Monetary Policy Mastery: Fueling Robust Economic Growth

Money moves the world, or so they say. But what truly fuels economic growth and keeps our markets buzzing? The secret lies in the mastery of monetary policy and economic growth. Central banks hold the power to shape our economy’s future, nudging it towards health and wealth or pulling it back when it overheats. With the right tweaks to interest rates and a sharp eye on market dynamics, they steer us clear from the rocks of recession.

In this deep dive, I’m busting the myths around those strategies and shining a light on how nuanced central bank actions ripple through our lives. Get ready to understand just how these monetary maestros can conduct an economy towards soaring highs or shield it from spiraling lows. It’s time to gear up for a journey through the lifeblood of our economic system!

Demystifying Central Bank Strategies and Interest Rate Influences

The Role of Central Banks in Shaping Economic Growth

Central banks hold the keys to our economic engine, kind of like wizards. They make choices that can lead to more jobs, stable prices, and better lives for all of us. Think of central banks as captains steering big ships—nations—through storms and calm seas. They decide when to speed up or slow down the flow of money.

They have a big job: keeping inflation just right, not too high or low. If prices rise too fast, your money buys less. But if prices don’t move much, businesses may struggle to grow. Central banks aim for a sweet spot, so everyone can plan and spend wisely.

Central banks use a magic wand called interest rates. When rates are low, it’s like a green light for people and companies to spend and invest. They set these rates to make borrowing money for a house or business easy on the wallet.

Interest Rates as a Tool for Economic Management

Interest rates are like levers that can cool down or heat up the economy. When the central bank drops the rate, it’s telling us to go, spend, create jobs. It’s like a sale on borrowed money—everyone loves a good deal. And when the economy hums along, people buy more stuff, and companies make more things.

But if there’s too much going on, like a party that’s gotten too wild, central banks can raise rates. This is their way of saying, “Let’s take it easy.” Higher rates mean borrowing costs more. People and businesses will think twice before taking out loans. This can slow things down a bit.

We’re in this together, and what central banks do affects us all. From the price of a loaf of bread to the cost of a home, their moves have power. They have to be smart and careful. It’s a balancing act—making sure the money flows, but not too fast or too slow.

So, when you hear about the central bank in the news, remember, they’re working behind the scenes. They’re helping make sure our money keeps its strength, and our economy grows just right. We all want a future where we can thrive, and central banks play a big part in getting us there.

And that’s what I do—I keep an eye on these powerful institutions and decode their every move. It’s like watching over the guardians of our economy. Every decision, every change in interest rate—they all fit together in a grand plan to keep us moving forward. It’s a big, complex puzzle, but one that can be solved. And understanding it can help you see where we’re heading—toward growth, stability, and success.

Unpacking the Effects of Inflation Targeting and Quantitative Easing

Inflation Targeting: Aiming for Economic Stability

Central banks work hard to keep prices stable. To do this, they set goals for inflation, which is how much the cost of things rises over time. These goals are like targets they try to hit. They use tools like setting the cost for banks to borrow money, called the interest rate, to help keep inflation where they want it. When prices rise too fast, it can be hard for people to keep up. So, central banks will make it more expensive for banks to get money by raising interest rates. This makes people and businesses slow down on spending, which can help stop prices from going up too quickly.

When we talk about price stability, we mean not letting inflation swing too high or dip too low. High inflation eats away at people’s buying power – it means that the money in their pockets can buy less. On the flip side, when prices fall, it’s called deflation. Deflation can be bad news, too, because people may wait to buy things, hoping they’ll get even cheaper, which slows down the economy.

Central banks keep an eye on lots of things to decide on inflation targets: how much stuff we’re making and selling, how many people have jobs, and more. They try to keep everything in balance so that our money keeps its value over time.

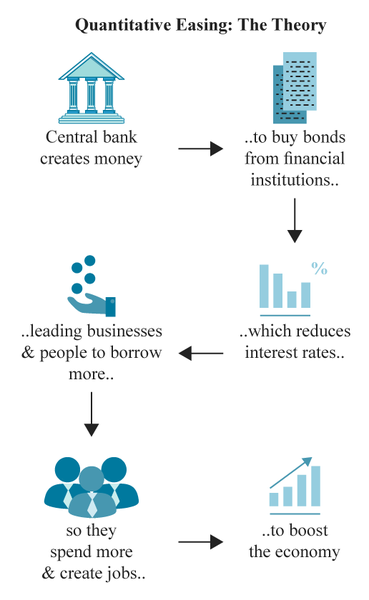

Quantitative Easing: Stimulus for the Economy During a Crunch

During tough times, like big economic slumps, the usual ways of managing money might not work well. That’s when central banks might try something called quantitative easing – or QE for short. QE is like a special boost for the economy. The central banks make new money, then use it to buy things like government bonds. This puts more money into the economy and encourages banks to lend more.

Think of it like putting gas in a car that’s low on fuel. It helps the engine start running smoothly again. With more money available, it’s easier for people to get loans for houses or companies to invest in growing their businesses. And when people and businesses spend more money, it can help the whole economy get moving again.

We can’t use QE all the time, though. If there’s too much money floating around for too long, it could make prices shoot up later on. That’s why central banks watch carefully and only use QE when it’s really needed. They also need to make sure they can take that extra money out of the economy later, once things start to pick up again.

QE has been a big deal since the financial crisis in 2008 when many countries used it to help their economies recover. It’s one tool in the box that central banks have that can help keep things steady when times get rough. They always look out for the right balance to make sure the economy can grow just right – not too fast, not too slow, but just enough for everyone to get by and maybe even a little better than before.

Analyzing the Impact of Monetary Policy Tools on Market Dynamics

Open Market Operations and Their Influence on Money Supply

Open Market Operations, or OMOs, play a huge role in our economy. You might ask, “What is an open market operation?” Well, it’s when our central bank buys or sells government bonds to control money supply. When the central bank buys bonds, money flows into the markets. This means more cash for people and businesses to spend or invest. It’s like adding fuel to a fire—the economy heats up.

But when the central bank sells bonds, it pulls money out. This is like dampening the fire so it doesn’t burn out of control. This control is vital. It keeps things stable. A stable market lets people plan their spending and investing without fear. It’s like knowing the rules of a game. It allows you to play smarter and with confidence.

The Delicate Balance of Expansionary and Contractionary Measures

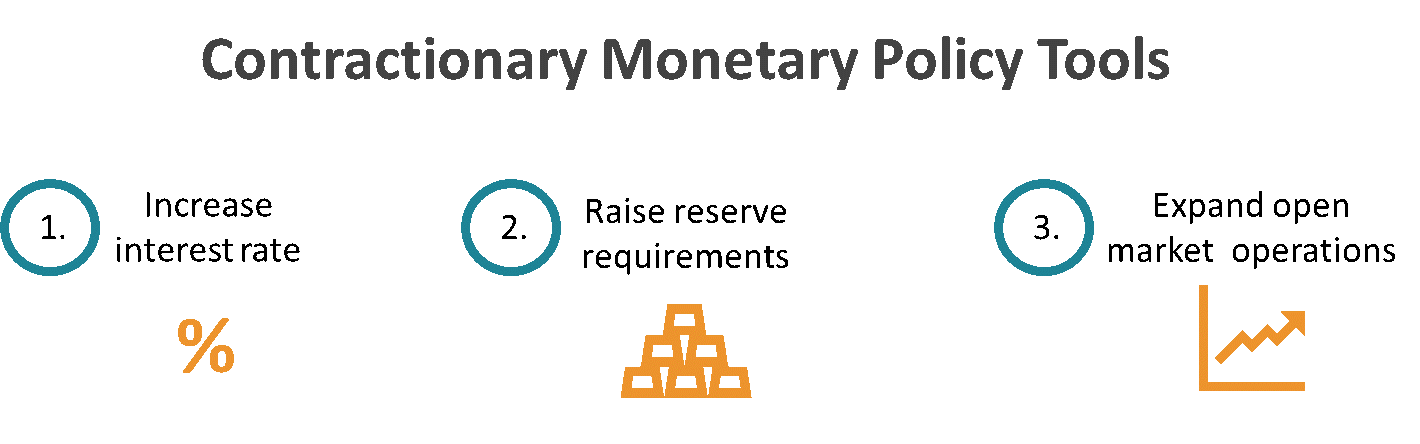

Central banks must juggle between two types of measures: expansionary and contractionary. Expansionary measures are when central banks try to boost the economy. Think lower interest rates and more money in the system. This can help when times are tough, and people aren’t spending much.

Contractionary measures are the opposite. They’re used to cool down an overheated economy where there’s too much spending. This can help prevent prices from rising too fast, which is a big no-no for a healthy economy. Higher interest rates and less money floating around are the tools used here.

This balance is delicate because getting it wrong can mean a bad time for everyone. If there’s too much money, prices shoot up (that’s inflation). If there’s too little, people stop buying stuff, and businesses can tank (that’s deflation). So, central banks aim to get this balance just right.

In short, central banks use different tools to shape the economy. They can be like a garden hose on a hot summer day—adding just enough water to help plants grow without drowning them, or cutting back the flow to make sure they don’t wither from overwatering. Whether they’re soaking or sprinkling, the goal is always to maintain a garden that’s lush and green—that is, an economy that’s healthy and growing just right.

Evaluating Economic Outcomes: From GDP to Consumer Behavior

Macroeconomic Indicators as Predictors of Growth and Stability

Central banks play a big game of balance. Their goal? To keep the economy steady. Think of it like a game of Jenga. You try to keep the tower stable, but one wrong move and it may come crashing down. Macroeconomic indicators are the rules of this game. They tell us how well the economy is doing.

Key signs like GDP growth rate, unemployment rates, and consumer spending shed light on economic health. A high GDP means the economy is doing well. Fewer people without jobs is also a good sign. And when folks are spending money, it means they feel good about the economy.

Assessing the Multiplier Effects of Economic Stimulus Packages on Consumer Spending and Investment

Now, let’s talk about what happens when the economy needs a boost. That’s where economic stimulus packages come in. Central banks, like the Fed, will sometimes offer extra money to the economy. This can come in many forms, like lowering interest rates or buying assets.

The trick is, this money should make both consumers and businesses spend and invest more. This is the “multiplier effect.” If a bank cuts interest rates, a family might say, “Hey, cheap loans! Let’s buy a new car.” Or a business may think, “Borrowing is cheap; let’s expand!” And just like that, more money moves, and the economy gets a kickstart.

These moves can have big impacts. They can help shop owners to factory workers and everyone in-between. But the central bank has to choose just right, so we don’t get too much inflation. Inflation happens when prices go up because too much money is chasing too few goods.

Not an easy task, but it’s important. It’s the way central banks keep our economic Jenga tower standing strong.

We just dug deep into how central banks use tools like interest rates to shape our economy. They aim to keep money flowing and stable. Then, we saw how fighting inflation and boosting the economy can come from smart moves like inflation targeting and pumping money in through quantitative easing. We also explored how these big bank moves stir up the markets. Finally, we peeked at how it all trickles down, from big growth numbers to the cash in your pocket.

So, here’s the deal. The money moves that central banks make are massive. They don’t just touch banks and fancy numbers; they touch you and me. The right push on the economy’s buttons can lead to more jobs and steadier prices. It’s a balance that banks try to get just right. And when they do, we all win – from the big market players to folks buying groceries. That’s the power of a well-tuned economic plan.

Q&A :

How does monetary policy influence economic growth?

Monetary policy can profoundly impact economic growth by manipulating the supply of money and interest rates in an economy. Central banks, like the Federal Reserve in the United States, use policy tools such as altering the discount rate, conducting open market operations, and changing reserve requirements to either encourage spending and investment during a downturn or restrain it during an overheated economy. Lower interest rates typically boost economic growth by making borrowing cheaper and encouraging investment and consumption, while higher interest rates can slow down an overheating economy and control inflation.

What are the main objectives of monetary policy in managing economic growth?

The primary objectives of monetary policy in managing economic growth are to control inflation, manage employment levels, and maintain long-term interest rates at a moderate level. The goal is to achieve a balance where the economy grows at a sustainable rate without triggering a high rate of inflation. In many countries, central banks aim for a low and stable inflation rate, which is believed to foster a favorable environment for economic growth and stability.

Can expansionary monetary policy lead to sustainable economic growth?

Expansionary monetary policy, which involves lowering interest rates and increasing the money supply, can lead to sustainable economic growth if applied judiciously and in the right economic conditions. By making credit more accessible and less expensive, businesses and consumers may be encouraged to spend and invest more, which can boost economic activity. However, if such policies are not implemented carefully, they can lead to excessive inflation or asset bubbles, which might ultimately harm the economy.

What role does monetary policy play in controlling inflation and promoting economic growth?

Monetary policy plays a critical role in controlling inflation while promoting economic growth. Central banks use various instruments to adjust the availability and cost of money to either stimulate the economy or cool it down. By increasing interest rates and reducing the money supply, a central bank can control inflation, thus fostering an environment that is conducive to sustainable economic growth. On the other hand, if the economy is sluggish, a central bank may lower interest rates and increase the money supply to encourage borrowing and spending, which can boost economic activity.

How do changes in monetary policy affect businesses and consumers?

Changes in monetary policy affect businesses and consumers by altering the conditions under which they borrow and spend money. When a central bank lowers interest rates, borrowing becomes cheaper, making it easier for businesses to finance new projects and for consumers to take loans for big-ticket purchases like houses or cars. Conversely, when interest rates rise, borrowing costs increase, which can reduce spending and investment. Monetary policy shifts can influence consumer confidence, business investment, and overall economic activity significantly.