Security of e-commerce payment platforms—it’s the silent gatekeeper of every online purchase you make. When you’re zooming through the checkout on your favorite online store, you’re not just thinking about that lightning-fast delivery. You’re trusting that store with your card details, personal info, heck, your entire financial peace of mind! So, is your checkout as safe as a bank vault or as risky as a cardboard box? You’re about to become your own security expert, and I’m here to guide you through this digital minefield. Buckle up, it’s time to dive into the world of encryption, compliance, and those cyber-ninjas keeping your wallet safe from the shadows.

Understanding E-commerce Payment Security Basics

The Role of SSL/TLS in Protecting Customer Data

You shop online, right? So you know that padlock icon on the address bar when you’re about to pay? That’s SSL/TLS working to protect your info. It’s like a secret code between your computer and the store. Only you and the store know it, keeping your details from sneaky hackers. SSL certificates are a must for any e-commerce site. They scramble data so only the right person can read it. No SSL means no security.

If you’re entering your card details, and don’t see HTTPS or a padlock icon, stop! That site might not be safe. Shops that care about security use SSL/TLS. This means they value your safety and are taking steps to protect it. So, always look for HTTPS and a padlock before you buy online.

PCI DSS Compliance: What It Means for Your Online Store

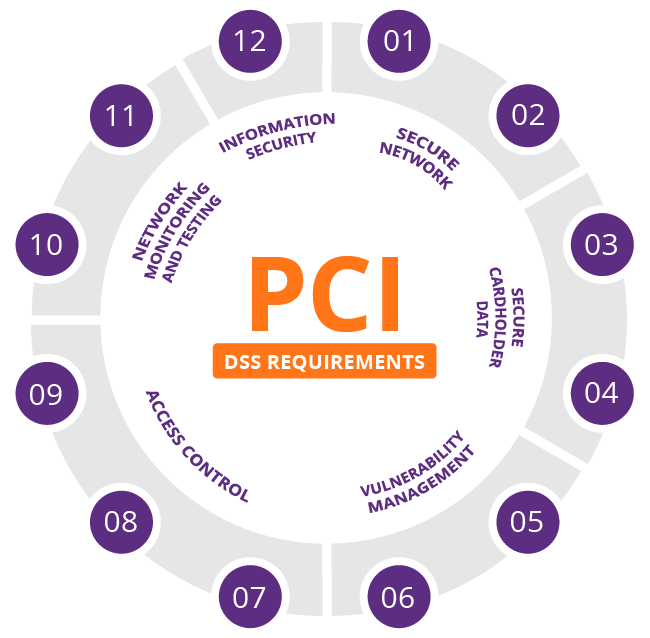

Ever wonder how you know your card details are safe after buying online? There’s a set of rules called PCI DSS. These rules make sure that stores handle your card info the right way. PCI DSS compliance means a store is following strict security steps. It’s like a store having a strong safe where they keep card details locked away. Just like the way banks protect your money.

Stores need to pass tests to show they protect your data. This includes building a strong wall against cyber attacks and checking for weak spots. They also have to make sure only the right people can see your info. Non-compliance can result in fines or worse, stolen data. Always use stores that follow PCI DSS. It means they take your security seriously.

Both SSL/TLS and PCI DSS are like guardian angels for your online shopping. They keep your money and personal info out of the bad guys’ hands. Remember, secure online transactions start with you. Check for that padlock and make sure the store follows these rules before you click ‘buy’. Stay safe and happy shopping!

Advanced Security Measures for Transaction Safety

Exploring Tokenization to Keep Customer Information Safe

Let’s dig into how we keep your details safe when you buy online. One word – tokenization. It’s like giving your info a secret code. This code protects your card’s real numbers. It’s a big deal for keeping you safe from thieves. Online stores use this secret code instead of your real card info. If hackers break in, they can’t use the codes to get your money. So, when you check out, your info turns into a unique code just for that buy. Cool, right?

Implementing Multi-factor Authentication and 3D Secure Technology

Ever bought something and had to confirm it’s you? That’s multi-factor authentication. It asks for more than one proof you’re the real deal – like a text code AND your password. It’s an extra step but super important for your safety. This stops someone else from using your card if they find out your info. Another layer to this safety shield is 3D Secure tech. You might’ve seen it as “Verified by Visa” or “MasterCard SecureCode.” It’s an extra check during payment that makes sure you – the card owner – are actually making the buy. Both of these steps beef up security big time. So next time you see them, you’ll know it’s all for keeping your shopping safe.

Combating Fraud with Intelligent Solutions

The Importance of Real-Time Anti-Fraud Software

In e-commerce, selling cool stuff is only part of the job. The other is fighting fraud. We need tools that spot bad guys the moment they try to buy. That’s what real-time anti-fraud software does. It watches over transactions like a hawk, checking each one for signs of trouble.

Think of it as a security guard that never blinks. If something seems off, bam, it steps in. This could mean blocking a dodgy payment or alerting a team to take a closer look. The goal is to let good sales through while keeping the bad ones out.

And these tools are smart; they learn and adapt. They look at patterns from millions of transactions to know what fraud looks like. They get better over time at catching it. Plus, they work fast – because in our online world, every second counts.

Effective Strategies for Risk Management and Chargeback Protection

Now, let’s dig into keeping risk low and stopping chargebacks. Chargebacks are when buyers ask their bank to return their money. They can happen if the buyer didn’t get what they paid for or if they claim they never bought the item.

We want to avoid chargebacks, right? So, we follow some smart steps. First, we make sure every shopper is really who they say they are. This is where checkouts ask for a bit more info. Stuff like CVV numbers from their card, maybe a zip code or even biometrics like a thumbprint if we want to get fancy.

Next up, we use something called “tokenization.” This is tech talk for turning private info into secret codes. Even if a hacker gets the codes, they can’t use them to steal money.

And don’t forget 3D Secure technology! It’s like an extra door with a lock. Buyers might have to answer a secret question or get a code on their phone to get through. This means only the real card owner can open that door and finish buying.

We also watch for anything that seems weird. Maybe it’s a bunch of expensive items bought in a flash, way faster than normal. Or a new user that suddenly wants to buy tons of stuff. If our gut says, “Hmmm,” we check it out.

In all this, we work with banks, credit card groups, and others who care about keeping payments safe. We all follow rules, known as PCI DSS compliance, to protect buyer info. But we also look out for new threats all the time, staying one step ahead.

So when you shop or sell online, trust that secure checkout processes have your back. By using tools that keep a watchful eye and strategies that are one step smarter, we aim to make online shopping amazing and super safe for everyone. And that’s how we turn the Internet into a place where good business wins and bad guys don’t stand a chance.

Ensuring Compliance and Trust in Payment Processing

Navigating PSD2 Regulations for Payment Security

PSD2 stands for the second Payment Services Directive. It’s a law in Europe that makes online card payments safer. It does this by making stores check that it’s really you who’s buying stuff. This way, no one else can use your card details wrongly.

Stores have to use something called “Strong Customer Authentication”. It means they must check at least two out of these: something you know, like a password; something you have, like your phone; or something you are, like your fingerprint. The law changed in 2019 to include this rule and it’s all about keeping your money safe when you buy online.

Audits and Certifications: Maintaining Secure Payment Gateways

For your payment gateways to be safe when you shop online, there’s a set of rules called PCI DSS. These rules make sure stores handle card info the right way. To follow these rules, stores must have secure systems, protect cardholder data, have a firewall, and test their systems often. They also need to limit who can see your card details.

Stores must do these checks every year. They must also do them if they make big changes to how they accept payments online. When stores do this, it means they work hard to keep your info safe when you shop. These checks help to stop hackers and keep everyone’s money from being stolen.

So, when you shop online, look for signs that the store follows these rules. This way, you know they’re doing their best to keep your card safe. Plus, you get peace of mind that you’re shopping at a safe place.

To wrap up, we dived into e-commerce payment security. We saw how SSL/TLS shields data and how your online store must stick to PCI DSS rules. We then explored tokenization and multi-factor authentication to better protect transactions. We also dug into fighting fraud with real-time software and smart risk strategies. PSD2 compliance and regular audits keep payment gateways safe.

Keeping customer data secure is key for trust in your store. Use these tips, and you can make your e-commerce site stronger against threats. Take these steps, and your customers will thank you for a safe shopping experience. Remember, safety leads to happy, loyal buyers!

Q&A :

How do ecommerce platforms ensure the security of online transactions?

E-commerce platforms employ a variety of security measures to safeguard online transactions. These typically include the use of Secure Socket Layer (SSL) certificates that encrypt data shared between the buyer’s browser and the e-commerce website, making it difficult for unauthorized individuals to intercept sensitive information. They also implement robust payment gateways that comply with the Payment Card Industry Data Security Standard (PCI DSS), which mandates stringent security controls. Additionally, platforms may use methods like two-factor authentication (2FA), fraud detection algorithms, and tokenization to further protect transactions.

What are the most secure payment methods for online shopping?

The security of a payment method can often influence consumer choice when shopping online. Credit cards are generally considered secure due to their ability to dispute charges and the consumer protection they offer. Digital wallets like PayPal, Apple Pay, and Google Wallet provide a secure layer as they do not share card details with merchants, instead using tokens to represent transaction data. Bank transfers and payment services that use encryption and monitoring, such as Wise or Stripe, also offer secure transaction methods for online shoppers.

Can consumers increase their security while using e-commerce payment platforms?

Absolutely, consumers can take several steps to increase their security on e-commerce platforms. Using strong, unique passwords for their accounts and enabling two-factor authentication (2FA) where available can significantly reduce the risk of unauthorized access. Monitoring account statements for unauthorized transactions, being wary of phishing scams, and ensuring the security of their own devices with updated antivirus software and a firewall also contribute to safer online shopping experiences. Additionally, shoppers should always make purchases from reputable websites and check for the HTTPS protocol and a padlock icon in the web address, indicating a secure connection.

How does tokenization enhance the security of e-commerce payments?

Tokenization is a technology that enhances transaction security by replacing sensitive payment information, like credit card numbers, with unique identification symbols – tokens – that retain all the essential information without compromising its security. These tokens can be used for payments without exposing actual card details, making them useless for fraudsters if intercepted or accessed unauthorizedly. Since the real card data is stored safely offsite by a third-party service or token vault, it increases the security level of online transactions, providing peace of mind for both the consumers and the merchants.

What is 3D Secure and how does it protect online payment processing?

3D Secure is an additional security protocol used in online credit and debit card transactions. Standing for “Three-Domain Secure,” this technology creates an extra layer of verification that requires the cardholder to authenticate themselves using a password, a text message OTP, or another method when making a purchase. This prevents unauthorized use of the card, as even if the card details are compromised, the transaction cannot be completed without this second form of verification. Many major card companies have their own versions of 3D Secure, like Visa’s Verified by Visa, Mastercard’s SecureCode, and American Express’s SafeKey.