Historical stock market crashes aren’t just chapters in textbooks; they’re real-life horror stories with villains, heroes, and lessons that can save us from repeating the same financial nightmares. Imagine standing on the edge of a market cliff. One push from panic, and down goes your hard-earned cash into the abyss of lost fortunes. It sounds scary, but it doesn’t have to be—the keys to survival are right in the tales of financial cataclysms past. Dive in with me, and let’s explore the anatomy and impact of these crashes, dissect major catastrophes, and understand the psychology behind them. By learning from the past, we fortify ourselves against future shocks and safeguard our financial future.

Understanding Historical Market Downturns

The Anatomy of a Stock Market Crash

Let’s dig into what a stock market crash really looks like. A crash means stock prices drop fast and far. Fear kicks in, and people sell stocks fast, causing a big loss in value. Think of it as a hurry to get out before things get worse.

One big example is Black Tuesday in 1929. Prices dropped, people lost faith, and chaos followed. That day kicked off the Great Depression. During a crash, lots of money vanishes fast. This can happen because of bad news, fears about the economy, or sudden drops in stock prices.

Another crash to remember is Black Monday in 1987. This time, the fall came out of the blue. Computers were trading fast, and that made the drop bigger. In hours, the markets lost a huge chunk of value. It was scary because it was so sudden.

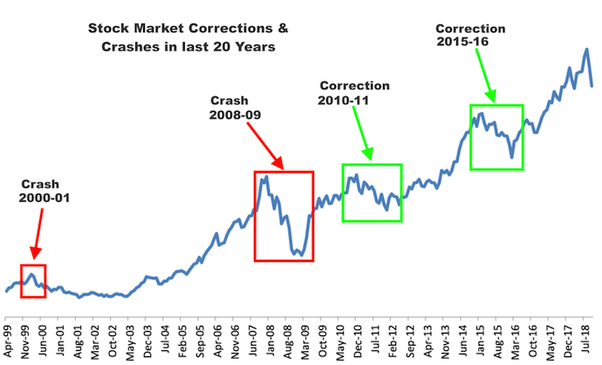

What about the dot-com bubble in 2000? Tech stocks had been the stars. But then, they weren’t worth as much, and the bubble burst. Lots of money went poof because people thought tech would just keep booming. They were wrong.

Then, there’s the 2008 financial crisis. Banks had played it risky with home loans. When that went south, it took a lot down with it. Stocks tumbled, and hard times hit the world. Lehman Brothers, a huge bank, fell, and fear spread.

Economic Impact of Historical Crashes

Crashes do more than drop numbers on a screen. They change lives. After 1929’s fall, it was hard times for years. Lots of folks lost their jobs, and it was tough to buy things. Back then, it took a while for the market to find its feet again.

In 1987, the crash shook things up, but a disaster didn’t follow. Why? People and governments got smart and worked to fix things fast. Programs that slow trading down, called circuit breakers, started to help keep panic low.

The dot-com bust in 2000 hurt a lot of people who bet big on tech. The market’s drop meant less money for companies and jobs. It took time, but things did start to look up again.

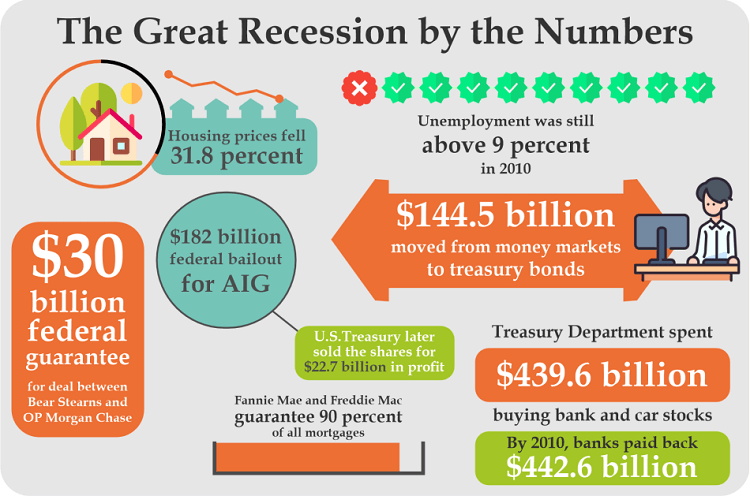

In 2008, the crash hit everyone hard. It wasn’t just stocks; it was about homes and jobs too. The government had to step in big time to get things back on track. It lent money to banks and saved companies to stop a total collapse.

Looking at these past crashes tells us a lot. It shows what can go wrong and how it hits the whole world. By knowing this, we can try to keep it from happening again. It’s tough, but studying these tough times helps us get ready for what might come next. When we learn from the past, we can plan for a smarter future.

Dissecting Major Financial Catastrophes: From Black Tuesday to the 2008 Crisis

The Wall Street Crash of 1929 and the Great Depression

Let’s dive into the Black Tuesday 1929 crash. It sent shockwaves around the world. This day, the market fell hard. It marked the start of the Great Depression. This tough time changed many lives. People lost jobs, homes, and hope.

You might wonder, “What exactly sparked the Wall Street Crash of 1929?” It was many things, including wild stock buying with borrowed cash. The market was too hot, then it all melted. The Crash didn’t happen in just one day. It spread over several, each adding to the downfall.

We saw banks, farms, and businesses crash too. The market collapse swept them along. This wasn’t just about Wall Street. It touched every town and family. People stopped spending. Trust in banks vanished. These were dark times.

Stocks didn’t recover for many years. The effects stayed with us for a long time. They taught us hard lessons about risk and safety.

The 2008 Financial Crisis and the Fall of Lehman Brothers

Fast forward to the 2008 financial crisis. This time, houses were the trouble. Banks gave too many loans to people who couldn’t pay them back. These bad loans were hidden in complicated bank deals. Then home prices crashed. The bad loans came to light. Huge banks felt this pain, especially Lehman Brothers.

“Why did Lehman Brothers collapse?” Lehman’s fall came after it lost billions. It was heavy into the housing market. When housing failed, so did Lehman. This was a big deal. Lehman was old and massive. Its fall scared everyone.

This wasn’t just about one bank, though. The whole system was shaky. The Lehman disaster showed just how bad it was. People saw big problems in the banking world. They got scared. They pulled money out. Markets around the world felt this fear.

In both 1929 and 2008, we saw something scary. When trust fades, disaster often follows. We also saw that crashes can start in one place. Then, they can spread far and fast. This is why keeping an eye on every market part is key. It helps prevent major financial collapses.

A crash isn’t just a money issue. It hits jobs, families, even countries. So, it’s important to understand these big bad days. We can watch for warning signs. We can try to keep crashes from happening again. And if they do, we can try to lessen the hurt they cause.

Looking at these huge falls teaches us a lot. We learn about what can tip a market over. We learn why people panic. And we see how that panic moves fast. This helps us get better at handling tough market times.

Through history, we’ve seen that crashes will happen. Yet, each time we face them, we can grow smarter. We can build stronger systems. This way, we’re ready for whatever comes next. And we can hopefully bounce back faster every time.

Behavioral Dynamics: Investor Psychology and Market Panic

Causes and Effects of Investor Panic

Fear can grip markets. Bad news spreads. Prices fall. Investors sell fast. This is panic. Causes? Many. Think risky loans, high share prices, or sad news. When fear hits, logic runs. People act fast. They think “sell now or lose more.” This flood of selling makes prices dive lower.

Let’s explore Black Tuesday, 1929. Stock prices soared before then. But warnings showed up. Banks gave too many loans. People bought stocks with borrowed cash. Some started selling stocks. Others saw this. Panic set in. Everyone wanted to sell. No buyers. Stocks crashed hard.

Same story, different years. 1987, markets fell again, big time, on a Monday. Computers did more stock trading. They made selling faster. A small drop turned into a wild slide. That day went into history as Black Monday.

And who can overlook the dot-com bubble? Tech stocks went sky-high by 2000. But many companies weren’t worth their stock price. Investors finally saw the truth. Stocks of these tech firms tumbled.

Fast forward to 2008. The housing market sank. Banks had given loans to folks who couldn’t pay back. Huge banks like Lehman Brothers fell. Stock markets worldwide felt the pain. The tumble was sharp and deep.

In each of these, panic was clear. One person’s fear can spread like wildfire. It jumps from one to another. This is how crashes can start and grow.

Government Interventions and Market Stability Measures

Governments try to stop crashes. How? They cut interest rates. They give money to banks. Sometimes they buy stocks. All this to make people less scared.

Circuit breakers are like break stops. They halt trading if stocks fall too fast. This gives investors time. Time to think and not just act on fear. These breakers help stop panic from getting worse.

Comparing 1929 and 2008, we see big changes. In 1929, not much was done early on. It led to the Great Depression. Many lost their jobs. It took years to get better. But in 2008, the government moved quick. They put money into banks. They saved some big companies. This helped. The crash was still bad, but it could have been much worse.

Panic selling is part of history. Stock markets have seen it many times. It’s like a scary movie that keeps playing. But we learn. We get better at stopping these drops. Understanding how fear moves in markets can help stop a ripple from becoming a wave.

Governments have tools now. They know how fast fear runs. They step in to calm things down. Is it perfect? No. But it’s a start. It gives us a way to face the fear in markets with a plan. Understanding the past gives us a map for today and tomorrow.

Learning from the Past: Mitigating Future Market Disruptions

Patterns and Predictions: Analyzing Historical Data for Forecasting

Let’s get one thing clear—markets have crashed before and will crash again. But why? Looking at past market crashes can give us clues. We learn that no two crashes are exactly alike. Yet, they share common thread. Fear, risk-taking, and bad loans often play their part.

Take the Wall Street Crash of 1929. It led to the Great Depression. People’s faith in the market hit rock bottom. They had seen their savings vanish overnight. This crash happened because the market was too high. People bought stocks with borrowed money. When stock prices fell, panic set in.

Then there’s Black Monday, 1987. The stock market fell once more. This time, computer trading and global finance played have bigger roles. Things went south fast. But we learned from this. We made systems to stop trading if panic-selling gets out of hand.

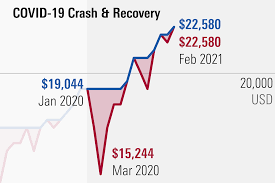

Jump to the Dot-com bubble burst around the year 2000. Tech stocks were the big deal. People thought they could only go up. They were wrong. When reality hit, those high-flying stocks crashed back to earth.

Not even a decade later, in 2008, housing loans gone bad led to a crisis. Big banks were in danger. World economies were rocked. It showed us how tied together our financial systems are globally.

With each crash, we learn. We get better at spotting danger signs. By understanding what caused past crashes, we might see the next one coming. Could we prevent it? Maybe not fully. But we can be ready. We can soften the blow.

Recovery and Regulations: Adapting After Market Collapses

After each crash, recovery has taken time. People lose trust and it takes a while for it to return. It’s a cycle. Markets fall, we pick up the pieces, and we rebuild.

After the 1929 market plunge, we learned the hard way. It took years and a World War for the economy to recover. The government started to play a big role in the economy. They wanted to make sure that kind of collapse didn’t happen again.

Post-2008, we saw change too. Banks got stricter rules. We kept a closer eye on who got loans. We aimed to fix the issues that caused trouble.

Every financial crisis teaches us something. We get new rules, which act like speed bumps, to keep markets from racing out of control. These preventions include circuit breakers. They stop trading if prices drop too fast.

From every crash we gather knowledge. We see how people react to fear in the markets. We can use this to make our financial world steadier.

Here’s the takeaway. Crashes hurt. But they also teach us. They make us stronger. They help us build a safer, smarter financial future.

In this article, we explored the deep dives and dizzying drops of market downturns. We unraveled the causes behind stock market crashes, from Black Tuesday to the 2008 financial meltdown. These events shape our economy and leave lasting effects.

We also peeked into the minds of investors during these tough times, seeing how fear can lead to panic. But it’s not all doom and gloom; we learned that with the right moves, and maybe some help from the government, markets can find their feet again.

Looking back helps us get ready for the future. By understanding patterns in the chaos, we can try to predict and, better yet, prevent new crashes. It’s about getting up, dusting off, and building stronger systems so we’re tougher than before.

So, let’s take these lessons to heart. We can’t stop markets from falling, but we can be smarter about getting through it. Remember, history’s blunders are today’s blueprints for a brighter, steadier tomorrow.

Q&A :

What are the major historical stock market crashes?

While discussing significant stock market downturns, several events are essential to mention. These include the Great Crash of 1929, which precipitated the Great Depression; Black Monday in 1987, when stock markets around the world crashed; the Dot-com Bubble burst in 2000; and the Financial Crisis of 2008, which was initiated by the collapse of Lehman Brothers and other financial institutions.

How often do stock market crashes occur?

Stock market crashes do not follow a predictable pattern, making their frequency irregular. On average, market corrections (a decline of 10% or more) happen every 1-2 years, while more substantial crashes, which are rarer, could occur several years apart or even within a single decade.

What causes stock market crashes?

Stock market crashes can be triggered by various factors, often resulting from a complex interplay of elements rather than a single cause. Some common contributors include economic downturns, excessive speculation, overvaluation of stocks, geopolitical crises, changes in fiscal regulations, and mass public panic.

How can investors protect themselves during a stock market crash?

Investors can employ several strategies to safeguard their portfolios during market downturns, such as diversification across asset classes, investing in traditionally safer sectors or instruments like gold or government bonds, and avoiding panic selling. Some might also consider using stop-loss orders to limit potential losses or holding cash to take advantage of post-crash opportunities.

Can stock market crashes be predicted?

Accurately predicting stock market crashes is extremely challenging and often not feasible due to the market’s complex and volatile nature. While economic indicators and stock valuation metrics can provide warning signs, the timing and extent of a crash are nearly impossible to forecast with precision. Investors and analysts can monitor these signs but should be cautious about relying heavily on predictions.