Feeling the pulse of the market after a tumble can be tough. Many folks are left wondering if stock market recovery signals a green light for opening their wallets. As the markets sway, you’re probably asking, “Is now the right time to dive in?” With shaky hands, investors eye the horizon for growth signs. Stick with me, and I’ll walk you through the current stock market scene, digging into economic hints that point to a comeback. Then, we’ll uncover how to spot fresh investment chances and smartly play your cards in this evolving landscape. From strategic moves in the recovery phases to steering clear of risks and grabbing gains, I’m here to unpack it all. Let’s get your investment strategy aligned with the pulse of today’s market.

Assessing the Current Stock Market Landscape

Economic Indicators and Stock Market Recovery

The stock market can leap or dip. It’s like a heartbeat. Now, it might start to speed up. Economic hints tell us if things look good. If jobs grow and people spend more, stocks may go up. These ups and downs are normal. To invest wisely, watch for these signs.

When shops sell more goods, it can mean the market will get better. This is a recovery. It’s when stocks start to climb back up. It happens after a dip. So, if people buy more and factories make more, stocks may rise.

We also keep an eye on interest rates. They can shape where the market will go. If rates fall, companies can borrow money easier. This helps stocks go up.

Think of the stock market’s recovery as a team sport. Everyone chips in for a win. Companies grow, people work, and as a team, they score. That’s how we see a market win.

Analyzing Recent Financial Markets Recovery Trends

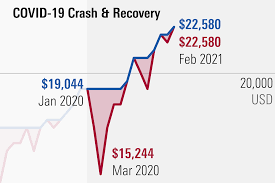

After a crash, the market often comes back strong. We call this a rebound. It’s when stocks jump back after a fall. Lately, we have seen some big leaps. So, yes, the market can look good after a drop.

Many ask, “Is it safe to dive back into investing?” Think about riding a bike. After a fall, you might hop back on a bit wiser. It’s like that with stocks. Learn from the past. Then choose smart.

Now, we spot the rise of tech and health stocks. They are having a good run. It’s a sign that shows where the market may go. These areas grow fast and can lift the market up.

But it’s not just tech and health stocks rising. Others join in too. It’s like a big wave that lifts all boats. We call this a bull market. It’s when most stocks climb together. This can be a great time to think about investing.

We also look for signs of a slow-down. When stocks rally too fast, they might drop again. This is a correction. But it’s not all bad. It can stop the market from getting too hot.

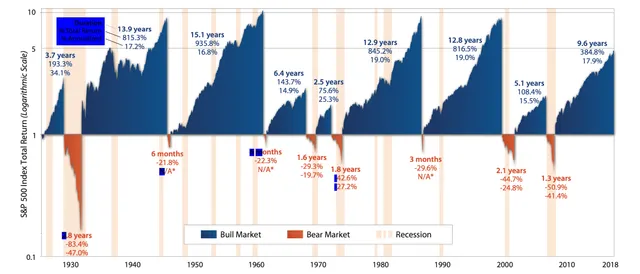

We’ve seen many market cycles. Each one is a big loop. Rise, peak, drop, and recover. Right now, we are on the upswing. It’s a phase with good chances to grow your money.

In the end, investing is a mix of smarts and timing. We look at hard facts and make our best guess. If you want in, think about these trends and aim to pick stocks on the up. With care and a keen eye, you can tap into recovery wins.

Identifying Investment Opportunities Post-Crash

Spotting Signs of an Equity Market Resurgence

After a stock market crash, we look for signs that stocks are coming back. These signs include a rally in stock prices and a general upswing in financial markets. As an expert who’s studied market dynamics for years, I can tell you key indicators to watch are spikes in trading volume, improvement in economic data, and a rise in investor confidence.

These signs paint a clear picture of an equity market resurgence. When you see big companies start to recover and stock prices climb day after day, it’s like the market is waking up again. We call this a bull market return. It’s a time when investors get excited, and buying stocks can be smart.

Evaluating Long-term Investment Opportunities in a Bull Market Return

But what about long-term investing? Well, in a bull market’s early stages, it’s prime time for identifying growth stocks with potential to soar. You want businesses that stand strong even when times get tough. Think about what people always need and which companies make those things.

It’s also a good plan to check out index funds. These funds are like baskets full of different stocks. They help you spread out your risk, which is super important. Say one stock isn’t doing so hot, chances are, the others in the fund will balance it out.

Investing post-crash isn’t just about jumping on the first opportunity. It’s about looking at the big picture. Consider how companies stayed strong or got back up after tough times. If they managed well during the fall, they’re likely to do well during the rebound. That’s the sign of a solid long-term investment.

In short, to make the most of a financial sector revival, focus on signs of growth. Spot the rally in stock prices, and choose companies that keep proving they’ve got what it takes. Remember, while the chance for quick wins can tempt you, the real goal is finding strong players that can last a long game. This way, you’ll be setting up your portfolio for a robust and rewarding future.

Strategic Investing During Market Recovery Phases

Recovery Phase Investing Vs. Recession-Proof Investments

Investing when markets bounce back is tempting. So is finding stocks that stand strong in a crash. Both have upsides, but they are not the same. Recovery phase investing is buying stocks as they start to climb after dropping. Recession-proof investing is choosing stocks that can weather a market storm.

Let’s start with recovery phase investing. Think of it as a chance to buy low and sell high. When the market starts its rebound, it’s like a green light for investors to jump in. You look for stocks that got hit hard but are set to rise. It’s like catching a wave just as it starts to form.

Recession-proof investments, though, are more about safety. They’re the life vests of your portfolio. During tough times, they aim to keep you afloat. Companies that sell things we always need, like food or power, often make this list. Their stock prices might not soar like others, but they also don’t crash as hard.

Asset Allocation Adjustments for a Portfolio Rebuilding

When markets change, so should your portfolio. It’s like fixing a boat after a storm. You patch it up, make it better, and get back in the water. Rebuilding a portfolio means looking at what you have and making changes. You might add more stocks if prices are low. Or, you might find safer places to put your money if things are unsure.

Adjusting your asset allocation is key here. This means changing where your money sits across stocks, bonds, and other assets. Think of it like balancing on a seesaw. Too much on one side and you might fall. You want a mix that fits your goals and how much risk you like.

Investors often turn to index funds during this time. Index funds are like baskets of different stocks. They help spread out your risk. If one stock in the basket falls, the others can help keep things steady. Index funds can help your money grow as the whole market lifts.

And don’t forget growth stocks. These are companies that may not pay big today, but have a bright future. After a crash, they might be cheaper to buy. And as they grow, so could your investment.

The big idea? When markets recover, you have choices. You can chase the rise, or play it safe. Make the right moves and you could do well. Remember, there’s no sure thing. But a smart plan can help set you up for the win.

Navigating Risks and Maximizing Gains Post-Recovery

Tailoring Recovery Investment Strategies for Growth

When markets rise, smart moves can pay off. But risks loom. So, we plan. We watch stock market rebounds and learn. We focus on financial markets recovery, looking for signs of growth. We pick stocks wisely after a crash. Care counts.

Investing post-crash means one thing – chance. Chance to buy low, sell high. It means seeking equity market resurgence. We must target stocks likely to rally. That’s the key to a bull market return.

Watch the market, as it guides us. Note the trends. Stocks that fell hard may climb back up. They may become the stars of a bear market recovery. This is not always sure. But we can hope, and we can act sensibly.

To win in investing during recovery, know two things. Know your risk level, and know the market’s state. Yes, it is a blend of art and science. Timing does matter, though not always as much as you’d think. Keeping a close eye is smart.

Post-Crash Analysis for Effective Rebound Strategies

After a crash, the dust settles. Then, we spot the gems left behind. Wise investors take this time for a post-crash analysis. It shows us what’s ripe for a rebound. It hints at what stocks may zoom up next.

We look for rebound strategies for investors. This means seeking stocks ready to jump. We think of the financial sector revival. Sectors hit hard may come back strong. That’s where gains can surprise us.

Investor confidence needs time to grow. We help this grow with smart picks and calm words. Our portfolios need rebuilding. They should balance risk and reward. We want a mix to keep us safe, but also to let us win.

Index fund recovery signals strength. When these rise, good signs appear. It shows much about stock rebound trends. Funds track markets wide and far. If they do well, so might we.

Growth stocks revival is our aim. These stocks can power portfolios to new heights. Picking them post-downturn is a prize. Yet, no prize comes without hard work. We must search and scrutinize. In this, we can’t let our guards down.

Market sentiment improves with care. We must keep tabs on this mood. It speaks volumes on what could happen. It is our guide and our friend.

We end with a sharp eye on economic indicators. These are the flags that warn or cheer us on. They point out when to move or to wait. It is a dance of sorts – one we join with eyes wide open.

In this post, we explored the stock market’s current state, looking at economic signals and recent trends to understand the recovery process. We spotted signs of growth and eyed long-term chances worth grabbing after the dip. Then, we tackled how to invest smart during different market recovery stages, comparing tactics that stand up in hard times to rebuilding strategies. We wrapped it up by learning how to adjust your assets and craft plans for growth, keeping risks low but aiming for high rewards.

Now, it’s clear that with the right tools and clear thinking, you can find solid opportunities and make smart choices even when the market shakes up. Keep your eyes on the signs, adjust your moves as you go, and stay ready. You’re set to navigate the rebound and come out ahead. Let’s invest with confidence and make the most of the market’s comeback!

Q&A :

How long does it typically take for the stock market to recover after a crash?

The duration for a stock market recovery post-crash can vary significantly depending on the cause of the downturn, economic conditions, and governmental responses among other factors. Typically, minor corrections may rebound within a few months, while more severe crashes could take several years for a full recovery. Historical patterns show varied timelines, so there is no one-size-fits-all answer to this question.

What are the signs of a stock market recovery?

Signs of a stock market recovery often include a sustained period of market gains, a decrease in market volatility, improving economic indicators such as GDP growth and employment rates, increasing corporate earnings, and a return of investor confidence. Additionally, market sentiment indicators and technical analysis can also suggest that a recovery is underway.

Can investors predict when a stock market recovery will begin?

Predicting the exact start of a stock market recovery is exceptionally challenging due to the complex interplay of various economic, political, and social factors. While experts may analyze historical data and economic indicators to make educated guesses, these predictions should be approached with caution as they are not guarantees. Investors are encouraged to focus on long-term strategies rather than trying to time the market.

What should I do with my investments during a stock market downturn?

During a market downturn, it’s important to assess your investment strategy in line with your financial goals and risk tolerance. Conventional wisdom suggests holding onto your investments and refraining from making panic-driven decisions. Some strategies include diversifying your portfolio, considering high-quality bonds, or dollar-cost averaging. However, consulting with a financial advisor is often recommended to tailor an approach suitable for your specific situation.

Are there any sectors that recover faster than others in the stock market?

Yes, some market sectors often recover faster than others. Historically, sectors such as technology and consumer discretionary may rebound more quickly due to their growth potential and adaptability to change. However, the pace of recovery also depends on the nature of the market downturn and the sectors most directly affected. Defensive sectors like utilities and consumer staples are sometimes less affected by economic downturns and may offer some stability during volatile periods.