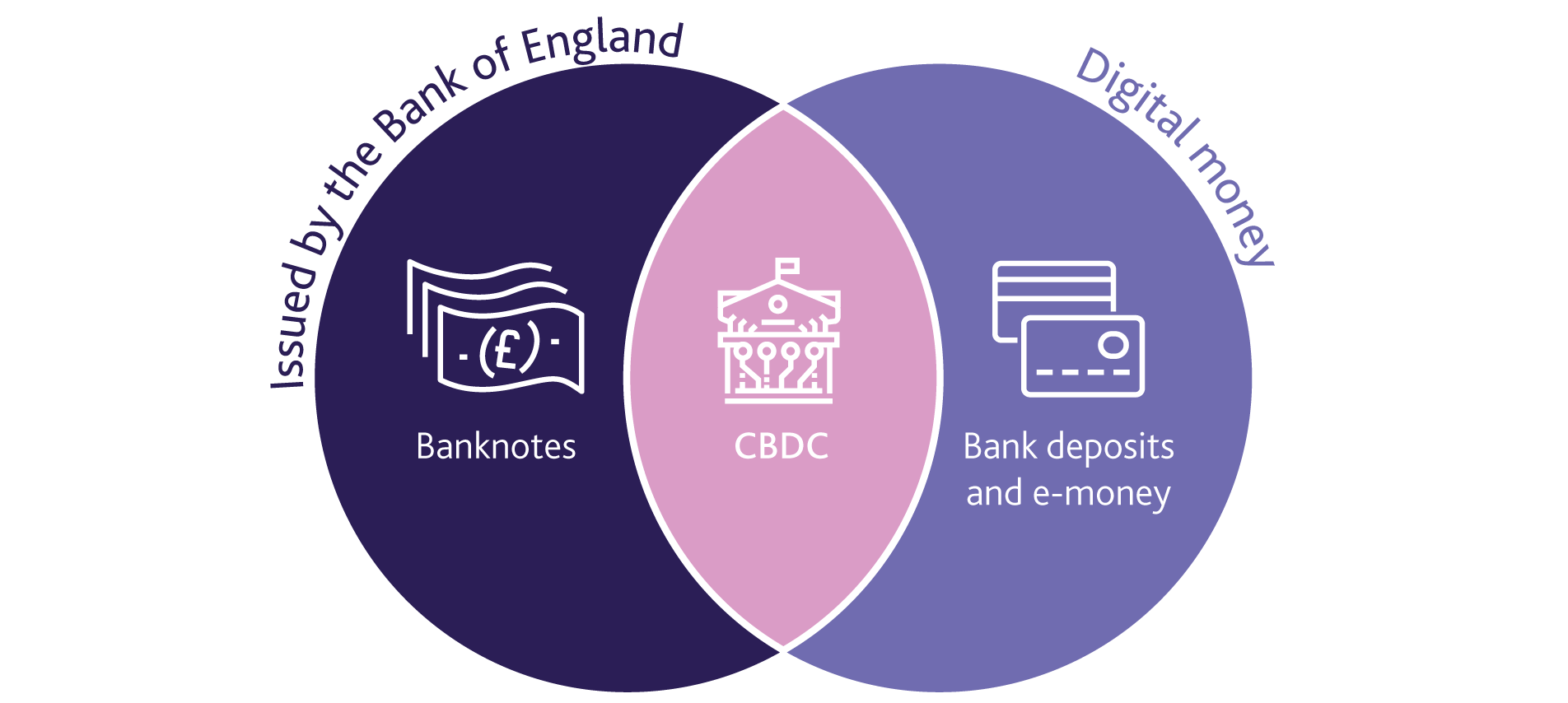

Central bank digital currency is like cash but lives on your phone. It’s created by a nation’s bank. It aims to make buying things smoother and to keep money safe. Unlike bitcoins, it’s like having dollars or euros, but in digital form.

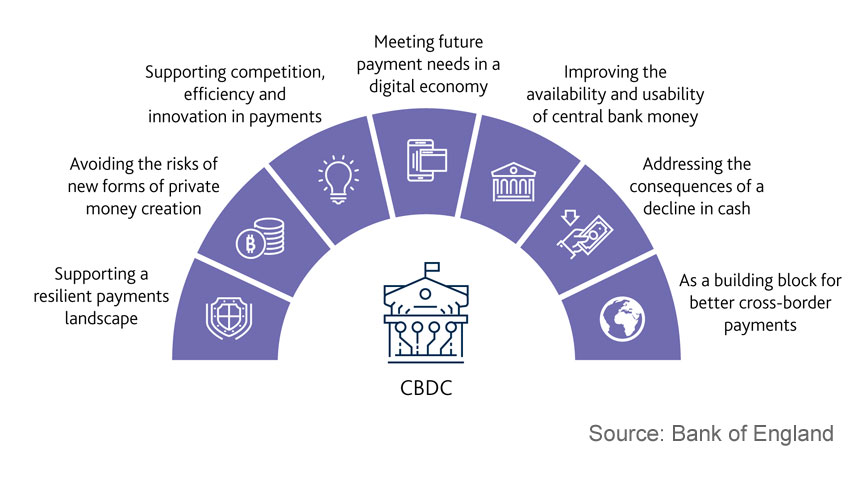

CBDC changes the way money rules work. One advantage is you can get money fast in tough times, like when jobs are scarce. It also makes sending money across borders quicker and costs less. The central bank keeps a watchful eye on it, making sure bad guys can’t mess with it as much. This is good for everyone using money.

Blockchain Technology As the Backbone of CBDCs

Do you know the cool tech behind games like Minecraft? It’s called blockchain. CBDC uses similar tech. It stacks up records that are hard to change. This means your money is secure and you can trust it’s there.

Blockchain lets the bank track every digital coin. It stops cheats and means you can trust your cash is real. This tech lets you pay someone far away fast, without wait. CBDC uses this tech to work smooth and let folks trust in digital cash.

The central bank uses blockchain to make sure every bit of money is safe. Just like your piggy bank, but nobody can break it open. It means even if bad things happen, the cash stays safe and sound. Plus, because it’s all on the blockchain, you can see where your money’s gone. This is super helpful for keeping things clear and easy to check.

By using blockchain, CBDC becomes like a super-safe bank in your pocket. It takes what works with money now and adds new tech to make it better. It’s important to get this right because it’s about keeping money safe, making sure it’s fair, and helping it move around easier. With CBDC, the money of the future is coming, and it’s awesome!

Designing CBDCs for Tomorrow’s Economy

Key Features of a CBDC for Secure and Efficient Transactions

When we think about money, we often picture coins and paper bills. But times are changing fast, and so is money. Imagine a future where you pay for everything with digital cash issued by central banks. This isn’t just a dream; it’s becoming real with Central Bank Digital Currencies, or CBDCs for short.

CBDCs are like money in your pocket but in digital form. They blend the safety of old-school cash with today’s digital smarts. They are not like Bitcoin or other cryptos. They’re a special kind of digital money that central banks create and manage. CBDCs aim to make paying for things faster, cheaper, and more secure for all of us.

Safety is key. With CBDCs, the central bank keeps an eye on the money to stop hacks and frauds. They’ll use the best tech like blockchain to keep our CBDC transactions safe.

CBDCs will also work around the clock. You can pay your friend back or buy a toy online at any time. Even banks take breaks, but CBDCs never need rest. This means you can do money stuff anytime without worry!

Balancing Privacy and Transparency in CBDC Implementation

When we talk about money, we want to keep some things private. With CBDCs, privacy still matters a lot. But central banks also have to check that nothing illegal is going on. That’s why designing them the right way is a big deal.

They’re working hard to get the balance just right. They want to give you your space but also make sure everything is by the book. They use smart systems that protect your details while checking for anything fishy.

Creating CBDCs is not just about making them work; it’s about winning your trust. If we trust that our money is safe and private, we’ll all be happier using it. It’s all about setting up rules to use CBDCs in ways that help everyone.

CBDCs promise to make everyone’s life easier and level the playing field in money matters. For folks who don’t have a bank, CBDCs can be a game-changer. They can join in and use money just like everyone else. It’s all about making sure that everyone gets a fair shot in our digital world.

In the end, it’s not just about fancy tech. It’s about a money system that’s better for you, me, and everyone else. CBDCs are a step towards that future. And they’re coming our way faster than you might think! So let’s keep our eyes peeled for how we’ll soon say hello to the money of tomorrow.

CBDCs in the Global Financial Landscape

CBDC Global Impact and Cross-Border Payment Innovations

Central bank digital currencies are changing money fast. Think of them as your cash, but digital. Imagine sending money across the world as easily as sending a text. Sounds cool, right? This is what CBDCs are starting to make happen. They aren’t like Bitcoin or other cryptocurrencies that go up and down in value crazily. Instead, they’re stable because they’re backed by national banks — like a trusted friend who always has your back.

By using CBDCs, central banks make moving money across countries faster and cheaper. No more waiting and extra costs. With just a few clicks, your money is where you need it to be. That’s a game-changer for businesses and families far apart.

Lessons from Pilot Projects and the Role of Digital Wallets

Now, let’s talk pilot projects. They’re like test runs for CBDCs before the big launch. Many countries are testing these digital dollars to see how they work in the real world. And guess what? It’s not just about whether they work; it’s about making them better. How you ask?

Digital wallets! Think of them like your physical wallet, but on your phone. These wallets hold your digital currency safe and sound. You can pay for your cool new sneakers or get money from grandma without breaking a sweat.

From these tests, central banks learn loads about making CBDCs work for everyone. That means checking that they’re safe from hackers and easy for you to use, whether you’re buying a hot dog or sending cash to another country.

So, when you hear about central bank digital currencies, know that they’re more than just talk. They’re about making money smart, fast, and for everyone. And that’s pretty exciting, isn’t it?

The Path to Adoption: Integrating CBDCs into National Financial Systems

Overcoming Challenges for Wide-Scale CBDC Digital Currency Adoption

To get everyone using a new kind of money, we first must trust it. Making a digital currency that folks can rely on is key. Central banks know this. They’re working hard on CBDCs – digital cash they control. But there are big hurdles to jump.

One big challenge is making sure CBDCs can talk to other money systems. If they can’t, people might not want to use them. Imagine if you couldn’t send money from your bank to a friend’s. That would be a real pain! Another is keeping our money safe online. Hackers are always looking for a way in. Central banks are beefing up cyber walls to keep digital dollars secure.

And don’t forget about the shops and people who need to accept this new cash. They need tools to do that. Special phones or machines can help. It’s a big change, so it has to be easy or they won’t use it. Plus, we all love our cash. Moving to only digital could scare some of us. So, banks are being smart. They’re moving slow and steady, testing like nothing’s been tested before!

Financial Inclusion and the Future of Programmable Money With CBDCs

But why switch from normal money to a CBDC? Think about everyone being able to join in. No one left out because they don’t have a bank. It’s more fair that way. With digital money, even far-away places can get fast access to cash.

Then there’s this cool idea called programmable money. It’s like money with a brain. You can set rules for how to spend it. Say, you can only spend it on food or books for school. This could help families budget their cash better. And it can make sure help from the government gets used right.

But how does all this start? It begins with pilot projects. Like mini-tests. Banks let some people use the CBDCs and see how it goes. They learn a lot from this. Then they tweak and fix things up.

Lastly, for CBDCs to really work, they have to be legal everywhere. Banks are figuring out the rules to make this happen. They want to make sure it’s cool and safe to use. This means talking to folks who make laws. And getting the tech just right. That way, a CBDC can shine like a bright new coin.

So, hang tight. The world of money is getting a digital makeover. It’s a big deal and it might take some time. But imagine a world where your money is as swift as a text message. Where sending cash to a friend across the world is quick and cheap. That’s the promise of CBDCs. A future where everyone, not just folks with banks, can tap into the magic of money. Let’s see how this journey unfolds.

We’ve walked through the future of money, from understanding CBDCs to picturing their role in global finance. We started by breaking down what CBDCs are and how they can change policy. We saw blockchain is key to these digital currencies.

Then, we designed CBDCs for safe, fast money moves. We weighed privacy against being open in handling CBDCs. Next, we explored CBDCs on the world stage, their effects, and the fresh border-crossing pay methods they bring.

We shared lessons from tests and talked about digital wallets. Lastly, we tackled the big task of making CBDCs part of daily money use. We thought about hurdles and how CBDCs make fair money access real.

In closing, CBDCs hold vast promise for our wallets, shops, and banks. Yet, our journey to this new money is just starting. As we dig in, let’s push for money that’s safe, open to all, and ready for the future. Here’s to turning the page on how we think about cash and trade!

Q&A :

Certainly! Below you’ll find a set of FAQ entries related to the keyword “Central bank digital currency”:

What is a central bank digital currency (CBDC)?

A central bank digital currency (CBDC) is a digital form of a country’s fiat currency, which is backed and issued by the nation’s central bank. Unlike decentralised cryptocurrencies, a CBDC is regulated and holds the same legal status as physical banknotes and coins. It aims to offer a new, secure and efficient means of payment.

How does a CBDC differ from cryptocurrencies?

Although both CBDCs and cryptocurrencies use digital technology, there are key differences. Cryptocurrencies operate on a decentralized network and often aim to provide anonymity, whereas CBDCs are centralized, issued, and regulated by a country’s central bank. CBDC transactions may be designed to be traceable to ensure financial security and compliance with regulations.

Why are central banks considering the introduction of CBDCs?

Central banks are interested in CBDCs for several reasons, including the potential to improve the efficiency and safety of payments, promote financial inclusion, maintain control over monetary policy, and counter the proliferation of private digital currencies which may undermine the financial system.

What are the potential risks of CBDCs?

Some of the risks associated with CBDCs include privacy concerns, cybersecurity threats, and the potential for a significant shift in the traditional banking system, which could affect bank deposits and financial stability. Additionally, there’s the challenge of ensuring that the digital currency is accessible to all citizens, including those without smartphones or internet access.

Which countries are leading in the development and implementation of CBDCs?

A few countries are at the forefront of CBDC development, with China’s digital yuan (e-CNY) being one of the most well-known examples. The Bahamas have also successfully launched the Sand Dollar, their digital currency. Other countries, like Sweden and the EU, are exploring or piloting their own versions of CBDCs.

These FAQs are designed to be informative and accessible, providing a balanced overview of central bank digital currencies tailored to likely search queries and optimized for SEO through the strategic use of the keyword.