Security of digital payment platforms: it’s the wall between your money and the bad guys. You use your phone to pay for a coffee, swipe a card at the grocery store, or send money to a friend. But is your money truly safe? Each tap, each scan, each send invites risk. Let’s drill down. How secure are these transactions? This article peels back the layers of digital payment security. We’ll explore the guts of safeguarding your cash: encryption, tokenization, and multi-layered defenses. We’ll dive into cutting-edge fraud detection — think machines outsmarting swindlers. You’ll grasp the compliance must-dos that form a safety net around your dollars. I’ll also arm you with the know-how for secure transactions because staying informed is your power move. Ready to trust your tap? Let’s secure that confidence.

Understanding the Architecture of Digital Payment Security

The Role of Encryption and Tokenization

When you shop online or use your phone to pay, your data needs protection. Just as a bank has walls and vaults, digital payment platforms use encryption and tokenization. These are big words, but they mean keeping your money safe. Think of encryption as a secret code that scrambles your payment info. Only the right person with a key can read it. Tokenization is like giving your credit card a disguise. It hides the real numbers during the transaction.

Now, the secret to this safety is not using just one, but mixing both methods. They work together to tight-lock your data. This makes it hard for thieves to get their hands on it. Using encryption and tokenization means that even if someone did grab your info, it’s all jumbled up or in a disguise they can’t decode.

Implementing Multi-layered Security Measures

Multi-layered security is like having a team of guards. Each one has a task to guard your money. There’s more than one way to stop bad guys. Each layer adds extra muscle to guard against different threats.

Multi-layered security involves a lot of parts. There’s two-factor authentication, which double-checks it’s really you. It’s like a secret handshake plus a password. Secure payment gateways are like checkpoints. They make sure your payment info travels safe. And then, fraud detection systems watch for sneaky behavior. They’re the detectives in this security squad.

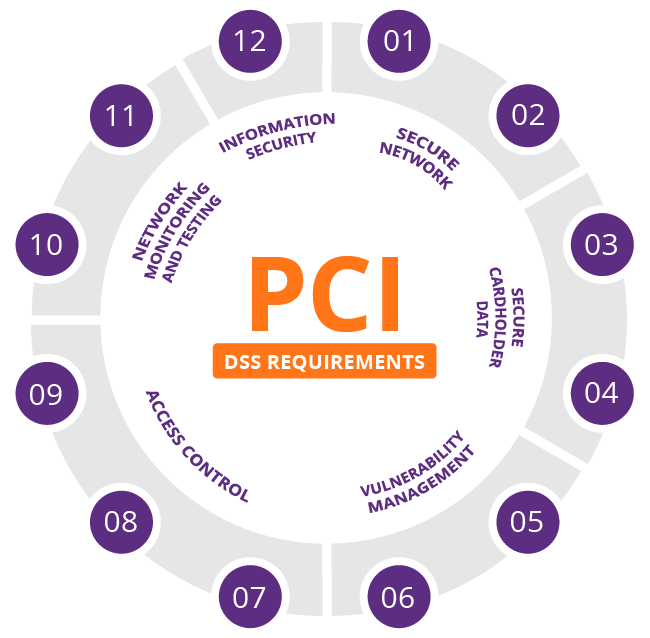

Now, it’s not just computers doing the work. Real people make rules and watch over things to stay ahead. PCI DSS compliance means following strong guidelines to keep payment data locked down.

Think about this: when you order a pizza online, you trust that your credit card info stays safe, right? That’s because behind the scenes, digital payment security measures work hard. They form an invisible, iron-clad bubble around your money.

The next time you tap your phone to pay or buy a new game online, remember this team of digital heroes. They’re always updating their tricks and tools to outsmart the bad guys and keep your digital dollars safe.

The Latest Innovations in Fraud Detection and Prevention

Machine Learning Algorithms in Identifying Fraud

We’re beating fraudsters at their own game. How? Machine learning – it’s our secret sauce. Imagine a smart cop that learns every trick crooks try to pull. That’s machine learning for you. It watches your back, checking each transaction. If something odd pops up, it raises the alarm.

“Are these algorithms really effective?” Yes, they spot odd patterns in huge data sets. This way, we catch fraud before it hits your wallet. Machine learning algorithms get better with time. They learn from past fraud to stop new tricks.

Now, let’s dig deeper. Imagine shopping online with your credit card. Each swipe or click sends out data. Machine learning algorithms analyze this in seconds. They look for weird patterns and match these against signs of fraud. A mismatch can flag a transaction for a closer look.

Real-world Impact of Biometric Verification

Biometrics are our next big win. They make sure it’s really you using your card or phone. Think of it as a high-tech guard, checking your face or fingerprint. This tech is top-notch for keeping your digital payments safe.

“So how does biometric security keep my money safe?” Your unique features – like your fingerprint – lock down your accounts. No one else’s print will do; only yours. This means thieves can’t just guess a password to get in. They need something they can’t fake: your biometrics.

Biometrics are super useful today. They’re the shields for our e-wallets and banking apps. You just use your finger or face, and voila – payment is done! It’s quick and secure. This tech also helps when you lose your phone. No one can pay using your lost device. Only your biometrics unlock the payment feature.

There you have it. Machine learning and biometric checks are the dynamic duo. They work non-stop to guard your hard-earned cash. With these pals, you can click “pay” with peace of mind.

Compliance and Standards: A Cornerstone for Payment Safety

Navigating PCI DSS Requirements

When you buy online, you trust the site to keep your card safe. We call that PCI DSS compliance. It’s a set of rules. They protect card info across the globe. All shops and banks online follow these. It means your payment data stays safe.

Shops must have a secure network to protect your card data. They must also watch all access to network resources and cardholder data. They need strong access control measures too. This stops unwanted people from seeing your info. Every company that takes card payments must pass a test each year. This shows they keep to these rules.

These rules are not just any rules. They are the gold standard for payment safety. Think of them like a big, tough lock on your data. And every year, that lock gets checked. To make sure it’s still tough to break.

Global Trends in Digital Payment Regulations

Now let’s talk about rules all over the world. Different places make their own rules. But they all want to keep your money safe. Europe has GDPR. It makes sure your privacy is a top priority. Then there’s PSD2, for safer and more open payments. It also lets you use other services to manage your money.

In the US, we have different laws. But they all say one thing. Your financial info has to stay secure. New rules keep coming as tech changes. Like rules for mobile wallet safety, and biometric checks.

We also see trends like more rules on mobile payments. And laws that fight online theft. They make sure if something bad happens, you don’t lose out. They make sure you get your money back.

In Asia, places like Singapore and Japan lead the way. They have strong laws for digital payments. They use tech to keep an eye on frauds. And make sure everyone plays by the rules. This way, every time you tap, swipe, or click, you know it’s secure.

So, what’s this all mean for you? When you see “PCI DSS compliant”, you can feel at ease. It’s like a badge that says “your money’s safe here”. And as the world makes more digital money rules, we stay on our toes. We make sure you can shop, send, and save money without worry.

The point is clear. Wherever you are, or how you pay, these rules and tests help keep your cash safe. They make sure the bad guys can’t sneak in. And that’s a big win for everyone who’s ever clicked “buy”.

Empowering Consumers: Best Practices for Secure Transactions

The Necessity of Two-Factor Authentication

In today’s world, keeping your money safe is a must. Two-factor authentication (2FA) adds a layer to this process. Think of it like a double lock on your front door. Even if someone has your key, they can’t get in without the second lock’s code. It’s simple. With 2FA, your account asks for two proofs that it’s really you. One might be something you know, like a password. The other could be something you have, like your phone.

Banks and apps use 2FA to keep bad guys out. When you log in, they might send a code to your phone. You must enter this code to prove it’s you. Without both factors, no access is granted. This stops thieves, even if they steal your password. They still need your phone, which they likely don’t have.

Using 2FA means one more step, yes. But it’s a small task for a big boost in safety. It keeps your hard-earned cash secure.

Educating Users Against Phishing and Scams

Have you ever got an email from a prince promising millions? Or a message saying you won a lottery you never played? These are called scams. As funny as they sound, they trick lots of people.

Scams trick you into giving away your money or private info. Even smart folks can get fooled. That’s why knowing about scams helps a lot.

For example, phishing is a common trick. It’s when bad guys send fake emails or texts. They look real, like they’re from your bank or a store. But they’re not. They want you to click a link and enter your info. Never do this unless you’re sure it’s safe.

Always check if the message is real. Look at the sender’s email. Does it match the company’s official one? Is the website you are asked to click straight from your bank or service? You can call the company to be sure. And remember, no real bank or company will ask for your password or pin by email.

By knowing these tricks, you can keep your money safe. It’s all about being alert and checking twice. Don’t let the scammers win.

With these practices, your digital payments should be safer. Take the time to set up 2FA. Learn how to spot those sneaky scams. This way, you take charge of keeping your money safe. And that’s a win for everyone!

We’ve walked through how digital payment security stands strong thanks to tough tech like encryption and tokenization. We also saw how layers of protection work together to keep our money safe. Tech heads are using smart tools like machine learning to spot fraud. Plus, our own fingers and faces help stop thieves through biometric checks.

On top of that, rules like PCI DSS are big deals for keeping everyone honest. And around the world, new laws are popping up to make sure our cash stays ours. Yet, what can we do? A lot, actually. Double checks like two-factor authentication put us in the driver’s seat. And knowing the tricks of con artists stops us from falling for their scams.

Remember, staying safe with money online means keeping up with tech, rules, and smarts. It’s our cash on the line, so let’s protect it like pros.

Q&A :

How secure are digital payment platforms?

Digital payment platforms employ a variety of security measures to protect users’ transactions and personal information. These usually include encryption, tokenization, and two-factor authentication processes. However, like with any online service, the level of security can vary between platforms. It’s important for users to ensure the platform they choose has a strong reputation for security and to follow recommended practices for safeguarding their own data.

What are the most common security features for digital payments?

Most digital payment platforms include several common security features:

- SSL Encryption: Protects data in transit between the user’s device and the payment servers.

- Tokenization: Replaces sensitive data, like credit card numbers, with unique identification symbols.

- Two-Factor Authentication: Requires a second form of verification beyond just a password.

- Fraud Detection Systems: Analyze transactions for signs of unusual activity that could indicate fraudulent behavior.

Can digital wallet transactions be hacked?

While no system is entirely immune to hacking, digital wallet transactions are generally considered to be very secure thanks to advanced encryption and security protocols. To further minimize risks, users should ensure their devices are secure, use strong passwords, and avoid conducting transactions on unsecured or public Wi-Fi networks.

What should I do if I suspect fraud on a digital payment platform?

If you suspect fraud on a digital payment platform, you should:

- Contact the payment service provider immediately to report the suspicious activity.

- Change your account passwords and any security questions.

- Review your recent transactions and flag any that are unauthorized.

- Monitor your bank statements and credit reports for any signs of identity theft.

- File a report with the proper authorities, such as your local police or a cybercrime agency.

How can I ensure my transactions are safe on digital payment platforms?

To ensure the safety of your transactions on digital payment platforms:

- Use secure and unique passwords for your accounts and change them regularly.

- Activate two-factor or multi-factor authentication where available.

- Be cautious of phishing emails and messages that request personal information or direct you to suspicious websites.

- Only use trusted networks when making transactions; avoid unsecured public Wi-Fi.

- Keep your software updated to benefit from the latest security enhancements.

- Regularly check your accounts for unauthorized transactions or signs of attempted fraud.