Central bank interest rates and monetary policy: they steer our economy like a captain navigates the sea. Just like waves can change a ship’s course, interest rate decisions shape the flow of money and trade. Understanding these moves is like reading a map. As your trusted guide, I’m here to chart the course through complex policies and reveal how they touch your wallet and the world’s markets. Let’s dive in and uncover the power of central banks.

Understanding Central Bank Policies and Interest Rates

The Role of Interest Rates in Monetary Policy

Interest rates are the heart of monetary policy. Central banks like the Federal Reserve set these rates. They decide how much it costs for banks to borrow money. By changing these rates, central banks aim to control inflation and keep the economy stable.

When a central bank raises rates, borrowing gets more costly. This can slow down spending and cool off an economy that’s too hot. On the other hand, when rates drop, borrowing is cheaper. This can help an economy pick up speed. It’s like the gas and brakes for a car. The rates tell the economy when to go and when to slow down.

How Central Bank Decisions Affect Global Markets

Central bank policies don’t just matter at home. They send waves across the world’s markets. If the Federal Reserve hikes rates, it can make the US dollar stronger. This means other countries might find it more expensive to buy things with dollars. Likewise, when the European Central Bank (ECB) changes rates, it can sway how many euros we need to buy goods from Europe.

The decisions central banks make show us their plans. They hint at how they see the future of the economy. Every move, every rate change, tells investors what to expect. And this can make prices of things like stocks and home loans swing up or down.

People who lend money watch these moves closely. They change what they charge for loans based on what they think the central bank will do next. All of this helps people decide on when to save, spend, or invest in a business.

Making sense of central bank policies can be a bit tricky. But once we get it, we can better guess what might happen next in our wallets and the world economy.

The Dynamics of Federal Reserve and ECB Rate Decisions

Analyzing Federal Reserve Interest Rate Trends

Imagine you’re steering a ship through waves. That’s like what the Federal Reserve does with interest rates. They change them to help our money and jobs stay in balance. When rates go up, it usually means the economy is doing well. But if rates rise too much, it could slow things down. Now, when the Fed lowers rates, they’re trying to pump up the economy. It’s like giving the ship more wind in its sails. By looking at the past, we can guess what might happen with jobs and shopping in the future.

So when we see the Fed’s interest rate trends, we’re peering at the path our economy’s ship might take. Right now, we’ve seen rates go up and down, much like the ocean’s waves. This back and forth is all about keeping prices in check and making sure there are enough jobs. It’s a tricky journey, but by watching the trends, we can all be better prepared.

The Implications of ECB’s Latest Rate Moves

Now let’s sail across the pond to Europe. The ECB, which is kind of like the Fed’s cousin, also makes big decisions on rates. They recently made some changes that could steer their economy in a new direction. When the ECB adjusts rates, it sends ripples across countries and businesses. It can mean lots of things, like how much a loaf of bread costs or how much it costs to borrow money for a new house.

What the ECB does with rates is super important for people’s wallets and businesses. If the ECB hikes rates, it can make it tougher for people to spend. But it also tries to keep prices from flying too high. It’s a balancing act on a great big seesaw. The ECB’s job is to find the sweet spot, where the ride is smooth and everyone can enjoy it.

When we hear about their latest rate moves, it can feel like we’re in for rough seas or calmer waters. Just like captains use stars to find their way, we use these rate decisions to navigate our economic skies.

Central bank policies steer the economy. They are like maps for our money’s journey. Both the Federal Reserve and ECB play a huge part in this. They decide on the best path for interest rates. Those rates shape everything from jobs to how much stuff costs. Knowing their moves helps us all plan for what’s ahead and stay shipshape!

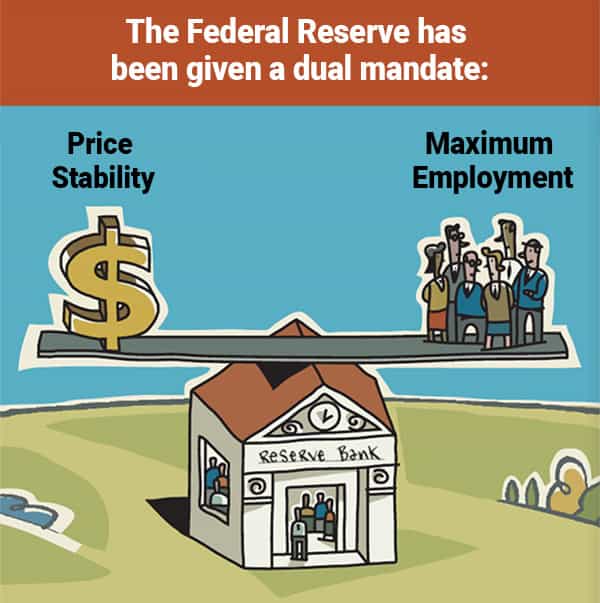

The Dual Mandate: Inflation Control and Economic Growth

Tools for Monitoring and Managing Inflation

Central banks have a big job. They must keep prices stable and help the economy grow. To do this, they watch the consumer price index (CPI) closely. The CPI measures how prices change over time. When prices go up too fast, that’s inflation, and it can be a real problem. Too much inflation and your dollar buys less than before.

“What tools do central banks use to keep inflation in check?”

Central banks use many tools, like changing interest rates and buying government bonds. Interest rates matter a lot. They can make borrowing money more or less costly. This, in turn, affects how much money is in the economy.

When there’s too much money chasing too few goods, prices rise. That’s inflation. By raising rates, central banks can cool down spending. They take away some of that extra money. Lower rates, however, can help the economy grow. Money becomes cheaper to borrow. People and businesses can spend and invest more.

Another powerful tool is called quantitative easing. This is where a central bank buys bonds to put more money into the economy. It’s a big move, used when other methods might not be enough.

Central banks also use the reserve ratio. This is how much money banks need to hold back and not lend out. A lower reserve ratio means banks can lend more. This can help the economy grow. But if it grows too fast, prices might go up.

The Relationship Between Economic Expansion and Interest Rate Adjustments

Let’s talk growth and rates. As the economy gets better, people have more jobs. They can spend more. This is good, but if it’s too good, prices can rise too fast. That’s where rate adjustments come in.

“How do central banks use interest rates to manage economic growth?”

Central banks set a target for the cash rate. This is the rate banks charge each other for overnight loans. When the target rate goes up, you feel it. Loans cost more, and you might think twice about spending.

On the other hand, when rates drop, money is easier to come by. You’d be more likely to take out a loan or buy big items. When a central bank wants the economy to grow more, they might cut rates.

But there’s a balance. Raise rates too much, and borrowing costs pinch wallets. This can slow down the economy. Cut rates too much, and you could push prices too high. It’s like steering a big ship. Too sharp a turn either way and things can get choppy.

Rate hikes and cuts are news that can shake markets. Businesses watch these central bank rate announcements for clues about the economy’s direction. Smart businesses plan for these changes. They know a rate hike means higher loan costs. More expensive loans can mean less profit. But they also know rate cuts can mean growth opportunities.

Central banks walk a tightrope. They try to keep prices stable and help the economy grow. It’s not easy. They use all the tools they have to aim for that balance. They hope to strike the right mix between not too hot and not too cold, helping everyone move forward together.

Forecasting and Preparing for Future Rate Adjustments

Interpreting Signals from the Yield Curve and Consumer Price Index

Let’s dive into the waves of financial change. Smart sailors in the sea of money must watch two big signals – the yield curve and the Consumer Price Index (CPI). But what are they?

Think of the yield curve as a wave pattern. It shows what folks earn from government bonds over time. When the wave peaks in front, it means people worry about the now, not the later. This can mean a storm of rate hikes is coming. On the flip side, when the wave peaks far out, the seas are calm; rate cuts may be on the horizon.

Now, let’s peek at the CPI. It’s a bit like a lighthouse flashing the cost of life’s goods. If that light shines brighter, things are getting more expensive, and central banks might ramp up rates to cool things down. If the light dims, meaning costs are steady, rates could stay put or sink lower.

Strategic Considerations for Anticipating Rate Hikes and Cuts

Ever played a game of high seas strategy? Forecasting rate moves can feel just like that. Here’s your captain’s map: know the patterns, and you’ll be ready for anything.

First, if you hear whispers of rate hikes, it’s like wind picking up. Businesses and people might borrow less. So, if rates could climb, maybe lock in loans early or hold off on big cash stows. If rate cuts are in the stars, it’s all hands on deck for growth. Companies tend to get bold, and cash starts to flow.

The bottom line? Keep your eyes wide and your mind sharp. With central bank policies and rate maps in hand, you’re set to sail the monetary seas like a pro.

We’ve covered a lot. We learned how interest rates are key in monetary policy and play a big part in markets worldwide. I also took you through the ins and outs of the Federal Reserve and ECB decisions, showing how they can stir economies. Then, we dug into managing inflation and supporting growth—two big goals that keep our money world steady.

But what about the future? We looked at tools like the yield curve and the Consumer Price Index to make smart guesses. This helps us prepare for hikes or cuts in rates. In short, keeping an eye on central banks’ moves is critical. It ensures you’re ready for what’s next in our money lives. Keep watching those trends and you’ll stay one step ahead. Trust your knowledge, stay informed, and you’ll navigate this with ease.

Q&A :

How do Central Bank interest rates influence the economy?

Central Bank interest rates, often referred to as the “cost of borrowing money,” play a crucial role in managing a country’s economic growth. By raising or lowering interest rates, the Central Bank can either encourage spending and investment during slow economic periods or cool down an overheating economy by making borrowing more expensive. Adjusting these rates, hence, directly impacts inflation, unemployment, and the overall economic activity.

What is the relationship between Central Bank monetary policy and inflation?

Monetary policy is a key tool used by Central Banks to control inflation. When a Central Bank sets low-interest rates, it increases the money supply, which can boost consumer spending and investment, but may also lead to higher inflation. Conversely, by hiking rates, the bank can reduce the money supply, discourage spending, and thus help keep inflation in check. The balancing act of regulating inflation without stalling growth is at the heart of monetary policy.

How often do Central Banks change interest rates?

The frequency at which Central Banks change interest rates varies depending on the economic conditions and the specific objectives of the Central Bank’s monetary policy. Some central banks have regular meetings, such as every six weeks or monthly, where they review and decide on interest rates. However, in response to unexpected economic events, Central Banks can make emergency adjustments as necessary.

What is the role of a Central Bank in managing a recession?

During a recession, Central Banks play a pivotal role in managing economic downturns through the use of monetary policy tools. By lowering interest rates, they aim to make borrowing cheaper, which can stimulate spending and investment by businesses and consumers. They may also inject liquidity into the financial system or purchase government securities to encourage lending and provide economic stability.

Can Central Bank policies impact currency exchange rates?

Yes, Central Bank policies, particularly interest rate decisions, can have a significant impact on currency exchange rates. Higher interest rates offered by a country’s Central Bank can increase foreign investors’ interest in holding that country’s currency, leading to an appreciation in value. On the other hand, lowering interest rates might result in a depreciation of the currency as investors seek higher yields elsewhere. This relationship underscores the interconnectedness of monetary policy and forex markets.