How Central Banks Wield Interest Rates to Steer Economies

Imagine you hold a remote that controls a nation’s wealth. Sounds powerful, right? This is close to how central banks use interest rates in monetary policy. As the economy speeds up or slows down, they tweak the rates to keep everything just right. I’m here to show you the levers they pull and push. With a flick of their rate-setting pen, they can tame inflation or give growth a nudge. You’ll get why these rate moves matter to your wallet and the wider world too. Strap in, and let’s dive into this monetary mastery together.

The Mechanism of Interest Rates in Monetary Policy

How Rate Adjustments Impact Inflation

Think of a central bank as a skilled captain. Its ship sails through waves of economic ups and downs. One of its trusty tools is the interest rate. This rate shapes how much it costs to borrow money. When prices rise too fast, the bank can increase rates. This is like a tap that slows down the flow of money. People and businesses borrow less and spend less. This cools down the economy and helps hold down prices.

Why care about prices rising, though? If prices climb too quickly, your cash buys less over time. That’s what we call inflation. If a toy car costs one dollar this year but two dollars next year, that’s inflation at work. A little inflation is normal, but too much is like a fast-moving car without brakes. So, central banks step in by tweaking rates. This keeps prices in a zone that’s just right.

Interconnection Between Policy Rates and Economic Growth

Interest rates and economic growth are dance partners. They move together in ways that can surprise. When central banks lower rates, they’re telling the economy, “Let’s dance faster!” Cheaper borrowing sparks spending and investing. Businesses grow, people buy more, and jobs are easier to find. This dance leads the economy to a brighter tune.

But, central banks can’t play the same song forever. If they keep rates low for too long, the room heats up too much. Prices start to jump, and the dance can turn into a mess. That’s when the bank may turn down the music by raising rates. It’s their way of saying, “Let’s slow down the party.”

In these ways, central banks hold a key role. They use rates to keep the economy’s dance smooth. They aim for the sweet spot: enough growth but not too much heat. When they get it right, we all enjoy the party.

The Ripple Effects of Central Bank Rate Decisions

Influencing Currency Value Through Interest Rates

Central banks have a big tool in their kit: interest rates. When they change rates, it’s like throwing a stone in water, making ripples that reach far. Think of interest rates as the cost of money. If rates go up, money costs more to borrow. And when they dip, it’s cheaper. This affects your dollars, euros, or pesos value. Let me break it down.

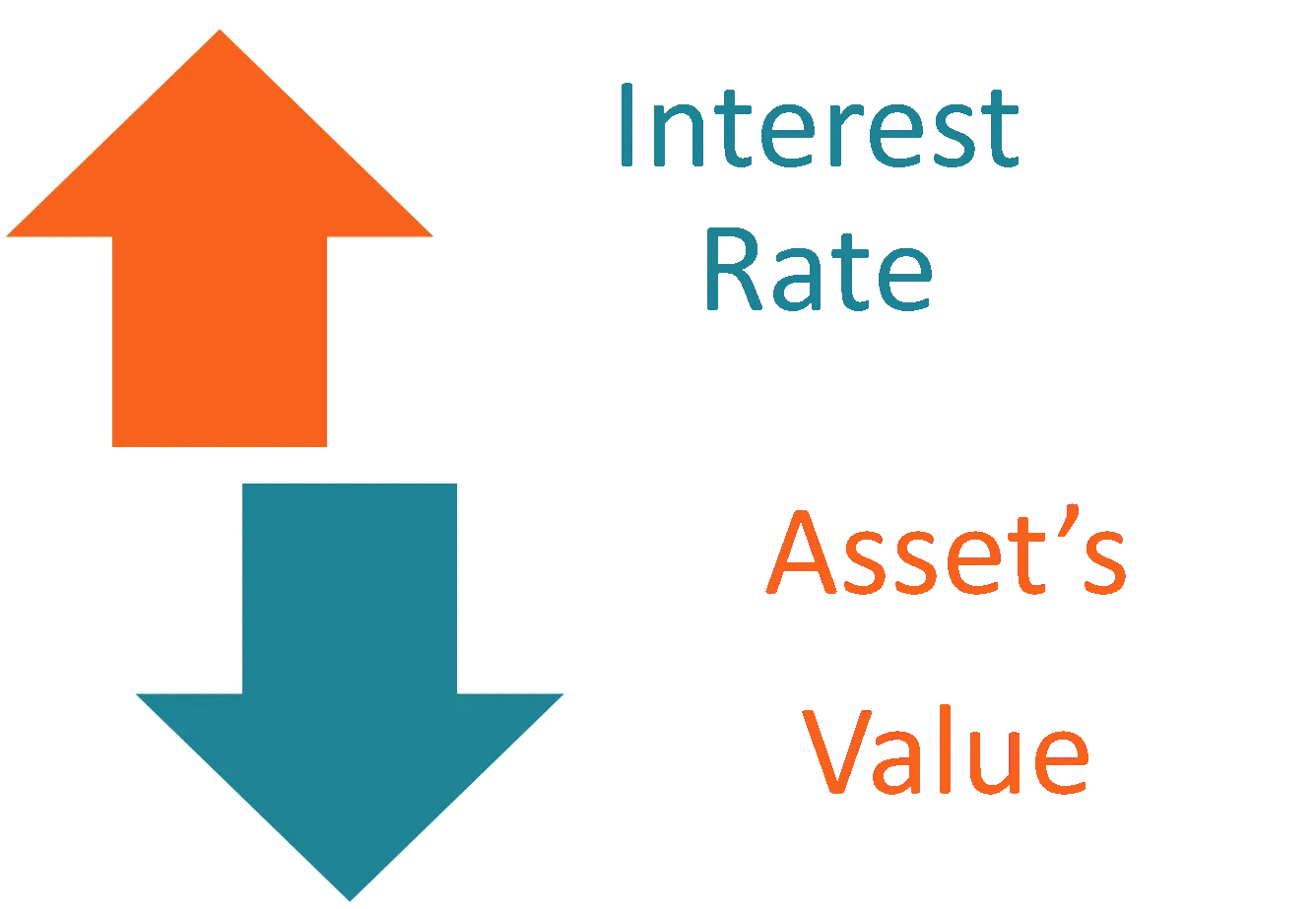

Why do higher rates boost currency value? It’s the reward for saving. Banks pay more for your deposits, pulling in cash from overseas. More demand for a currency raises its value. Yes, it’s that simple.

Now, what happens when rates fall? Money gets cheap. It flows more easily. People and businesses borrow and spend. But, there’s a catch. If too much money chases too few goods, prices hike – that’s inflation. Central banks keep an eagle eye on this.

The Dynamics of Loans, Mortgages, and Interest Rates

Let’s talk homes and businesses. They need loans and mortgages, right? Interest rates are a key part. Lower the rate, lower the payment. It’s a no-brainer. This gets more people to buy homes or start businesses. And that’s not all. Lower payments can mean more money to spend elsewhere.

But high rates? They cool things down. People think twice about borrowing. Those who do pay more each month. Less cash floats around. Businesses slow down on big plans. It’s a balancing act. We want growth, but not so fast that it runs off the rails.

Central banks use these adjustments like a thermostat. Too cold? They lower rates to heat up spending. Too hot? They ramp up rates and settle things down.

Remember, each move is a calculated step. They’re not just winging it. They aim to smooth out the ups and downs. They watch economic indicators like hawks. Inflation, jobs, and growth numbers all play a part. They tweak interest rates to keep everything steady. It’s all about not letting our economic engine run too hot or cold.

Now, this affects you more than you might think. Notice how savings account interest changes? Or how credit card rates move? That’s the central bank steering the economy, right there in your wallet.

Banks also adjust what they charge each other. This rate, called the prime rate, is the base for many other rates. When central banks tweak their main rate, the prime rate follows suit. And so do the rates for loans and credit lines.

In the end, central banks have a crucial job. They use rate changes to guide our economic journey. They aim for that sweet spot. You know, where jobs grow, but prices don’t balloon up. They keep an eye out for all of us, making sure our money keeps its might and our economy stays on an even keel.

Implementing Monetary Tools for Financial Stability

Combating Economic Cycles: Recession and Inflation

Picture this: your body gets hot or cold, and you adjust to stay comfy. Central banks do something like this with money. They cool or heat the economy using tools. One big tool is interest rates. When things slow down, like in a recession, banks cut rates. This makes it cheaper to borrow money. Cheap loans help people buy more and businesses grow. The economy then warms up.

But what if prices soar too high, too fast? That’s inflation. Banks then hike up rates. It makes borrowing cost more. Spending on big things, like houses, slows down. With less money chasing goods, price hikes take a chill pill.

Quantitative Easing: A Liquidity Tool Beyond Interest Rates

Now, rate cuts are great. But sometimes, they need help. Enter quantitative easing, a fancy term for a cool trick. When rates are super low, banks buy up stuff like government bonds. This pumps money into the banking system. Banks can lend more to folks and businesses. It’s like adding oil to a rusty engine.

Interest rates and these tools, they’re like a dance. Banks lead to keep the economy grooving. Too much inflation or too deep a slump, and the moves change. That’s the dance for financial health.

That’s how banks aim for a just-right economy. Not too hot, not too cold, like that porridge Goldilocks found. Next time you see the rates change, you’ll know the central bank is doing its thing. And that’s keeping our money world balanced and smooth.

Strategic Moves in Interest Rate Policy

When and Why Central Banks Adjust Rates

Let’s talk about how central banks move rates to guide economies. Banks change rates to match what the economy needs. When growth is slow, they cut rates to make borrowing cheap. This helps to boost spending and jobs. But if inflation—costs of goods going up—is too high, they raise rates. This makes loans cost more but cools down spending and lowers inflation.

Balancing Act: Stimulus vs. Inflation Control through Interest Rates

Now, here’s the trick. Banks must balance growth and stable prices. Low rates can spur the economy but risk too much inflation. High rates control inflation but can slow down growth. It’s like keeping a bike steady; too much one way and it tips. Banks aim for just the right rate to keep the economy rolling smooth.

When we look at our money in the bank, interest rates matter a lot. Low rates mean you earn less on savings. High rates mean you earn more. But for folks with loans or mortgages, low rates are good news. You pay less on what you borrowed.

Interest rates don’t just live on their own, though. They’re tied to lots of things. Like the price of stuff we buy, or how much stuff gets made and sold. They affect how much people spend or save. Banks watch all this because it shows how healthy the economy is. Rates have to line up with these signs to keep the economy fit.

Remember when I said central banks change rates for the economy’s needs? Here’s how they decide. They look at things like jobs, prices, and trade to pick the best rate. They use special tools to make this happen, like open market actions, tweaking rates banks charge each other, and changing how much cash banks need to hold.

One of their big goals is to make sure prices don’t bounce up and down too much. They call this “inflation targeting.” When they set that target, they’re saying, “We want prices to go up just a little bit each year.” This little bit helps keep the economy chugging along but doesn’t let it run wild.

Currency value—how much our money is worth compared to others—is also key. If our rates are higher than in other places, people want our currency more. That means our money’s worth more. But make rates too high, and it can be rough on businesses that sell stuff to other countries.

All this rate changing takes skill. Banks must watch the economy like hawks and act when needed. Sometimes they need to pump up the economy, give it some juice. That’s when they lower rates, so people can invest, spend, and get loans easier.

Other times, when prices climb too fast, they need to cool things off. That’s when they hike rates up, making it costlier to borrow. This helps to bring down the buying frenzy and keep inflation in line.

Central banks have a lot on their plate, with all these rate adjustments and tools. They work to keep our spending in check, help jobs grow, and stop prices from swinging wild. It’s a huge task, but they do it to steer the ship of our economy, making sure we stay on course for steady waters ahead.

We’ve explored how central banks use interest rates to steer the economy. Adjusting rates can tame inflation or boost growth. Higher rates can slow things down when the economy heats up too much. Lower rates can give it a kick when it needs to wake up.

Interest rate moves ripple through markets, affecting the value of currencies and the cost of borrowing. When you get a loan or a mortgage, these rates decide what you pay back.

We also checked out tools like “quantitative easing” that help when usual methods fall short. These are key in tough times like recessions or when prices soar.

Central banks have to juggle stimulating the economy and keeping prices steady. It’s not easy, and each move is a carefully thought out balance.

Understanding how interest rates work is powerful. It helps you see why your savings may earn more or less interest and how your mortgage payments can change. This knowledge puts you in a better spot to make smart money moves.

Q&A :

How do central banks manipulate interest rates to influence economic activity?

Central banks adjust interest rates as a part of their monetary policy to control economic activity. By lowering rates, they aim to stimulate borrowing, investment, and spending, which can boost economic growth. Conversely, increasing rates can help temper inflation and cool down an overheating economy.

What is the primary goal of central banks when setting interest rates?

The primary goal of central banks when setting interest rates is to maintain price stability—keeping inflation low—and to sustain economic growth. By achieving a balance between these two, central banks aim to foster a stable financial environment conducive to job creation and long-term investment.

How do interest rate changes by central banks impact inflation?

Interest rate changes by central banks directly impact inflation. When interest rates are increased, borrowing becomes more expensive, which can reduce consumption and investment, leading to lower demand for goods and services, thus, in theory, reducing inflation. When rates are decreased, it can stimulate economic activity, which may increase inflation if the economy grows too quickly.

Can central banks directly control market interest rates?

Central banks cannot directly control market interest rates; however, they can influence them. They set a benchmark interest rate, such as the federal funds rate in the United States, which guides the rates at which banks lend to each other and affects the rates banks offer to their customers for loans and savings.

What tools besides interest rates do central banks use in monetary policy?

Besides interest rates, central banks use several other tools in monetary policy. These include open market operations (buying and selling government securities to influence the money supply), reserve requirements (changing the amount of money banks must hold in reserve), and the use of forward guidance (communicating future monetary policy intentions to influence economic expectations).