Leading fintech payment platforms are changing how you do money things, big time. The old ways of sending, spending, and saving cash are taking a back seat. We’re diving deep into the tech that makes your wallet digital and your life way easier. You’ll learn how these platforms have risen, the cool new trends, and how they keep your money safe. Plus, we’ll get into why everyone’s phone is turning into a magic money wand with NFC and QR codes. Get ready, ’cause we’re about to make sense of how fintech is taking your dough to the next level.

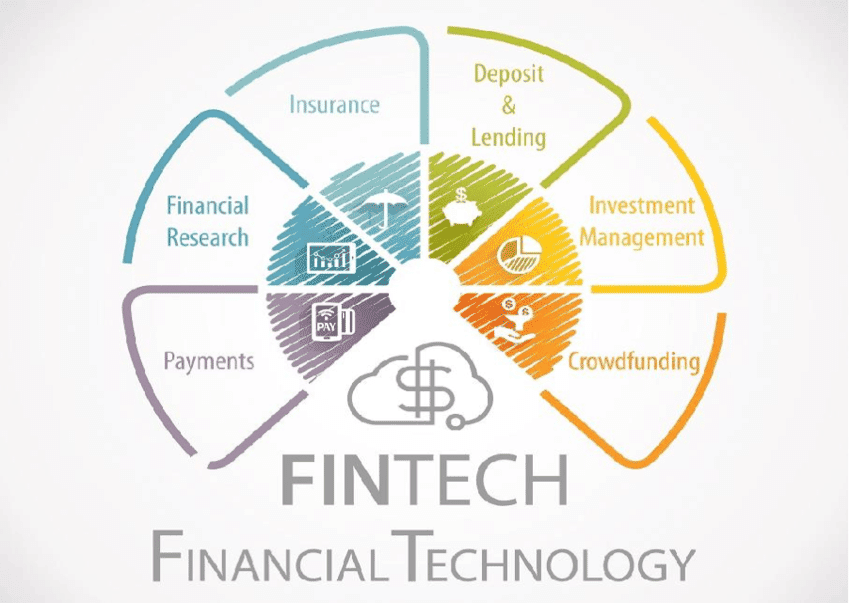

Overview of Fintech Payment Platforms

The Rise of Digital Payment Services

Every day, we buy more online and on our phones. This boom is thanks to digital payment services. You see them in action when you buy a coffee with your phone or when you pay a friend back for dinner. These handy tools are part of digital payment platforms.

But what makes these services rise to the top? It’s their ease and speed. Tap your phone, and you’re done. No more fumbling for cash. Plus, you can pay from anywhere. From big purchases to a quick snack, they got you covered.

Safe payments also push their growth. They protect your money like a safe. This is key, as no one wants to lose money to thieves. Clever tech keeps your cash tight and right.

Key Financial Technology Innovations and Trends

A wave of cool stuff is changing how we handle money. We talk shopping without cash and sending cash fast as lightning. Contactless payments like tapping cards come to mind. This tech is a hit in stores worldwide. Mobile payments are big too. They turn phones into wallets, making life easier.

We see peer-to-peer tools help friends split bills without stress. Online systems let shops sell to the world, and no one’s left out. Thanks to these systems, buying and selling things across borders is smoother.

Mobile trends are part of this. More people pay by phone, ditching cash. Even street vendors are in on this. They use QR codes – those square barcodes. You scan, you pay. Quick and simple.

People feel safer if the checkout is secure. No surprise, right? We all want our money to land where it should. So, systems that promise tight security win big.

Tech keeps moving, too. Payment platforms are now smarter. They can figure out problems and fix them with no human help. Blockchain is part of this. It records payments in a way that’s tough to mess with.

Rules and laws for fintech keep things fair. They make sure that everyone plays nice. New startups often come up with bold new ideas. This keeps the giants on their toes. And each new service wants to be easiest to use.

The world talks about cash vanishing. Some folks are all in, some worry. Not having to haul cash is great and smooth. But what if the net goes down? People study these questions a lot.

Great fintech platforms give everyone a shot. Got a phone? You can join in. No need for a fat wallet or a local bank.

Well, guess what’s next? Even cooler ways to pay. Watch out for them, because they’re coming your way. They’ll change your shopping and your hangouts, making everything a breeze. And that’s a peek at the future – right in our pockets!

Examining Top Mobile Payment Solutions

The Surge of Mobile Payments Platforms and Their User Benefits

Let’s dive into mobile payment platforms. They’re the wallets of the future. Everywhere we go, folks choose their phones over their wallets to pay. That’s how we roll now. It’s all about simplicity and quick service. You get to tap, pay, and be on your way. No digging for cash or cards.

With these leading fintech solutions, safety joins hands with convenience. They pack top-notch e-payment security measures. So, you spend less time worrying about your money’s safety. Mobile payments have a cool side too. They offer deals and rewards you can’t resist.

Are instant payment services changing the game? Absolutely. You hit ‘send’ and the cash moves in a blink. That’s the beauty of it – it’s fast, it’s here, and it’s for all of us. So, folks get to enjoy their day without payment hiccups.

A Closer Look at NFC Technology and QR Code Payment Systems

Now, let’s peek at how your phone talks to the payment machine. NFC stands for Near Field Communication. Think of it like a high-five between two devices. When they get close, they share your payment info. A quick tap, and you’ve paid for your coffee or movie ticket. It’s that easy.

QR codes? They’re those funky squares you see at registers. You scan them with your phone’s camera. It’s another cool way to say, “Here’s my payment, thanks!” It’s contactless, safe, and sharp. Two methods, one goal: to make payments snap-fast and super safe.

These technologies are sprinting ahead. So is our world becoming cashless? It sure looks that way. And that’s a big deal for all of us – shop owners, families, and even friends splitting a pizza. It’s all part of this amazing digital payment dance we’re all learning.

So there you have it, folks. Mobile payments are big, and they’re only getting bigger. They’re packing our phones with power. The power to pay with a tap and get on with our lives. Because, let’s face it, we’ve got places to be and things to do. And our payment tech is keeping up with us, every step of the way.

Ensuring Security in Digital Transactions

Implementing E-Payment Security Measures and Compliance

Keeping your money safe is vital when buying or selling online. Today’s leading fintech solutions are like digital bodyguards for your cash. They guard your money with tough security tools. These tools follow strict rules that financial experts set.

Take mobile payments, for example. Each time you tap to pay, safety measures are working behind the scenes. From mobile payment platforms to digital wallet adoption rates, they all use high-end security. This means encryption, which scrambles your payment info into codes that bad guys can’t read.

But what about laws and rules? Fintech payment regulations make sure companies play fair and keep data safe. This requires payment processing technologies to meet certain standards. It’s a lot like making sure everyone wears a helmet when riding a bike. Only, it’s for your digital cash.

To keep up with the online transaction systems, businesses need to integrate payment gateways rightly. This includes being up to date with a cashless economy’s impact. They also need to think about how, where, and who will use these systems.

Security isn’t just tech talk. It’s about trust. For instance, when you use a QR code to pay, a secure online checkout is essential. To build that trust, systems have checks called compliance frameworks. Think of them as the rules of the game for digital payment startups.

Understanding Cryptocurrency Payments and Blockchain Integration

Now, let’s talk about cryptocurrency payment gateways. These gateways let people use digital money like Bitcoin to buy stuff. They are part of a cool new tech called blockchain. Blockchain is like a ledger. But instead of one book, it’s lots of copies spread across computers worldwide. And once you write something, you can’t change it. That’s a big deal for keeping payments safe.

Cryptocurrencies can cross borders with ease, making them a neat fit for cross-border payment services. When used in mobile payment trends, they promise a world where money moves as freely as emails.

Have you heard of blockchain-based payment platforms? Well, they’re not sci-fi. They are real, and they ensure that no one messes with your transactions. They also help businesses stay on the right side of fintech payment compliance.

All in all, e-payment security measures keep your money safe on the internet. It’s a crucial part of financial technology innovations and a big reason why folks are comfortable buying online today. By staying secure, these systems let us enjoy the benefits and convenience of modern digital payment services. And that’s a win for everybody!

Expanding the Reach of Payment Technologies

Enhancing Cross-Border Payments and Multi-Currency Digital Wallets

Let’s talk money, but not the kind you fold. We’re going digital, borderless. Leading fintech solutions do more than just shine; they span the globe, making money moves quick and smooth. Thanks to them, you can pay for a coffee in Paris or a cab in Tokyo with a tap in your app.

People ask, “How do I use digital wallets across countries?” It’s easy – pick a wallet that likes to travel. These tools let you store multiple currencies, so you can pay or get paid using the local cash, no sweat. And when you need to send money afar, some apps let you do it with just a phone number. Shopping online across borders? Secure online checkout solutions have your back. Their smart systems swap your cash to the right type, easy as pie.

It’s not magic; it’s tech – the mobile payment trends and digital payment services that keep your cash safe and sound, while they zip around the world. With killer apps and shiny cards, paying or getting paid in any currency is a breeze. And these tools are smart; they hunt down the best exchange rates, saving you some coin.

Now, let’s dive deep. How does it all stick together? It takes some nifty code and networks to keep your money moving smooth and fast. We have payment processing technologies working behind the scenes. They’re the silent heroes, making sure every buck from point A hits point B without a hitch.

Fostering Financial Inclusion Through Fintech Innovations

But what about folks who have been shut out of banks? Enter fintech’s big heart – its push for financial inclusion efforts. These champs are on a mission to put banking power in every hand. Yes, even in far-off places where the nearest bank is a dream away.

So, how do we give banking power to all? By building apps that run on any phone, not just the pricey ones. Peer-to-peer payment tools make it a piece of cake to pay back your pal. And what if there’s no internet? No problem. Some apps use simple codes that work offline too.

Sure, cash has its charm, but the world’s switching gears. The cashless economy impact is no joke; it’s changing our pockets. Going cashless means no more lost bills or coins in the couch. Money lives in your phone – clean and simple.

This switch isn’t just cool; it’s kind. With contactless payment applications, folks who could barely join banks are now paying bills from their beds. Digital payment startups are setting up shop everywhere, bringing all of us into the future, one tap at a time.

The world’s a big place, but ideas like these know no bounds. They link us across lands and languages, through clicks and taps. So, the next time you pay with your phone, think big. You’re part of a wave that’s rolling out a red carpet for everyone to walk on, right into a new age of money.

In this post, we dove into the fast-paced world of fintech payment platforms. We saw how digital payment services rose and shook up the finance scene. Then, we looked at key tech trends that keep money moving smartly and swiftly.

We also explored today’s top mobile payment methods. We learned why they’re booming and how they make life easier. We talked about NFC and QR codes, which let us pay with just a tap or a scan.

Next, we tackled keeping cash safe online. We covered strong security steps and rules that guard our digital bucks. Plus, we peeked at how crypto and blockchain are changing the game.

Finally, we checked out how payment tech reaches across borders. We saw how it helps more people join in, no matter where they are or what they earn.

So, as we wrap up, remember: fintech is all about making money moves simple and secure for everyone. It’s a world that keeps growing, one clever click at a time. Keep your eye on these trends—they’re reshaping how we all pay and get paid!

Q&A :

What are the most prominent fintech payment platforms today?

Fintech payment platforms have revolutionized how transactions are conducted, providing consumers with fast, secure, and convenient ways to manage their finances. Among the leading names in this industry are PayPal, Square, Stripe, and Adyen. These platforms offer a range of services, from peer-to-peer transfers to business payment solutions, underlining the diversity and adaptability of fintech to various financial needs.

How do leading fintech payment platforms ensure transaction security?

Security is a cornerstone for any payment platform’s success. The top fintech payment platforms employ several layers of security, including end-to-end encryption, two-factor authentication, and compliance with industry standards such as PCI DSS. They also use machine learning algorithms to detect and prevent fraudulent activities, ensuring that users’ financial information is protected.

In what ways have leading fintech payment platforms influenced traditional banking?

Leading fintech payment platforms have been pivotal in shaping consumer expectations and exerting pressure on traditional banks to innovate. They have introduced immediate transaction processing, reduced fees, and more user-friendly interfaces. In response, many banks have adopted new technologies and formed partnerships with fintech firms to improve their services and retain customers.

Are there any global regulations affecting leading fintech payment platforms?

Yes, fintech payment platforms operate under a complex web of global and regional regulations. These include directives like the Payment Services Directive (PSD2) in Europe that enhances consumer rights and introduces stricter security protocols. Globally, fintech companies must navigate AML (Anti-Money Laundering) and KYC (Know Your Customer) regulations, which are crucial for maintaining the integrity of financial systems.

Can leading fintech payment platforms help in reducing costs for small businesses?

Many leading fintech payment platforms offer cost-effective solutions tailored to small businesses. By streamlining the transaction process, these platforms often reduce processing fees and eliminate the need for traditional point-of-sale systems. Furthermore, the competitive landscape of fintech means that small businesses can choose from numerous providers to find the most affordable and feature-rich service for their specific needs.